[ad_1]

BRITISH POUND ANALYSIS & TALKING POINTS

- GBP/USD has taken a hit from a more hawkish set of Federal Reserve minutes

- Bulls are struggling to defend an important chart level

- Whether or not they can do so into the week’s end could be instructive

Recommended by David Cottle

Get Your Free GBP Forecast

GBP/USD FUNDAMENTAL BACKDROP

GBP/USD remains under significant pressure in Thursday’s European session, with most of that coming from the ‘USD’ side of the pair.

Wednesday’s release of minutes from the US Federal Reserve’s last interest-rate setting meet on January 1 showed the central bank in perhaps rather more hawkish mood than the markets had expected, and warning again that interest rates might have to remain higher for longer in order to bring inflation to heel.

Policymakers are worried that China’s emergence from its more draconian Covid-lockdown measures, along with Russia’s ongoing war in Ukraine, will increase the upward pressure on global prices. The Fed raises borrowing costs by a quarter of a percentage point last month.

Its outlook had its predictable strengthening effect on the US Dollar, with sterling particularly hard hit.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

UK ECONOMY OFFERS FEW SIGNS OF HOPE

The UK of course has its own inflationary problems, but, given the underlying fragility of the economy, the Bank of England is felt to have less room to raise borrowing casts without causing a significant recession. Growth data have shown that the country just scraped some growth at the end of lastly year, but the BoE still worries that contraction will be unavoidable in 2023.

BoE Monetary Policy Committee member Catherine Mann said on Thursday that it was too soon to say whether the risks posed by last year’s inflation surge had peaked and that the central bank should continue to raise rates.

GBP/USD rose to six months peaks at the end of last year, as markets hoped that the end of US rate rises might be within sight. However, it has slid consistently since as the data have forced a rethink of that view.

Market focus for the remainder of Thursday will likely be on official revisions to US Gross Domestic Product data for last year’s final quarter. Growth is expected to be adjusted downward from the 3.2% initially estimated.

GBP/USD TECHNICAL ANALYSIS

Introduction to Technical Analysis

Fibonacci

Recommended by David Cottle

Chart Compiled by David Cottle Using TradingView

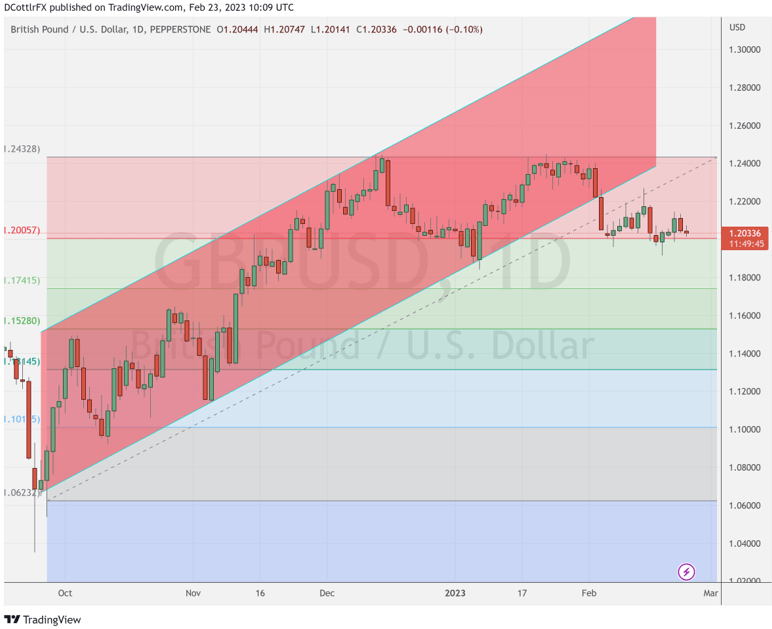

Brave breed that they are, sterling bulls are clearly mounting a dogged defence at the first Fibonacci retracement of GBP/USD’s rise from the lows of last September to those December, six-month peaks.

That comes in at a $1.20057, a level at which the pair has bounced since February 3.

It’s clearly an important point to watch now, and sterling’s ability to stay above it in to this week’s close could be interesting. Should it fail, immediate focus will be on January 6’s intraday low of 1.18456. That point the start of a significant bounce, but should it give way, the second retracement level of 1.17415 will be in the bears’ sights.

They seem to have control at the moment, with GBP/USD showing a clear inability to break its nascent downtrend. IG Sentiment data offers little hope, with fully 65% of traders bearish on Sterling.

—By David Cottle for DailyFX

[ad_2]