GBP/USD PRICE, CHARTS and ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read:

GBP/USD FUNDAMENTAL BACKDROP

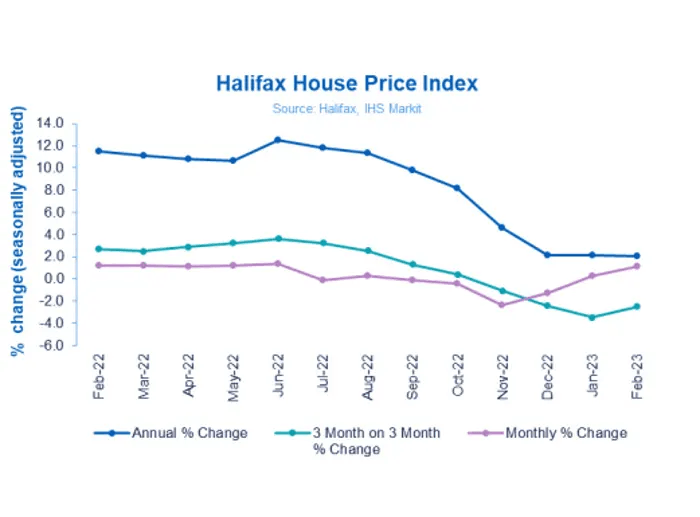

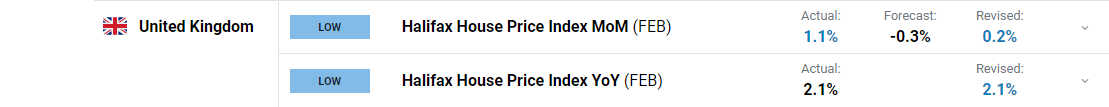

GBPUSD enjoyed a 35-pip bounce prior to the European open following a positive read from the UK Halifax House Price Index which indicated a 1.1% price rise for the month of February. The data follows a positive read from yesterday’s PMI data from the UK construction sector as well as retail sales data which came in at 4.9% for February in comparison to 3.9% last in January. Since the open however cable has struggled to maintain momentum hampered by a resurgence in the US dollar trading at 1.2030 (at the time of writing).

A sense of stability has returned to the UK property market following the turmoil experienced last year with a second successive month of gains following a drop in December 2022. Prices do however remain down 2.5% on QoQ basis, with underlying activity still indicative of a downward trend. The report attributed the February rise in prices to reductions in mortgage rates, improving consumer confidence and the ongoing resilience displayed by the UK labor market.

For all market-moving economic releases and events, see the DailyFX Calendar

The Dollar Index meanwhile began the week slightly on the back foot yesterday ahead of a busy week for the greenback on the data front. We have the NFP jobs report on Friday, but all eyes will no doubt be fixed on Federal Reserve Chair Jerome Powell who begins his semi-annual testimony before the Senate Banking Committee in Washington DC later today. The two-day testimony may provide further clues as to where the Fed sees peak rates ending up as well as the continued fight against inflation. Market participants will have to keep their ears peeled for potential comments which could either spur on further gains for the USD or leave it susceptible to losses following a strong February which saw peak rate expectation rise from 4.8% to a high of 5.5%.

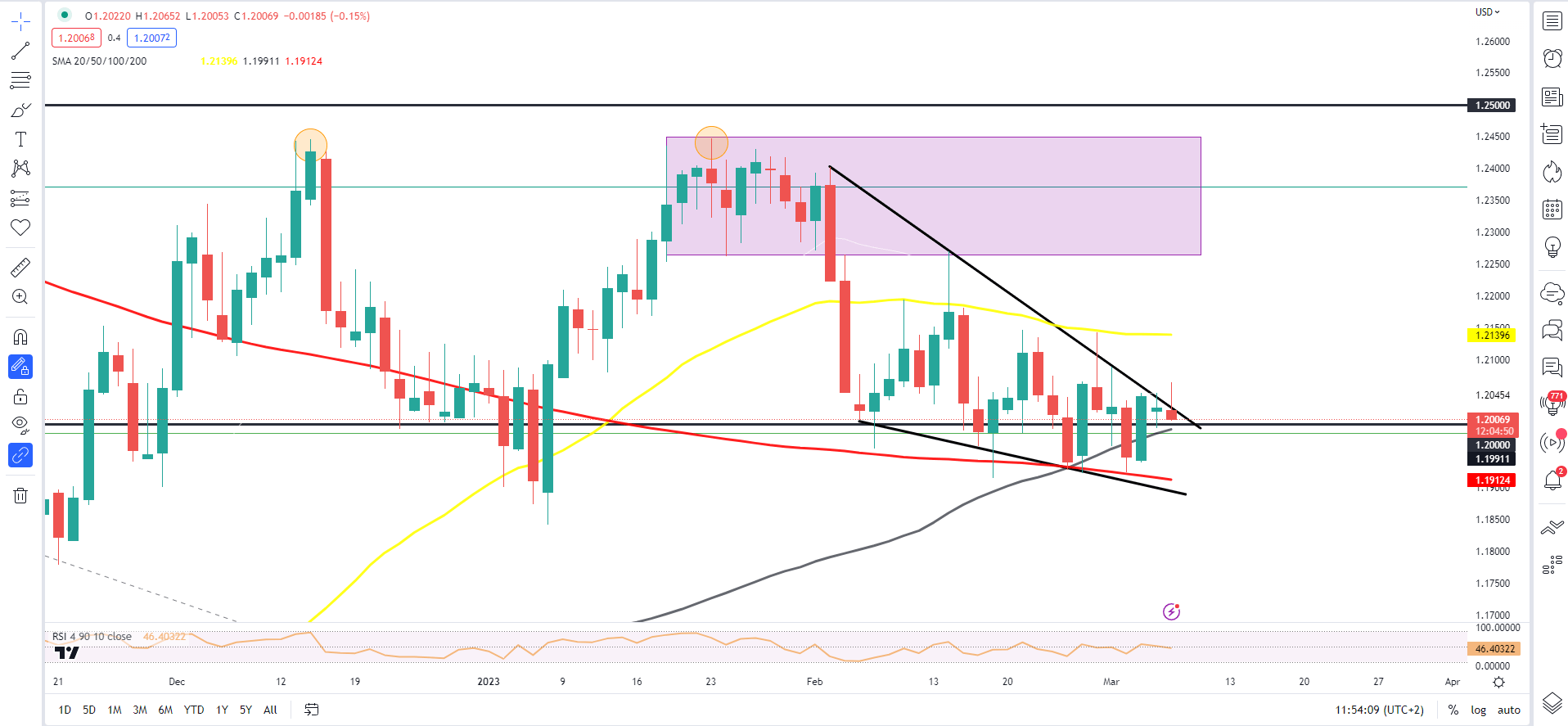

TECHNICAL OUTLOOK

On the daily timeframe remain caught between the moving averages with the 50-day MA providing resistance to the upside and the 100 and 200-day MA having formed a golden cross providing support. This morning’s bounce saw us trade temporarily outside the upper end of the wedge formation, however a daily candle close above will be needed to confirm a breakout.

The range between 1.1925 – 1.2145 remains firm as well and a breakout of the wedge pattern on either side may find still find it difficult to break out of the 220-pip range.

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

Later today Fed chair Powell’s testimony may provide a catalyst and some volatility, whether this will be enough to inspire a breakout of the wedge with a daily candle close remains to be seen but is worth keeping an eye on.

GBP/USD Daily Chart – March 7, 2023

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda