[ad_1]

GBP/USD PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free GBP Forecast

Most Read: Breaking News: CPI Miss Confirms Cooling UK Inflation, GBP on Offer

GBP/USD FUNDAMENTAL BACKDROP

GBPUSD printed mild gains overnight which continued following the European open this morning on the back of its worst day of losses in 2 weeks. The selling pressure faced by cable came courtesy of softening UK inflation and upbeat US retail sales data which kept the bears firmly in control.

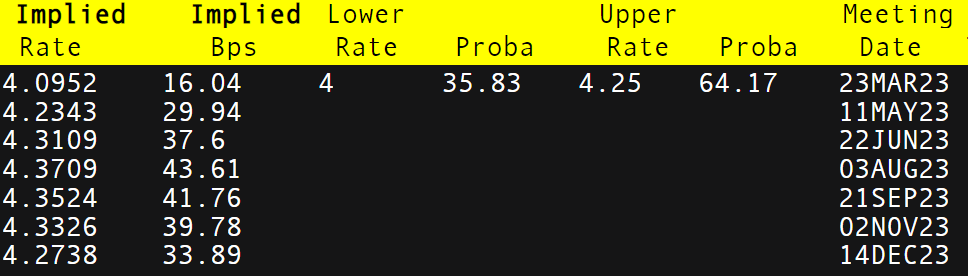

UK inflation data released yesterday surprised to the downside which resulted in a decline in rate hike expectations. This followed positive data employment data as well with market participants now pricing in a peak rate below 4.5% for the first time since February 2. This week’s positive data may be the push the Bank of England (BoE) needed to signal an early pause in interest rate hikes which could see GBP face further selling pressure moving forward.

SOURCE: REFINITIV

US data on the other hand has continued its positive trajectory as retail sales data beat estimates yesterday, fueling further upside for the US dollar. The Congressional Budget Office (CBO) in the US meanwhile issued a warning yesterday regarding the debt ceiling which continues to be a contentious issue. The CBO stated that congress has 5-8 months (dependent on IRS revenue) to prevent a debt default which could have widespread ramifications for the US.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

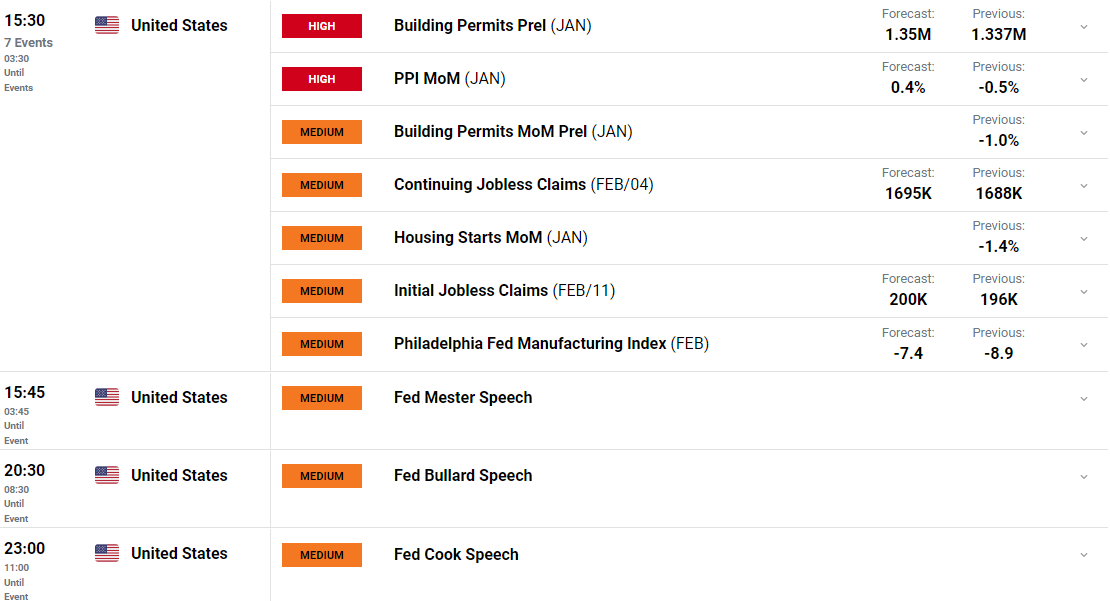

A busy day ahead on the economic calendar with a host of data releases as well BoE and Fed policymakers speaking. We could see some volatility during the US session particularly if Fed officials continue the hawkish rhetoric we have seen of late.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

