[ad_1]

USD/JPY, EUR/USD, GOLD FORECAST

- The U.S. dollar gains, but finishes the day off the session high after the Fed minutes trigger a pullback in yields

- All eyes will be on the U.S. jobs report later this week

- This article focuses on the near-term outlook for the U.S. dollar, analyzing major pairs such as EUR/USD and USD/JPY. The piece also examines the technical bias for gold prices.

Most Read: Gold Price Forecast: XAU/USD Tanks as Traders Eye Reversal, US Jobs Data Next

The U.S. dollar, as measured by the DXY index, extended its rebound on Wednesday, but ended the day well off the session high after the Fed minutes triggered a pullback in yields. For context, the account of the last FOMC meeting revealed that interest rates could stay high for longer, but also that policymakers see inflation risks moving toward greater balance, the first step before launching an easing cycle.

With the Fed’s policy outlook a state of flux, it is important to keep a close eye on macro data, considering that incoming information on the economy will be the main variable guiding the U.S. central bank’s next moves and the timing of the first rate cut. That said, the next important report worth following will be the December nonfarm payrolls survey (NFP), which will be released on Friday morning.

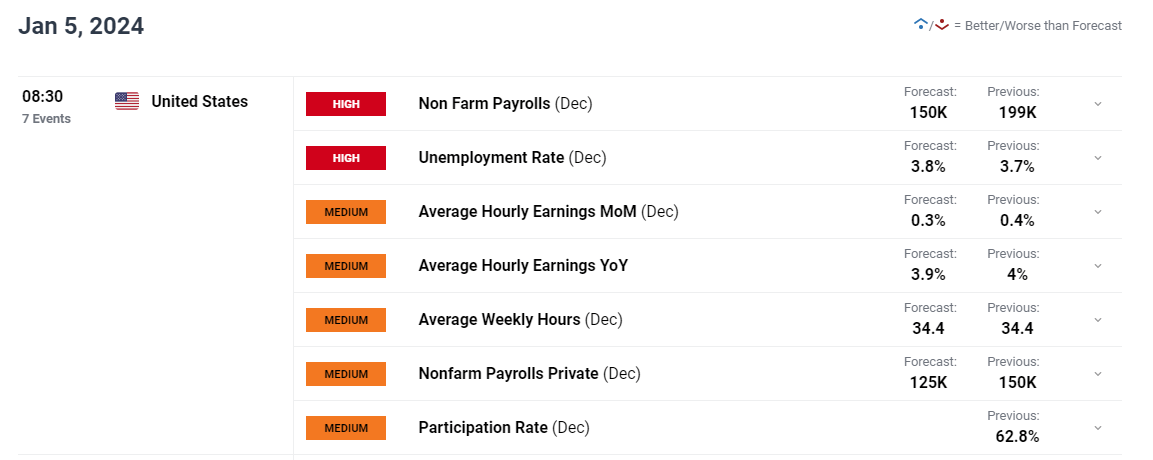

In terms of consensus estimates, U.S. employers are forecast to have added 150,000 jobs last month after hiring 199,000 people in November. The unemployment rate, for its part, is seen ticking up to 3.8% from 3.7% previously, indicating a better balance between supply and demand for workers – a situation that should help alleviate future wage pressures.

Wondering about the U.S. dollar’s trajectory? Dive into our Q1 trading forecast for comprehensive insights. Don’t miss out—get your copy today!

Recommended by Diego Colman

Get Your Free USD Forecast

For the U.S. dollar to continue its recovery in the coming weeks, labor market figures must show that hiring continues to be strong and dynamic. This scenario would drive yields higher by signaling that the economy remains resilient and able to forge ahead without the immediate need for central bank support. That said, any NFP figure above 200,000 should be bullish for the greenback.

On the flip side, if job growth underwhelms and misses projections by a wide margin (e.g., anything below 100K), we should expect the opposite reaction: a weaker U.S. dollar. This result would validate bets on deep rate cuts by confirming that growth is downshifting and that the Fed needs to intervene in time to prevent a hard landing.

UPCOMING US JOBS REPORT

Source: DailyFX Economic Calendar

For a complete overview of the yen’s technical and fundamental outlook over the next three months, make sure to download your complimentary Q1 trading forecast now!

