[ad_1]

US DOLLAR FORECAST – USD/JPY, AUD/USD, GOLD

- The U.S. dollar, as measured by the DXY index, slides despite the advance in Treasury yields

- All eyes will be on the U.S. employment report on Friday

- This article analyzes the near-term outlook for the U.S. dollar, examining major FX pairs such as USD/JPY and AUD/USD. The piece also scrutinizes the technical profile for XAU/USD

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar’s Revival Threatened by Fed Minutes; Setups on USD/JPY, EUR/USD, Gold

The U.S. dollar, as measured by the DXY index, was subdued on Thursday, down about 0.10% to 102.31 despite the upswing in U.S. Treasury yields, with traders reluctant to take large directional positions ahead of key U.S. jobs data.

The U.S. Department of Labor will release on Friday its December nonfarm payrolls report. According to surveys, U.S. employers hired 150,000 workers last month, down slightly from the 199,000 increase in November. The unemployment rate, for its part, is seen ticking up to 3.8% from 3.7% previously, indicating less tightness in labor market conditions.

With interest rate expectations in a state of flux, it is important to closely examine the details of the upcoming NFP report, keeping in mind that its revelations about the health of the labor market could significantly influence the path of monetary policy over the coming months.

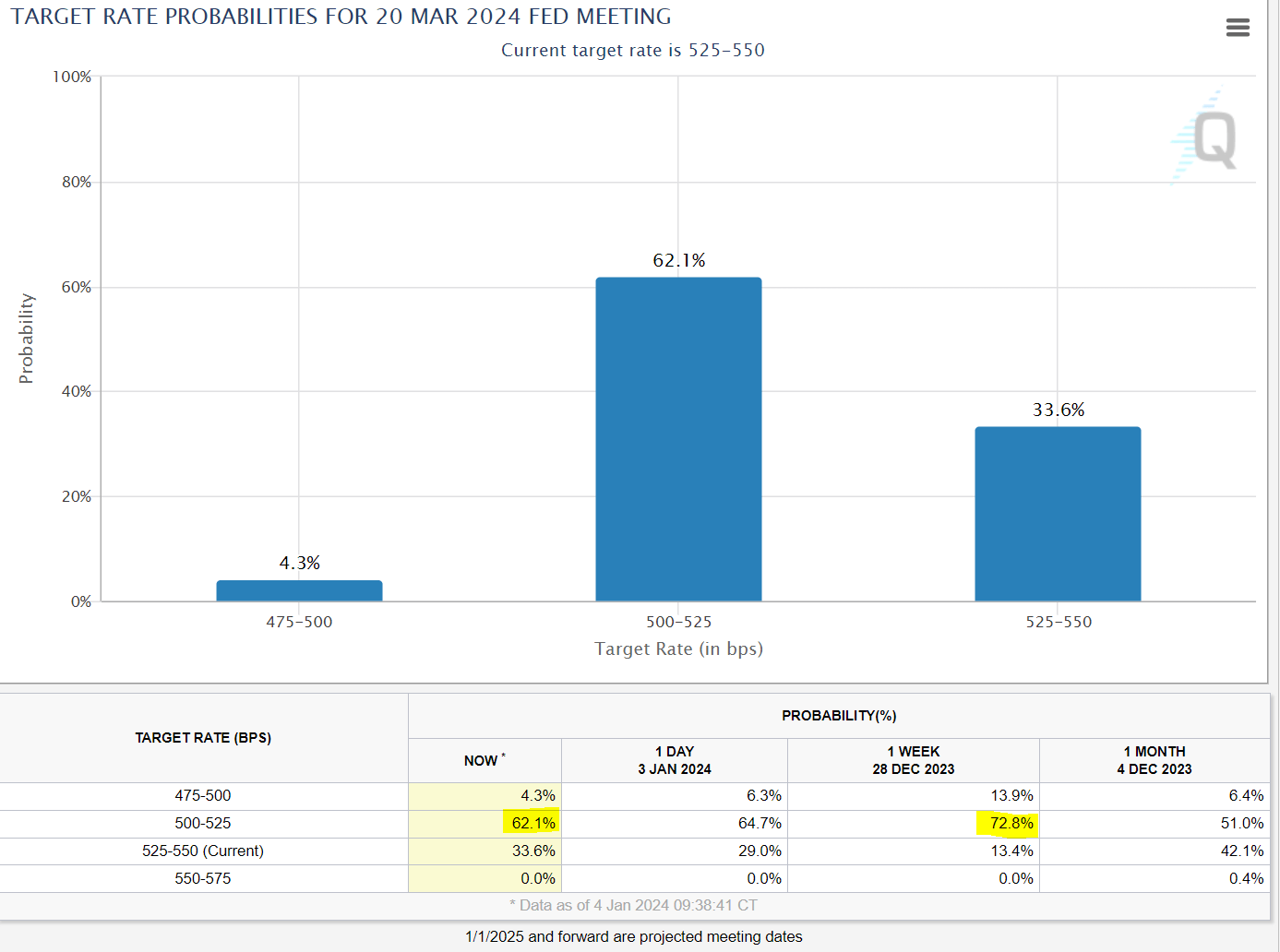