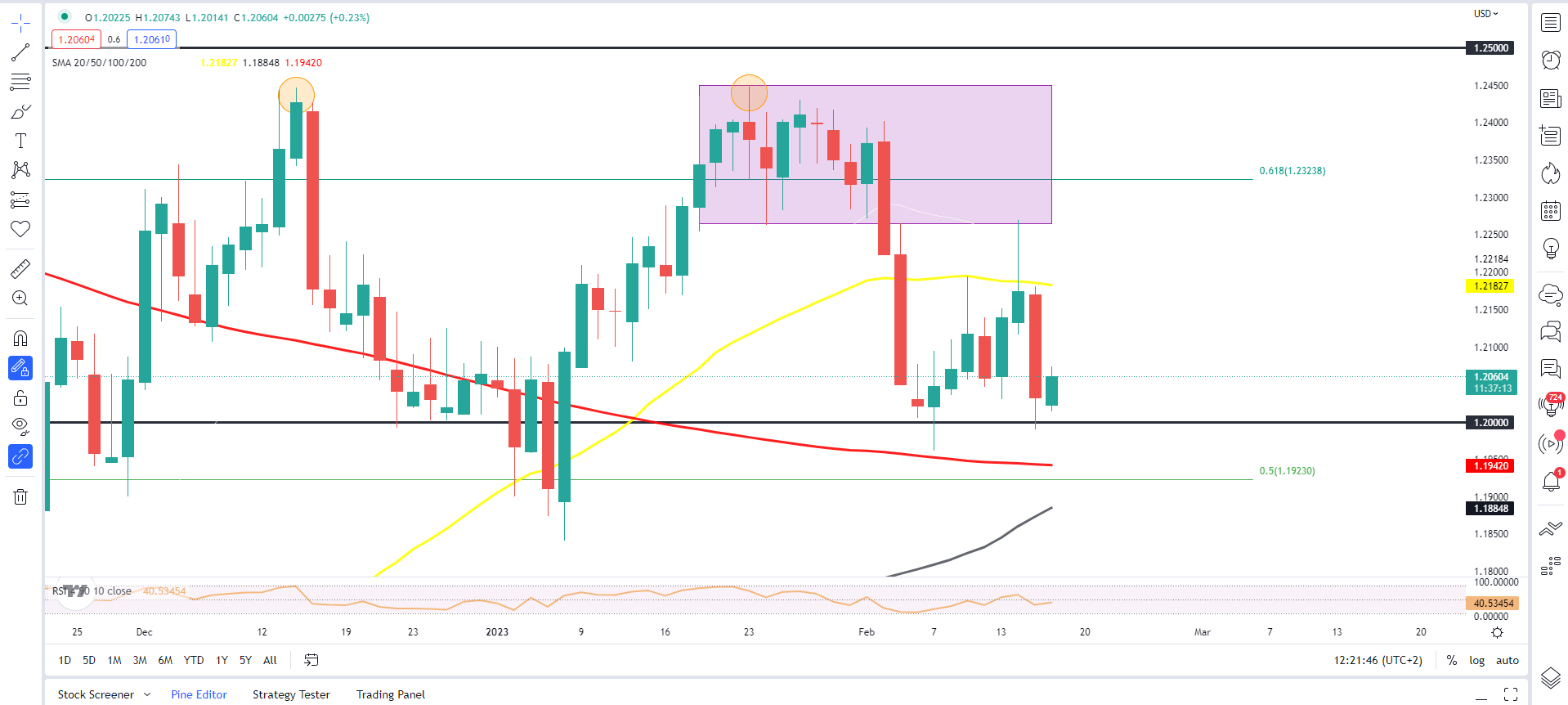

On the daily timeframe we had a bearish engulfing candle close yesterday but failed to close below the psychological 1.2000 handle. This is the second time in the last 10 days that we have failed to print a daily candle close below the psychological level. GBPUSD price seems to be stuck in a 200-pip range at present between the 50 and 200-day MAs with a breakout seeming unlikely at present. Given the fundamentals at play any further upside moves may be capped while a downside breakout needs to contend with support at the 1.2000 handle and below that the 200-day MA around 1.1940.