Recommended by Diego Colman

How to Trade USD/JPY

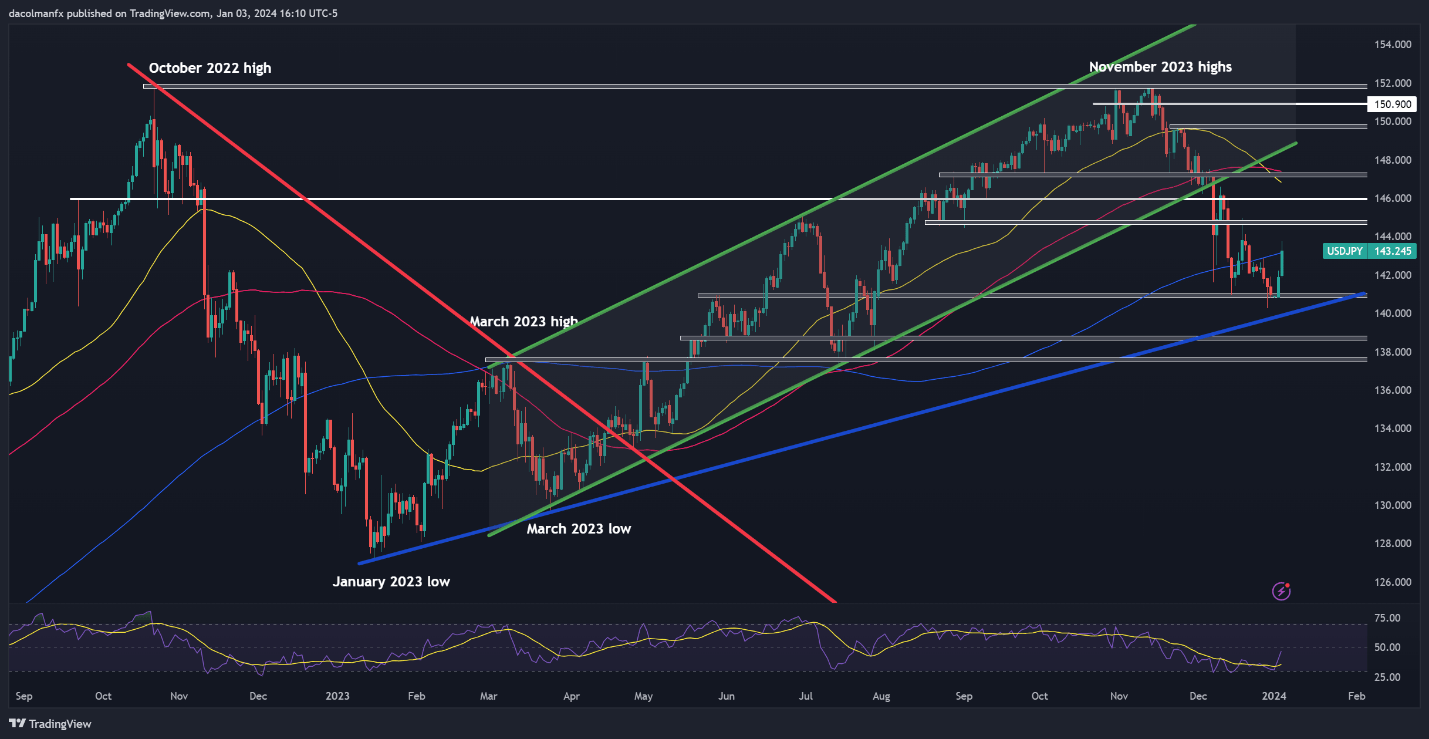

USD/JPY TECHNICAL ANALYSIS

USD/JPY rallied and pushed past its 200-day simple moving average on Wednesday, though the advance lost some momentum in late afternoon trading. In any case, if the bullish breakout is sustained, bulls could regain commanding control of the market, setting the stage for a possible rally towards 144.80. On further strength, we can’t rule out a move towards the 146.00 handle.

Conversely, if sellers reemerge and drive USD/JPY below its 200-day SMA, sentiment around the U.S. dollar could sour, setting the right conditions for a pullback towards 140.95. The pair is likely to establish a base in this area before bouncing, but a decisive breakdown could send the exchange rate staggering toward trendline support at 140.00.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Interested in learning how retail positioning can offer clues about EUR/USD’s directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Download it now.

