[ad_1]

Euro Bumped up by US Dollar Weakness and a GDP Beat. Where to for EUR/USD?

The Euro has steadied against the US Dollar on Thursday as the market ponders the path of Fed rate hikes and technical resistance levels remain overhead for now. Will EUR/USD rally?

Euro, EUR/USD, EZ GDP, US Dollar, Federal Reserve, FOMC – Talking points

- The Euro has benefitted from US Dollar weakness ahead of FOMC

- Euro-wide GDP beat expectations, but it may not be enough

- EUR/USD pulled back from resistance levels. Will it break above them?

{{GUIDE|EUR}}

The Euro gained overnight after better-than-expected Euro wide GDP figures showed a 0.3% QoQ expansion for the third quarter rather than the 0.2% anticipated. This gave an annual read of 2.3% YoY to the end of September, above the 2.1% forecast.

While a pleasant surprise, annual inflation is still near 10% and presents a worrying problem for the European Central Bank.

Broader US Dollar weakness also helped to underpin the Euro into the Asian session with the market now focussing on next week’s Federal Open Market Committee (FOMC) meeting.

While 50 basis points is all but baked in, the market will be scrutinising the language used by Fed Chair Jerome Powell in post-meeting remarks.

{{GUIDE|HOW_TO_TRADE_EURUSD}}

EUR/USD TECHNICAL ANALYSIS

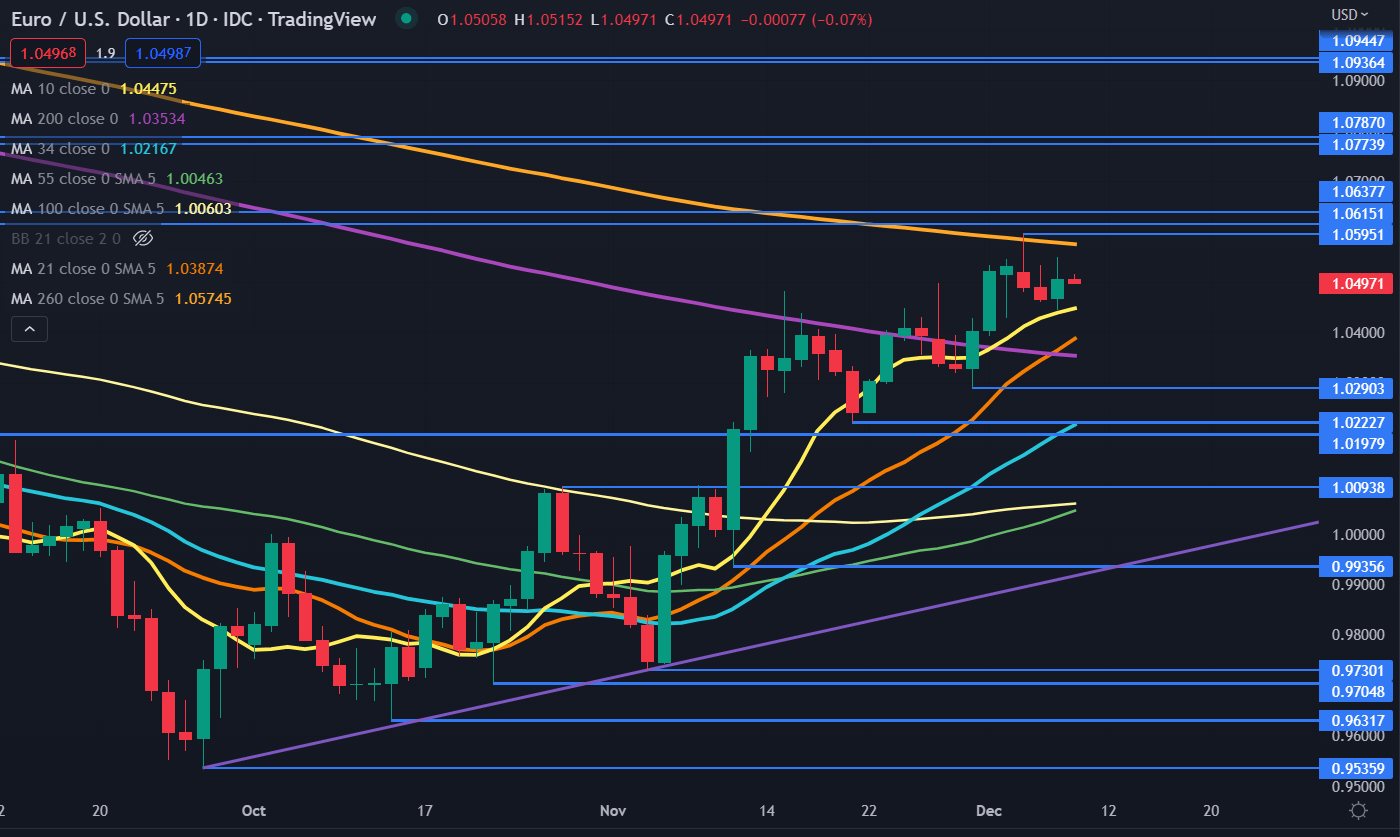

EUR/USD ran to a five-month high to start this week but was unable to overcome the late June peak of 1.0615 and the 260-day simple moving average (SMA) when traded at 1.0595. These levels may continue to offer resistance.

The pullback to yesterday’s low of 1.0443 was just above the 10-day SMA which was at 1.0439 at the time. That low and the 10-day SMA might persist as a support level.

Looking at momentum, the price remains above all short, medium and long-term SMAs except for the 260-day SMA. This could indicate that short and medium-term momentum is bullish, but it is facing underlying long-term momentum headwinds.

While the gradients on most SMAs are positive, the 200- and 260-day SMAs maintain a negative slope. If the price moves above the 260-day SMA, currently at 1.0575, and stays there, it may turn on a bullish triple-moving average (TMA).

A bullish TMA formation requires the price to be above the short-term SMA, the latter to be above the medium-term SMA and the medium-term SMA to be above the long-term SMA. All SMAs also need to have a positive gradient.

Resistance could be at the previous highs and breakpoints of 1.0638, 1.0774, 1.0787, 1.0936 and 1.0945.

On the downside, support might lie at the prior lows and breakpoints of 1.0290, 1.0228, 1.0198, 1.0094 and 0.9936. The latter also currently coincides with an ascending trend line.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]