[ad_1]

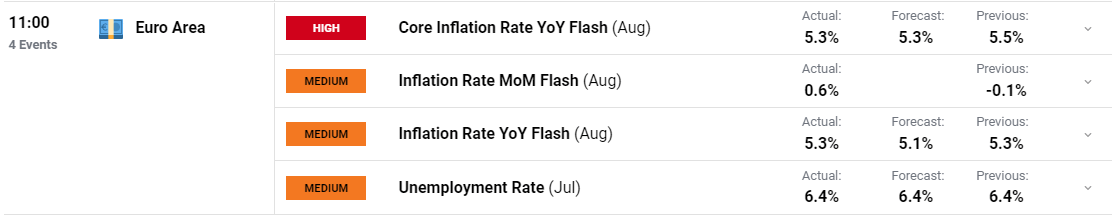

EURO AREA INFLATION KEY POINTS:

Key News and Data Releases this Week, Download Your Free Guide for Tips on News Trading.

Recommended by Zain Vawda

Trading Forex News: The Strategy

The core inflation rate in the Euro Area (filters out volatile food and energy prices) cooled coming in at 5.3% from a previous 5.5%. Core inflation had been a sticky issue for the ECB and the drop will be welcome even though the figures are still some way off the Central Banks overall target.

For all market-moving economic releases and events, see the DailyFX Calendar

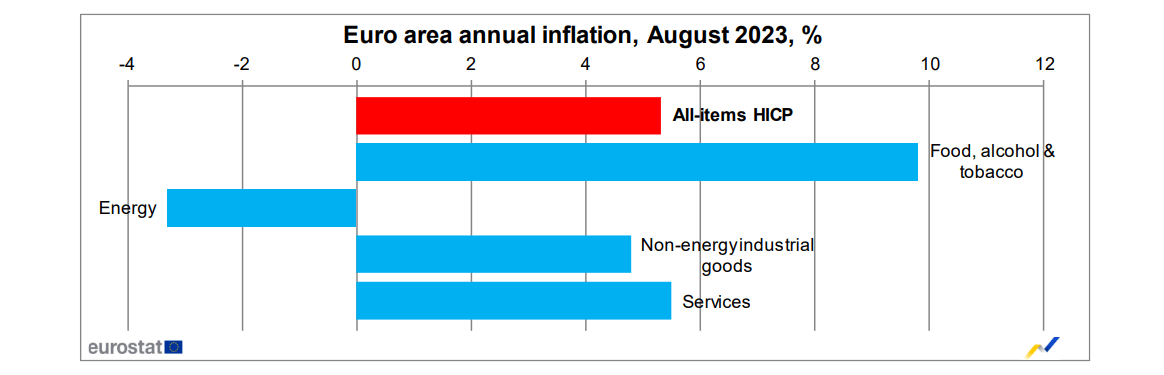

The YoY inflation rate held steady at 5.3% in August, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in August (9.8%, compared with 10.8% in July), followed by services (5.5%, compared with 5.6% in July), non-energy industrial goods (4.8%, compared with 5.0% in July) and energy (-3.3%, compared with -6.1% in July).

Source: Eurostat

Food price inflation is likely to remain an area of concern as it remains uncomfortably high in comparison to the other components.

Tips and Tricks to Trading EUR/USD, Download Your Free Guide Now.

Recommended by Zain Vawda

How to Trade EUR/USD

IMPLICATION FOR THE EUROPEAN CENTRAL BANK (ECB) MOVING FORWARD

The ECB’s task continues to grow harder by the day, however the decline in core inflation today will no doubt be a positive for the Central Bank. This comes as we are seeing a significant slowdown in the Euro Area while this morning we saw an uptick in inflation from France, Germany and Spain as well, yet headline inflation in the Euro Area as a whole remained steady. Lending data for July also showed further signs of the impact of the tightening cycle, giving doves the upper hand. As we know the tightening cycle needs time to take effect and now that we are seeing some of the effects across the data spectrum a hold at the upcoming September meeting may come to fruition. This will give the ECB more time and allow them to assess more data before making a decision.

ECB Policymaker Isabel Schnabel, a known hawk acknowledged the “visible” moderation in activity and implied that both a hike or a pause could be seen at upcoming meetings. The probability of a September rate hike by the ECB hovered around the 50% mark this morning but following the data we are seeing market participants pare back rate hike bets. The probability of a September hike in the immediate aftermath of the data dropping to a low of 30%. In simple terms, this print will no doubt create a conundrum for the ECB, not providing any real clarity.