Just before the end of 2023, investors were confident that the Fed would deliver its first rate cut in March, but the likelihood of this outcome has retreated sharply recently, as the chart below shows. If U.S. employment figures surprise to the upside, the prospects for the easing cycle commencing in Q1 are likely to diminish further, reinforcing the rebound in yields and the U.S. dollar seen over the past week.

FOMC INTEREST RATE PROBABILITIES

Source: FedWatch Tool

The opposite is also true. If NFP falls below Wall Street estimates, interest rate expectations may shift in a more dovish direction, sending yields and the greenback lower. For this scenario to play out, however, the magnitude of the miss in job growth has to be meaningful. A weak employment report would validate wagers on deep rate cuts, boosting the probability of the first rate cut arriving as soon as March.

Access a well-rounded view of the Japanese yen‘s fundamental and technical outlook by securing your complimentary copy of the most recent trading forecast

Recommended by Diego Colman

Get Your Free JPY Forecast

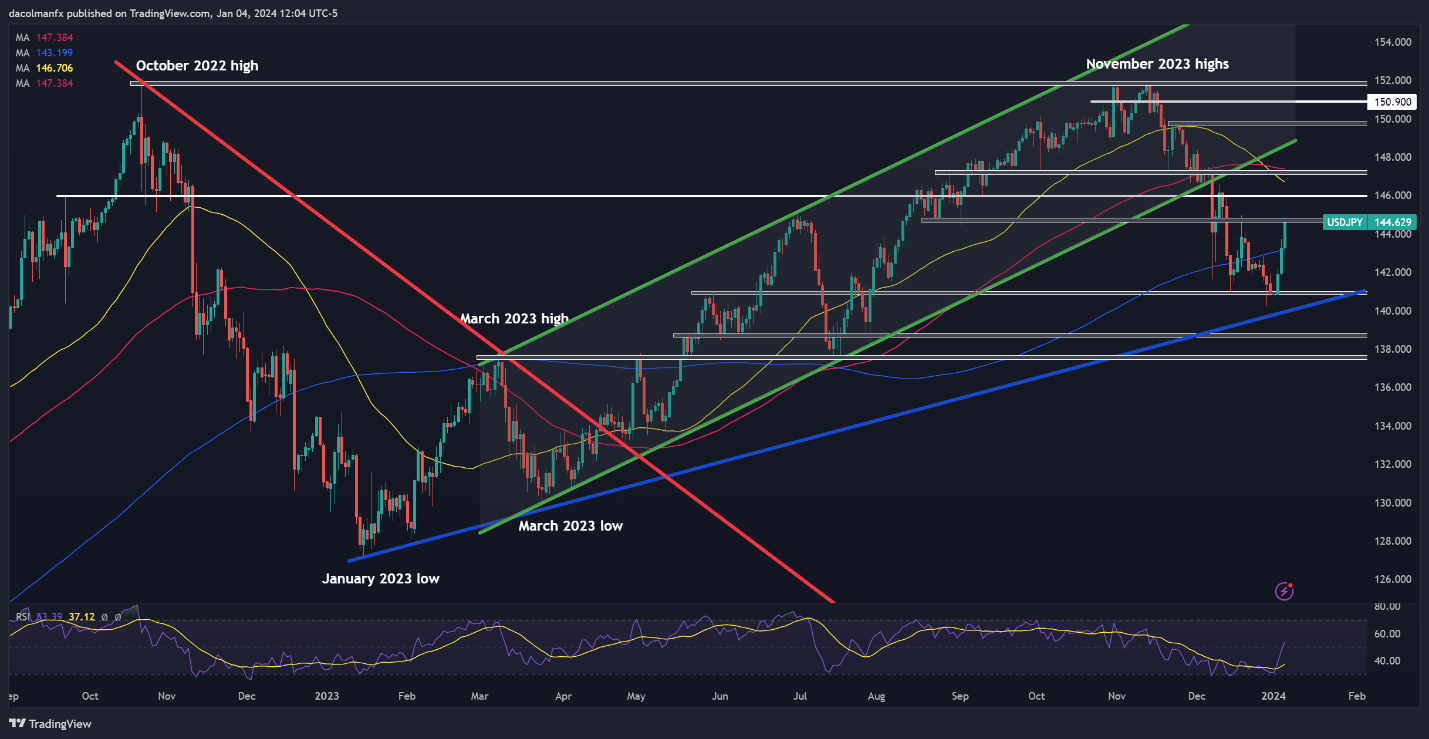

USD/JPY TECHNICAL ANALYSIS

USD/JPY accelerated higher on Thursday after breaking above its 200-day simple moving average in the previous session, pushing towards overhead resistance near 144.80. If buyers manage to drive the exchange rate above this technical barrier in the coming days, we could see a move toward the 146.00 handle in the near term. On further strength, the focus shifts to 147.20.