Recommended by Diego Colman

Get Your Free EUR Forecast

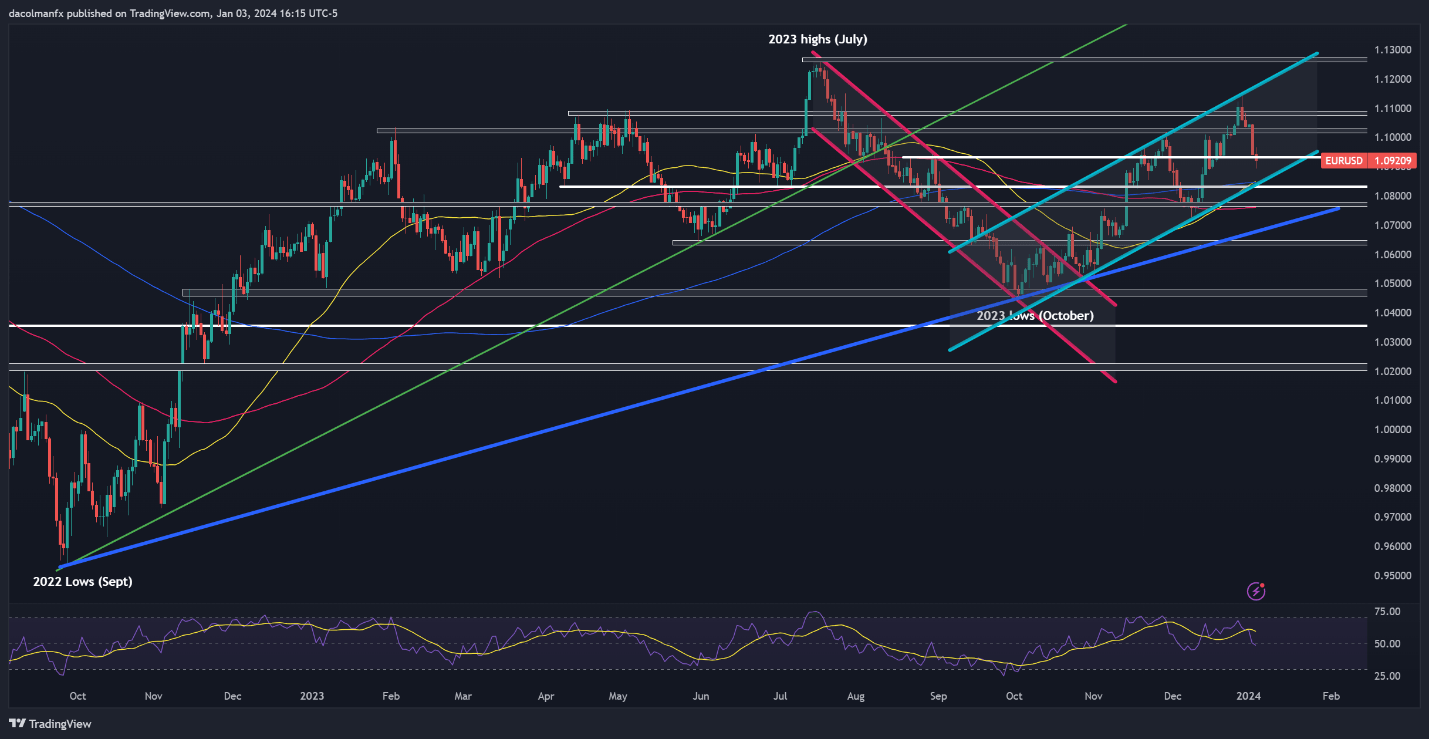

EUR/USD TECHNICAL ANALYSIS

EUR/USD climbed to multi-month highs in late December, but failed to maintain its advance, with the pair taking a turn to the downside after failing to clear channel resistance near 1.1140. Following this bearish rejection, prices have started to trend lower, slipping below support at 1.0935 on Wednesday. If such a move is sustained, EUR/USD may head towards channel support at 1.0840 in short order.

On the other hand, if buyers stage a turnaround and spark a bullish reversal, initial resistance is visible at 1.0935, followed by 1.1020. On further strength, the bulls may be emboldened to mount an attack on 1.1075/1.1095. Sellers would need to defend this ceiling at all costs– failure to do so could prompt an upswing toward December’s high at 1.1140 (also channel resistance).

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

Want to know how to trade precious metals? Get the “How to Trade Gold” guide for expert insights and strategies!