GBP/USD Daily Chart – February 16, 2023

Source: TradingView

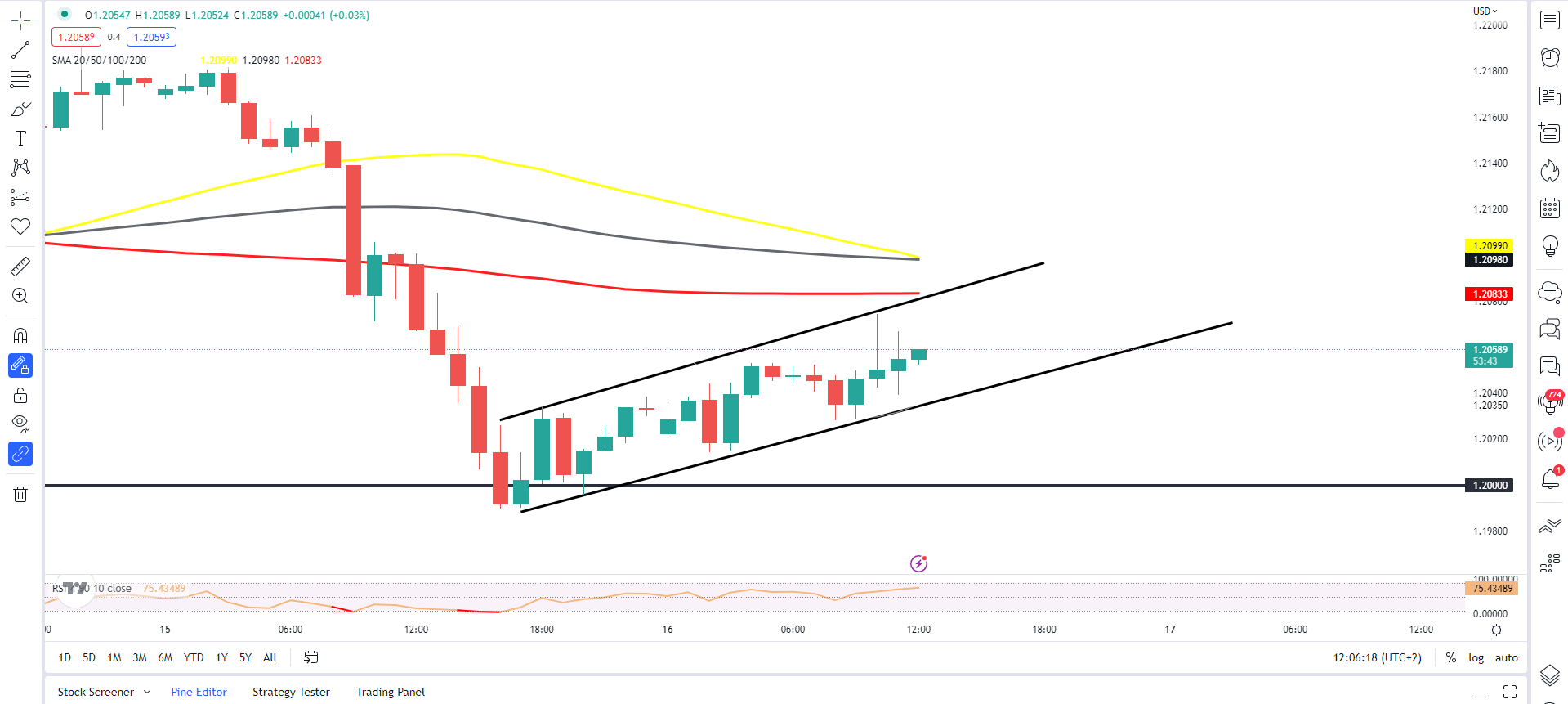

Looking at the H1 chart we do have a bear flag pattern in play which hints that further downside is the path of least resistance at present. This lines up with the fundamental picture and a H1 candle close below the bear flag pattern could open up that retest of the 1.2000 handle and a potential push lower.

GBP/USD One-Hour Chart – February 16, 2023

Source: TradingView

KEY RESISTANCE LEVELS:

KEY SUPPORT LEVELS:

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]