On the flip side, if sellers return and trigger a rejection of current levels, the 200-day simple moving average near 143.20 will be the first line of defense against a bearish assault. The pair is likely to establish a base in this area before bouncing, but a decisive break could put the pair on track for its December lows, followed by trendline support at 140.00.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

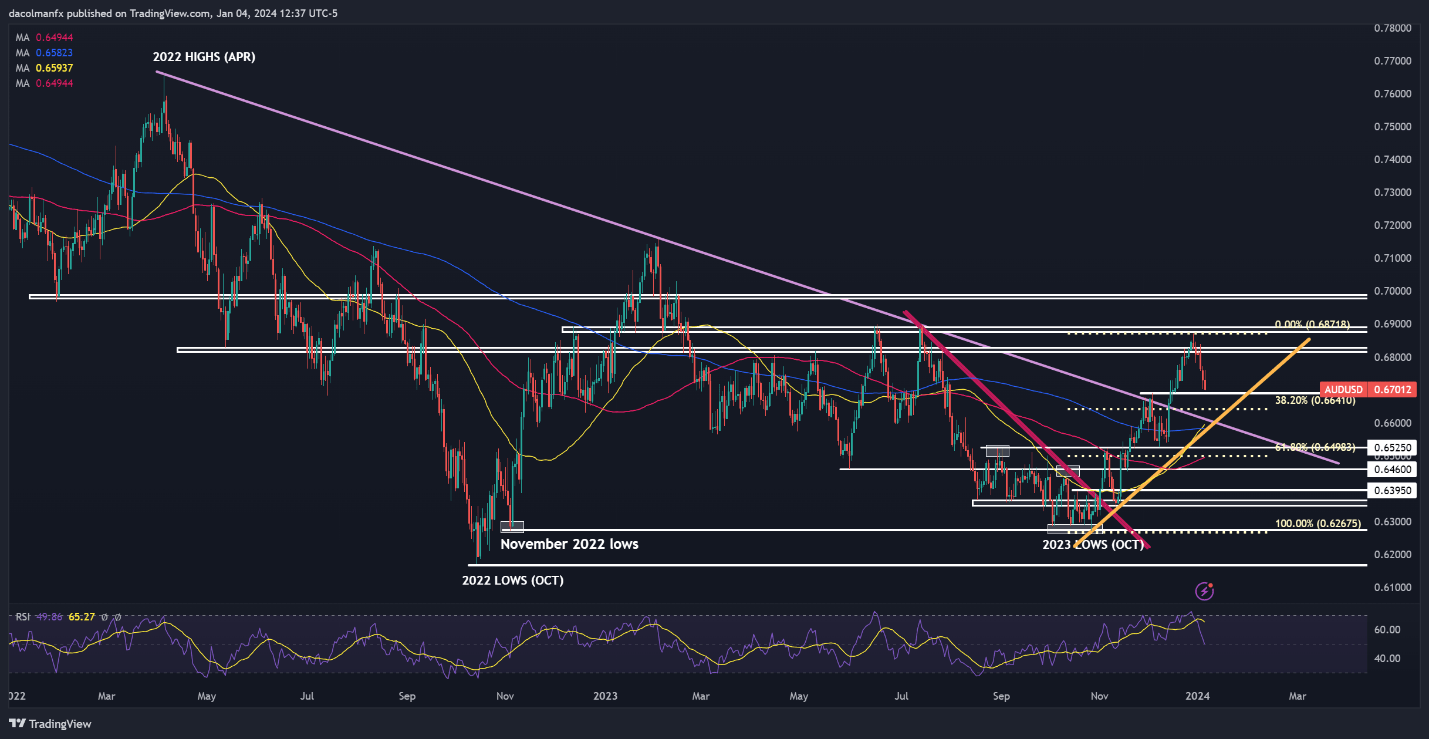

AUD/USD TECHNICAL ANALYSIS

AUD/USD extended its decline on Thursday, falling towards an important support region around the psychological 0.6700 mark. Bulls must defend this technical floor at all costs; failure to do so could spark a pullback towards 0.6640, the 38.2% Fibonacci retracement of the October/December rally. On further weakness, attention turns to trendline support at 0.6600.

Conversely, if the pair rebounds from its current position, the first resistance worth watching appears at 0.6820. Buyers will have a difficult time overcoming this obstacle, but further gains could be in store on a bullish breakout, with the next area of interest at 0.6870. Gazing higher, all eyes will be on the 0.7000 handle.

