[ad_1]

US DOLLAR FORECAST:

- U.S. dollar retreats on the week as Treasury yields plunge on banking sector turmoil

- The FOMC’s monetary policy meeting will steal the limelight next week

- The Fed is expected to raise rates by 25 basis points, but a pause should not be entirely ruled out in case of further stress in financial markets in the coming days

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Gold Prices Jump as Yields Slump, Sentiment Dismal as Bank Angst Lingers

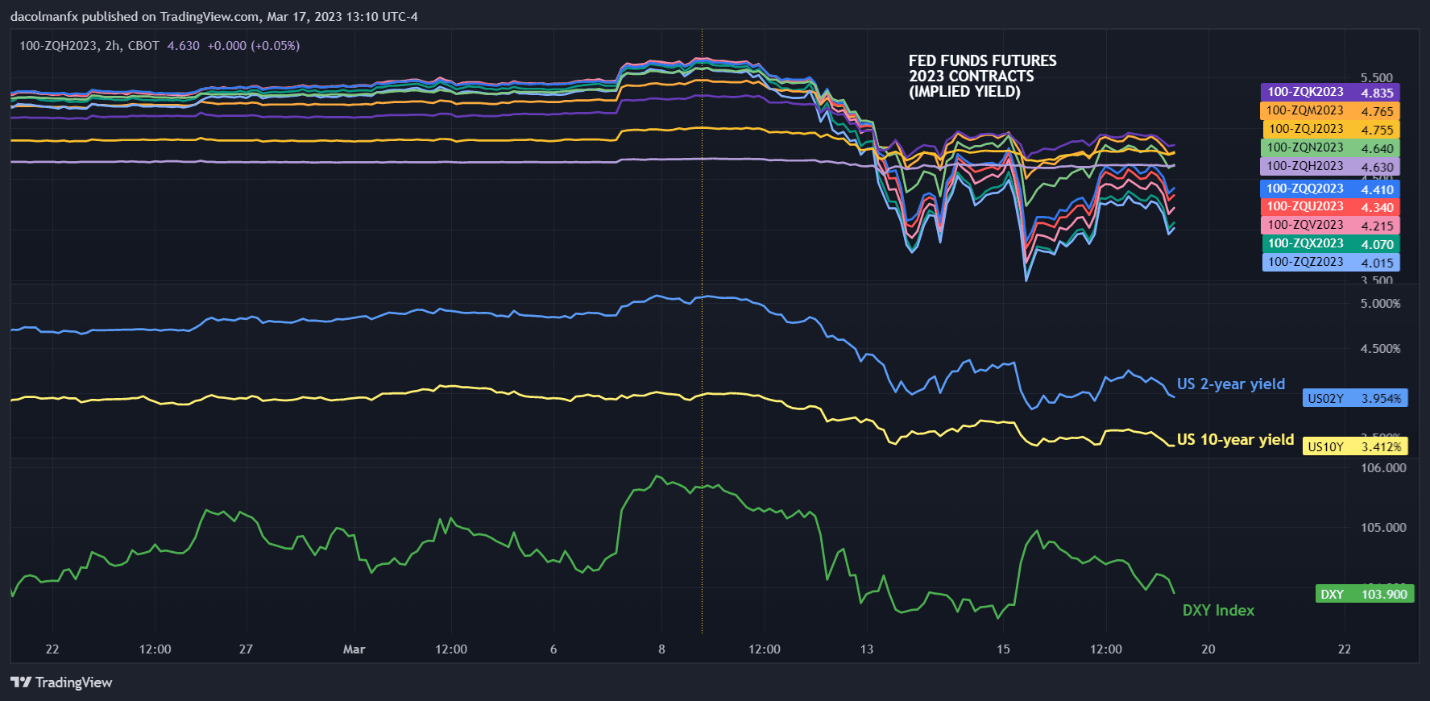

The U.S. dollar, as measured by the DXY index, came under pressure this week, sliding about 0.8% to settle slightly below the 104.00 level, undermined by the steep drop in U.S. bond yields, as traders repriced lower the Federal Reserve’s tightening path in the face of tremendous banking sector turmoil.

Bets about the outlook for monetary policy shifted in a dovish direction after the collapse of two mid-size U.S. regional banks fanned fears of a financial Armageddon, prompting the Fed to launch emergency measures to shore up depository institutions facing liquidity constraints.

The chart below displays how much Treasury yields and Fed terminal rate expectations have fallen since the middle of last week despite Jerome Powell’s hawkish message to Congress. It also shows how the dollar has retreated in parallel with those assets.

2023 FED FUNDS FUTURES IMPLIED YIELD

Source: TradingView

Recommended by Diego Colman

Introduction to Forex News Trading

Taking into account recent developments, the path of least resistance is likely to be lower for the U.S. dollar, provided the current situation doesn’t spiral out of control and leads to a large financial crisis, as that would stand to benefit defensive currencies.

Traders will be equipped with more information to better assess the greenback’s prospects after the Fed announces its March policy decision this coming Wednesday. While expectations have been in flux, market pricing now leans toward a quarter-point interest rate hike – a move that would take borrowing costs to 4.75%-5.00%, the highest level since 2007.

Anyway, a “pause” is still in play and should not be completely ruled out, as a lot could happen between now and Wednesday. Events in the last few days have shown that bad news comes unannounced and out of nowhere. That said, any renewed financial stress could nudge policymakers to err on the side of caution and adopt a “wait and see” approach.

Whatever the Fed decides next week, the stars have aligned for guidance to be dovish. The FOMC is likely to emphasize the importance of preserving financial stability and its readiness to act to prevent systemic risks from materializing. The implications of this message could lead to further U.S. dollar weakness.

Written by Diego Colman, Contributing Strategist

[ad_2]