Recommended by Diego Colman

How to Trade Gold

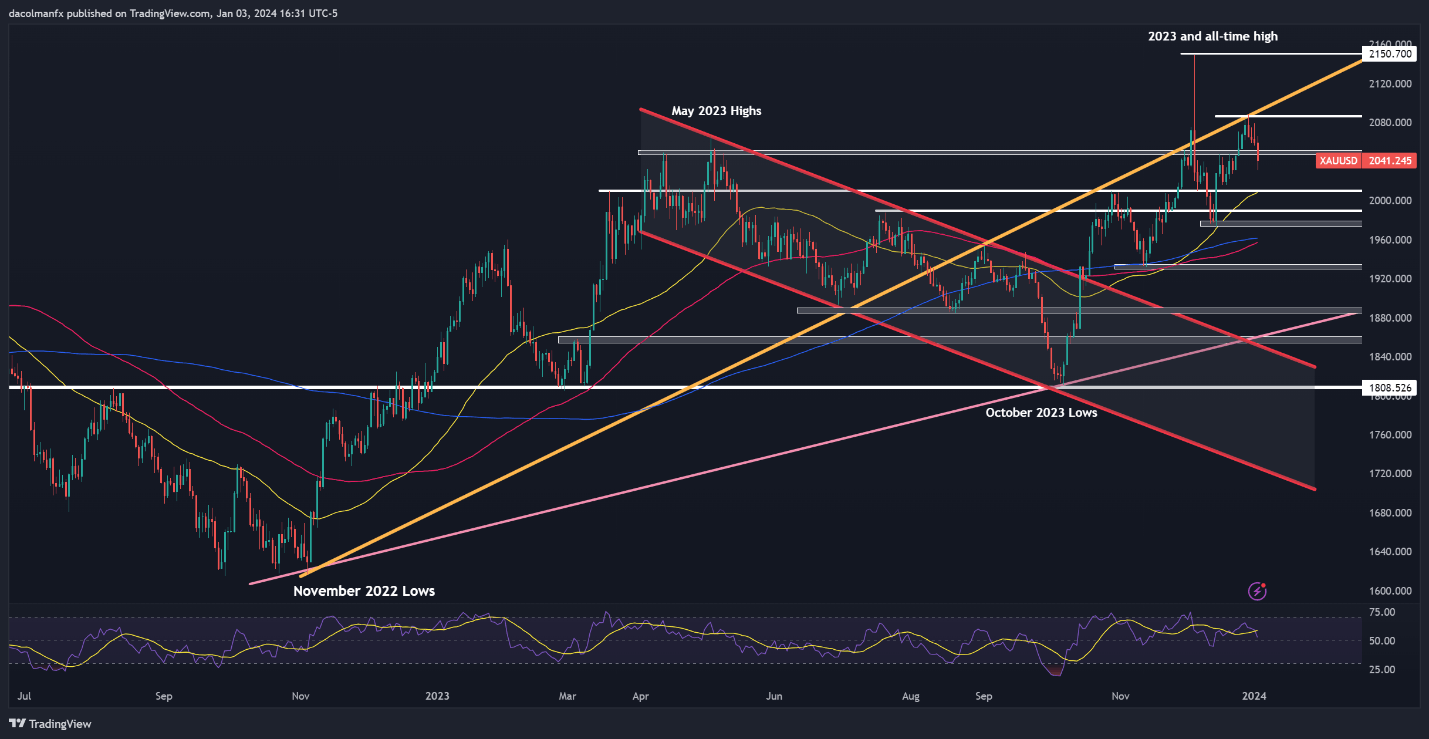

GOLD TECHNICAL ANALYSIS

Gold experienced a notable downturn on Wednesday, slipping below crucial technical support between $2,050 and $2,045. Should XAU/USD linger beneath this range for long, sellers might find momentum to steer prices toward the 50-day simple moving average near $2,010. On further weakness, all eyes will be squarely set on $1,990, followed by $1,975.

On the flip side, if selling pressure abates and buyers regain control of the wheel, initial resistance is located at $2,045-$2,050. Though taking out this technical barrier might prove difficult for the bulls, it will not be impossible, with a breakout likely exposing December’s high. Continued upward impetus might then draw attention to the all-time high near $2,150.

GOLD PRICE TECHNICAL CHART

[ad_2]