If you’re curious about what lies ahead for the Australian Dollar and the important market catalysts to track, download the Aussie’s Q1 outlook now!

Recommended by Diego Colman

Get Your Free AUD Forecast

AUD/USD TECHNICAL CHART

AUD/USD Chart Created Using TradingView

For an extensive analysis of gold’s medium-term prospects, which incorporate insights from fundamental and technical viewpoints, download our Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free Gold Forecast

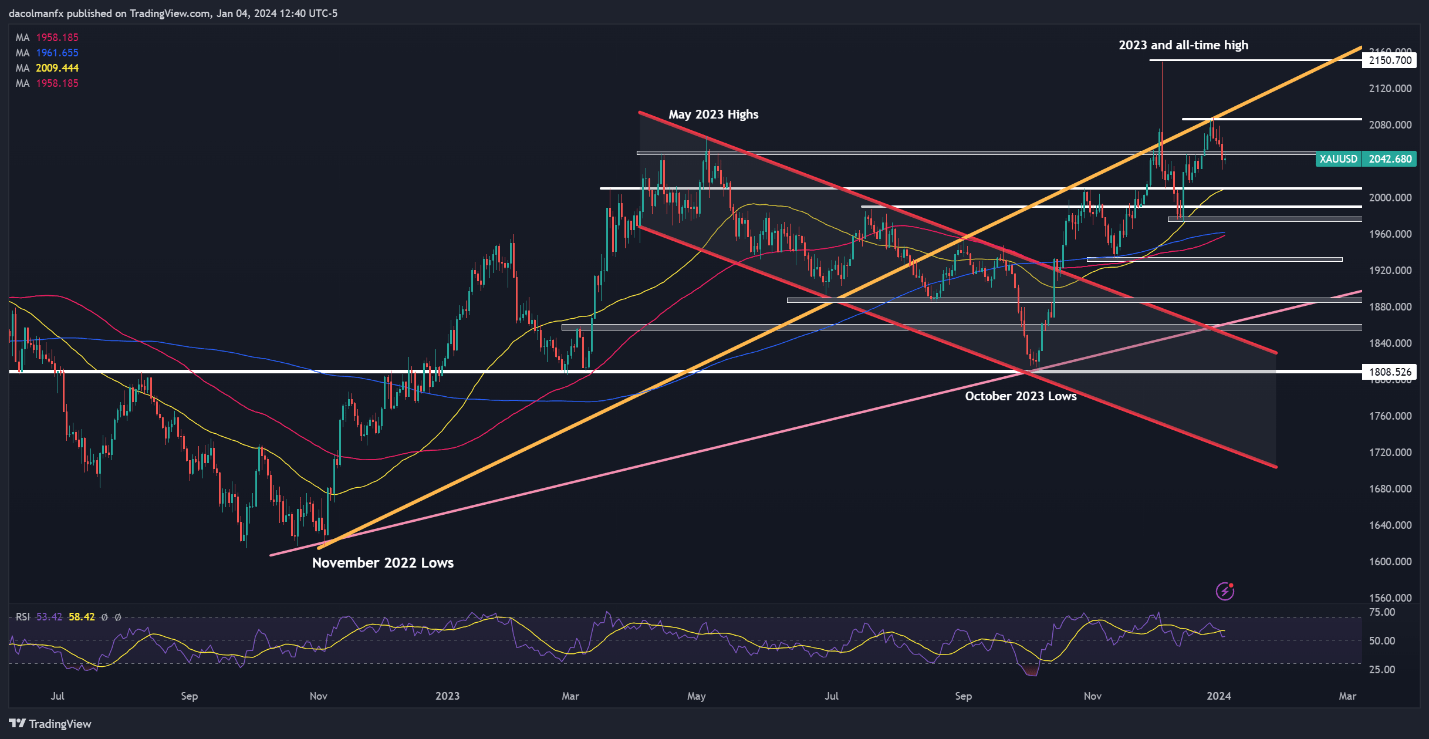

GOLD PRICE TECHNICAL ANALYSIS

Gold prices (XAU/USD) were virtually flat on Thursday after breaching an important support region between $2,050 and $2,045 in the previous session. Prolonged trading beneath this range could empower sellers to drive prices towards the 50-day simple moving average situated around $2,010. Continued weakness would shift the spotlight to $1,990, followed by $1,975.

On the contrary, if the selling pressure eases and buyers regain dominance, the first hurdle lies within the $2,045-$2,050 band. While reclaiming this area might pose a challenge for the bulls, a breakout could open the door for a rally towards the late December peak near $2,085. On further strength, the record high of around $2,150 could be within arm’s reach.

GOLD PRICE TECHNICAL CHART

[ad_2]