GOLD PRICE OUTLOOK:

- Gold prices rally as bond yields take a turn to the downside

- U.S. banking sector turmoil weighs on sentiment, boosting appetite for defensive assets

- This article looks at key XAU/USD technical levels to watch in the coming days

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: Gold Price Holds the High Ground Amid Banking Turmoil. Where to for XAU/USD?

After a modest pullback on Thursday, gold prices (XAUUSD) resumed their advance on Friday, rallying more than 2% to ~$1,965 and heading for their best week since November of last year, boosted by falling U.S. Treasury yields and stronger safe-haven demand.

While sentiment seemed to be on the mend following news that 11 large U.S. financial institutions have banded together to rescue First Republic Bank, the cheerful mood was short-lived on Wall Street, with traders acknowledging that the banking sector turmoil is still unresolved. This is benefiting defensive assets.

The market narrative is in a flux, but the fear now is that collective aid by top banks to prop up their beleaguered peer may spread the crisis rather than contain it. Why, because if the smaller regional lender were to fail, the aiding institutions will be exposed to large losses, increasing the risks of contagion.

In this environment, gold is likely to retain a bullish bias. In fact, gains could be meaningful if threats of financial instability lead the Fed to pause its tightening cycle at its March gathering. Although investors are expecting a 25 bp hike at this meeting, a pause should not be entirely ruled out if market conditions worsen in the coming days.

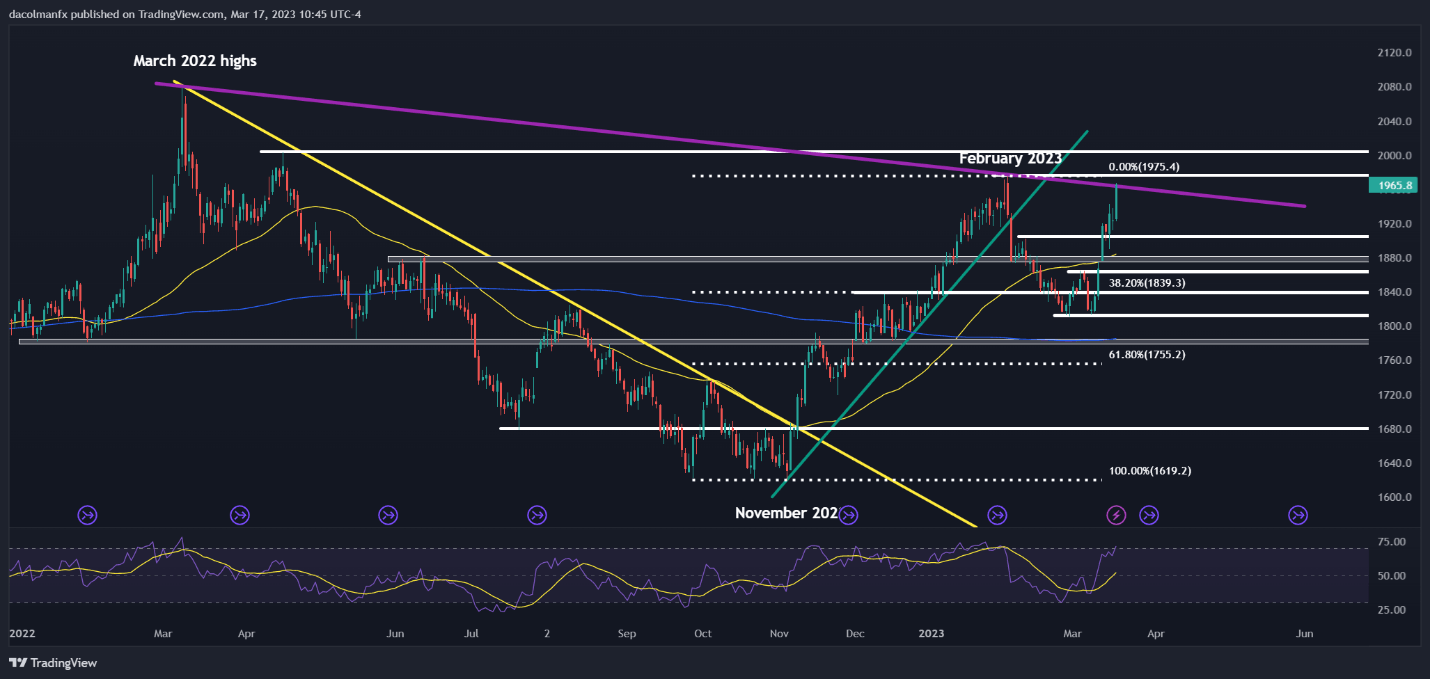

In terms of technical analysis, XAU/USD is now challenging trendline resistance in the $1,960/$1,965 area following the recent rally. If prices break above this barrier, bulls could launch an attack on the February’s high near $1,975. On further strength, the focus shifts to the April 2022 high near just a touch above the psychological $2,000 level.

On the flip side, if sellers regain control of the market and spark a pullback, initial support rests at around the $1,900 region. Below that, we have the 50-day simple moving average near $1,875 and $1,860 thereafter.

| Change in | Longs | Shorts | OI |

| Daily | -7% | 17% | 3% |

| Weekly | -23% | 76% | 3% |