[ad_1]

GOLD OUTLOOK & ANALYSIS

- Markets expect Fed to cut in May 2024 post-jobs numbers.

- Core PCE & jobless claims the focal points for today.

- XAU/USD trades at key area of confluence as bulls eye $1950.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL FORECAST

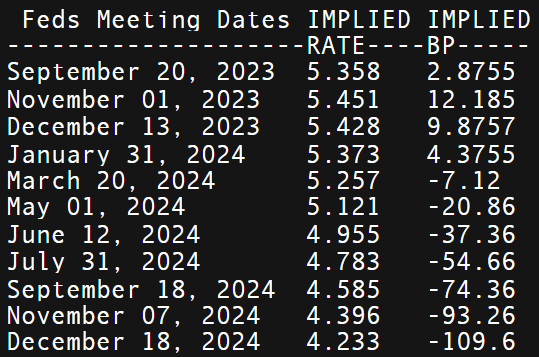

Gold prices remain buoyant after yesterday ADP employment change data supported job openings (JOLTs) earlier in the week by way of weaker than expected numbers. Coupled with US GDP missing estimates, the dollar weakened as markets anticipated an earlier interest rate cut by the Federal Reserve that has now been brought forward to May 2024 from June/July pre-announcement (refer to table below).

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

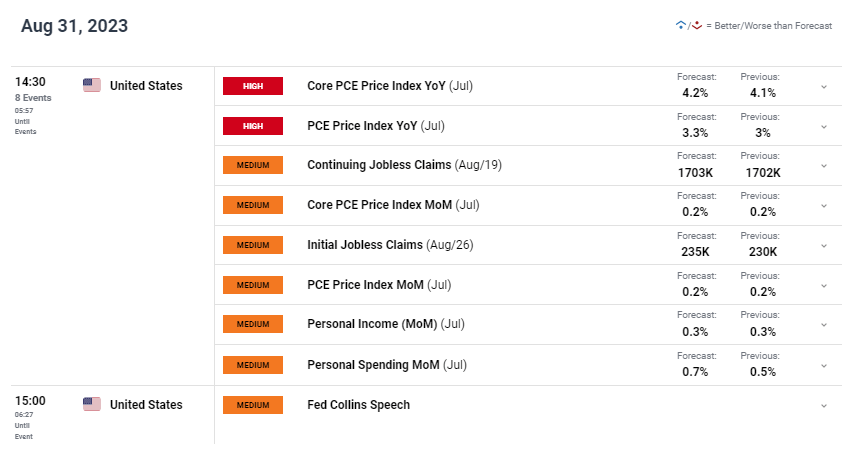

Later today, the focus will be on PCE price index data as well as jobless claims. Although jobless claims and the aforementioned labor reports are seen as inferior to the Non-Farm Payroll (NFP), markets tend to react but in a less significant manner.

GOLD ECONOMIC CALENDAR

Source: DailyFX

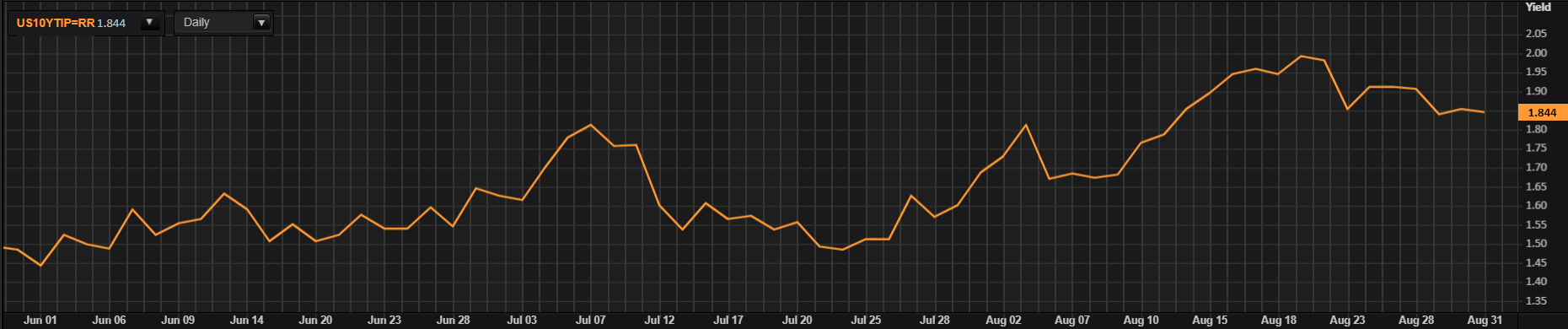

Market participants are aware that the NFP release often opposes prior labor statistics which is why there has not been any major fluctuations just yet. If NFPs follow the prior reports, gold may rally in a notable manner. Real yields have consequently fallen thus reducing the opportunity cost of holding bullion as it is a non-interest bearing asset.

