[ad_1]

British Pound Latest: GBP/USD Charts and Analysis

Most Read: EUR/GBP – Respecting Multi-Month Boundaries

Download our brand new British Pound Q1 2024 Forecast below

Recommended by Nick Cawley

Get Your Free GBP Forecast

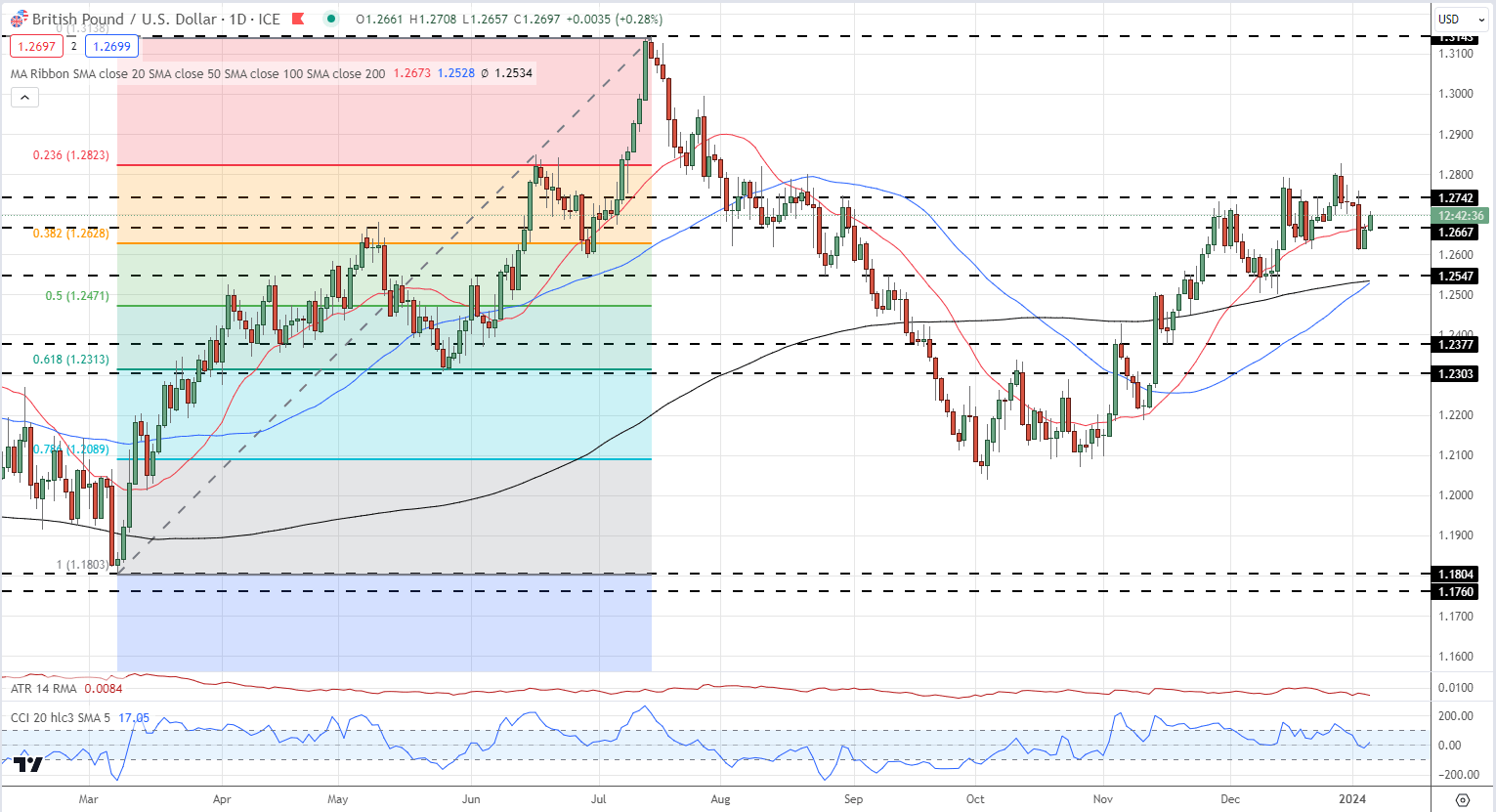

Sterling has found a short-term level of support against the greenback between 1.2610 and 1.2628 (38.6% Fibonacci retracement) and is using this support zone to press higher and re-test 1.2700. Cable has been under pressure of late from a strong US dollar but with the greenback flat on the session so far, 1.2700 may not hold for long.

The British Pound is also pushing ahead against the Euro with EUR/GBP nearly one point lower from the recent 0.8715 high. EUR/GBP has been a multi-month range trade (See story above) and this looks set to continue in the weeks ahead.

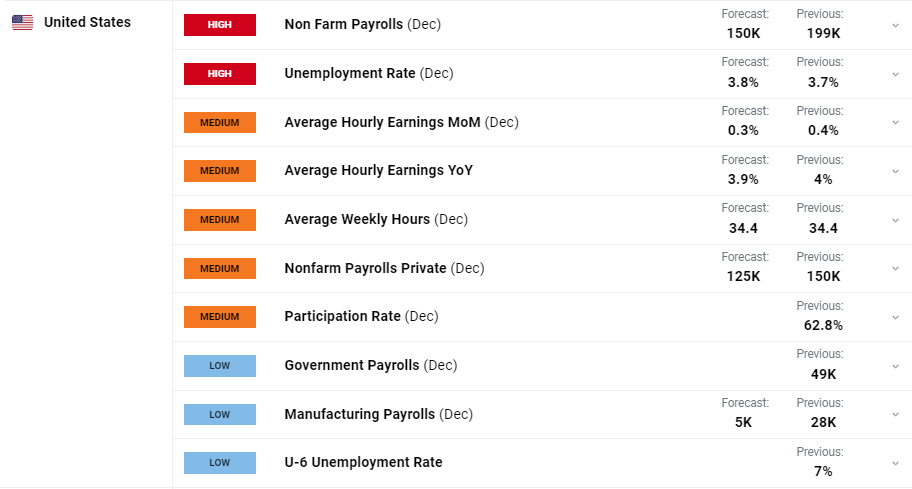

Today sees the latest ADP employment report released at 13:15 UK with analysts forecasting little change from the November 103k release. While ADP is important, Friday’s US Jobs Report (NFP) will set the market tone for the near term. The market is forecasting 150k new jobs in December, down from a prior month’s 199k and any deviation from forecast, or revision of last month’s data should be noted.

For all market-moving economic data and events see the DailyFX Economic Calendar

Recommended by Nick Cawley

Trading Forex News: The Strategy

The daily GBP/USD chart looks mixed to mildly positive with the CCI indicator in neutral territory. Support between 1.2610 and 1.2628 should prove robust ahead of US NFPs and any US dollar weakness could see cable test 1.2742. A confirmed break here would leave the recent multi-month high of 1.2828 vulnerable.

GBP/USD Daily Price Chart

Chart using TradingView

Retail trader GBP/USD data show 52.43% of traders are net-long with the ratio of traders long to short at 1.10 to 1.The number of traders net-long is 10.48% lower than yesterday and 29.73% higher than last week, while the number of traders net-short is 12.07% higher than yesterday and 17.09% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

What Does Changing Retail Sentiment Mean for GBP/USD Price Action?

| Change in | Longs | Shorts | OI |

| Daily | -11% | 14% | -1% |

| Weekly | 27% | -14% | 3% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]