MARKET REACTION

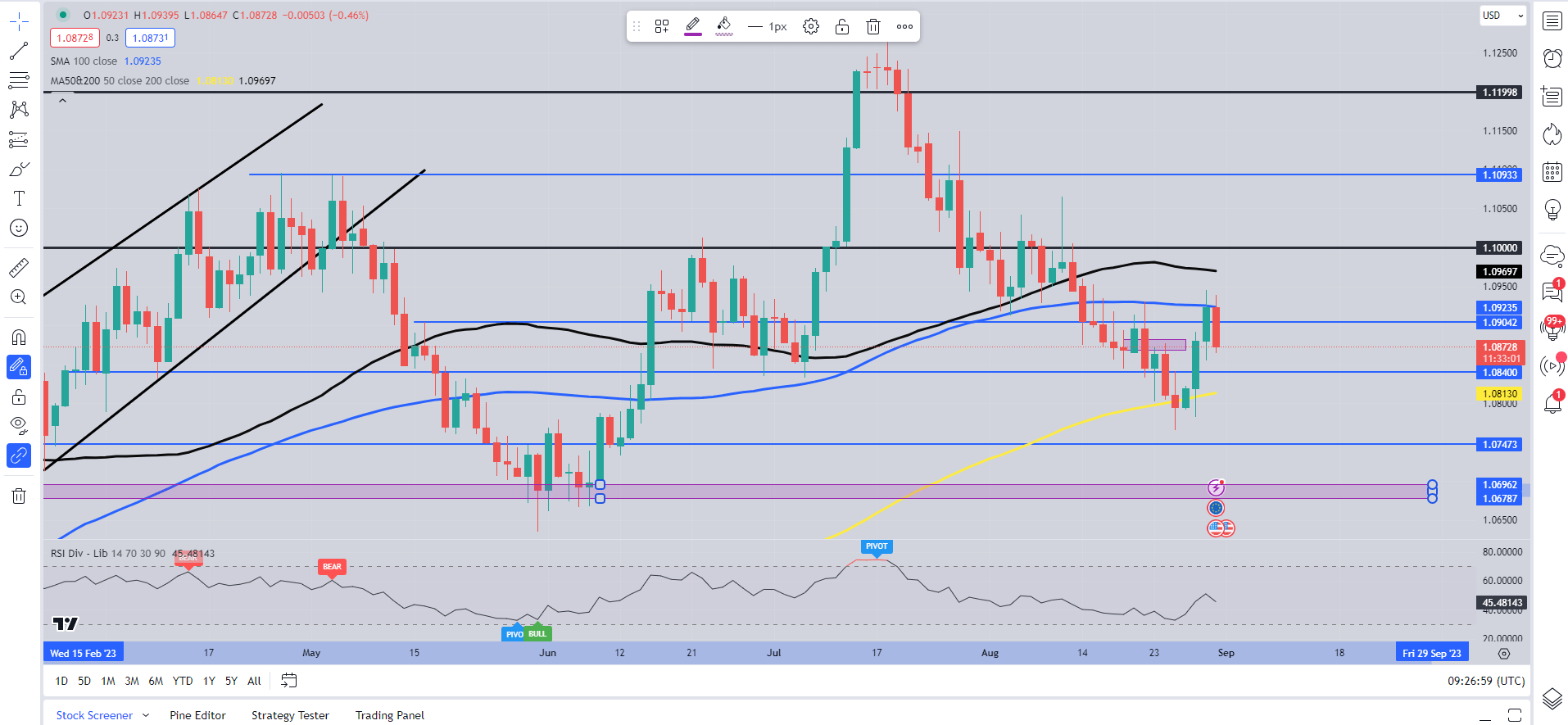

EUR/USD Daily Chart

Source: TradingView, prepared by Zain Vawda

EURUSD saw an initial 15 pip spike lower before holding steady. The pair has been on a steady decline since the start of the European session as we are seeing a slightly stronger US dollar as well. Looking at the bigger picture and EURUSD has enjoyed a slight bullish run of late, eyeing a return above the 1.1000 handle. This morning did see a slight pullback ahead of the Euro Area inflation release as price remains trapped between the 100 and 200-day Mas as price action continues to whipsaw back on forth on high impact data releases. Looking at a directional bias is difficult at present but the possibility for further upside on EURUSD cannot be ruled out.

Key Levels to Keep an Eye on:

Support Levels:

Resistance Levels:

| Change in | Longs | Shorts | OI |

| Daily | -9% | -1% | -5% |

| Weekly | -17% | 10% | -6% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]