US 10-YEAR REAL YIELDS

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

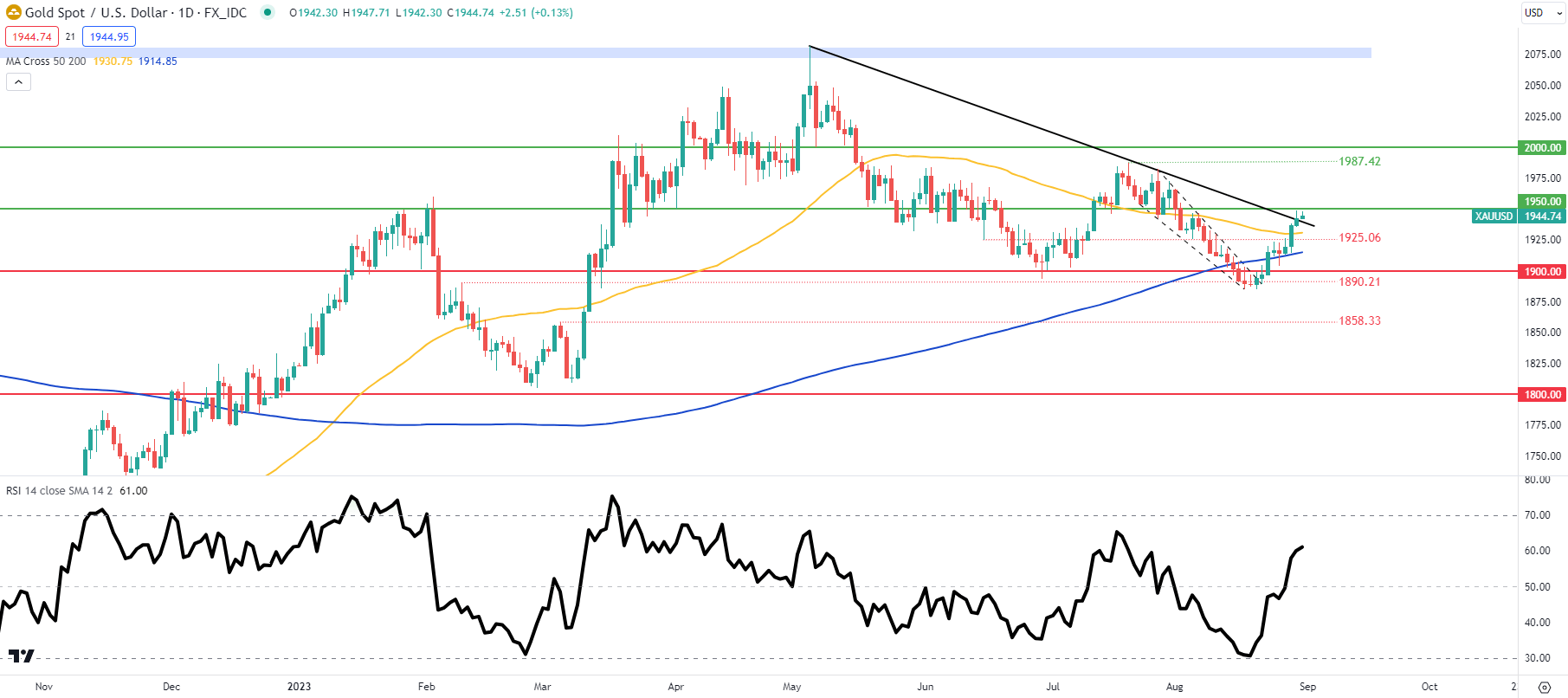

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action above now trades above the medium-term trendline resistance level (black) but is yet to confidently break above. There has been rejection by bears around the 1950.00 psychological handle while the Relative Strength Index (RSI) heads towards overbought territory. As mentioned above, upcoming US economic data will be crucial to set the directional tone for the rest of the month.

Resistance levels:

Support levels:

- 50-day MA (yellow)

- 1925.06

- 200-day MA

- 1900.00

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently distinctly LONG on gold, with 66% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GOLD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

[ad_2]