[ad_1]

USD, S&P 500 Pre-FOMC Analysis

• US stocks and the US dollar learn of their fate at today’s FOMC meeting

• S&P 500 Pre-FOMC Analysis: Bullish Technical Cues Stack up

• US Dollar Basket Ahead of the FOMC: Consolidation Sets in

• The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Risk Assets and the Steady Greenback Learn of Their Fate Today

The US dollar and the risk assets like the S&P 500 have experienced very different outcomes of late. The dollar, much like US treasury yields, has witnessed a steady decline as interest rate expectations dropped in anticipation of an actual rate cut later this year. On the other hand, the tech heavy Nasdaq 100 produced one of the most impressive starts to the year in over two decades, rising 11%, while the S&P 500 rose by a respectable 6.2%. Whichever way you cut it, the outcome of the Fed rate decision and press conference is likely to stop one of these assets in its tracks.

If the Fed presses on with its hawkish stance on rate hikes despite clear signs of disinflation, markets may have to reprice dollar bets higher. A strong enough message may erase market pricing of a rate cut at the end of this year, which is likely to boost bond yields and the greenback at the expense of high-flying equities. The other outcome, an admission from the Fed that inflation is showing clear signs of easing is likely to be celebrated by equity market participants, supporting the S&P 500 bull run at the expense of US treasury yields and ultimately, the dollar.

S&P 500 Pre-FOMC Analysis: Bullish Technical Cues Stack up

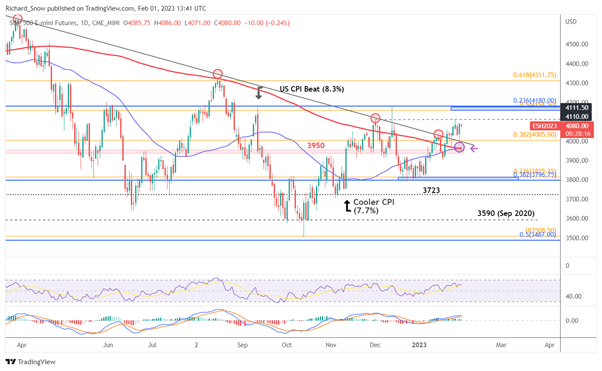

The S&P 500 has risen off the zone of resistance – comprised of the confluence of the 38.2% Fibonacci retracement of the 2020 to 2022 move as well as the 23.6% retracement of the major 2022 move. The index finally managed to break and hold above the long term trendline and even held a test of the trendline as support before continuing higher yesterday.

Before the zone of resistance comes into focus (the confluence of the 23.6% and 50% Fib retracements) the prior December high of 4110 will need to be surpassed. Further supporting bullish price action is the golden cross of the 50 and 200 simple moving averages as well as the upward momentum revealed by the MACD. In the event the Fed is perceived as very hawkish, a downward move could be fairly sharp given the ascent based on a more favorable economic environment. Trendline support is the nearest level to watch out for, with 3950 not far off.

S&P 500 (E-Mini Futures) Daily Chart Showing a Golden Cross

Source: TradingView, prepared by Richard Snow

US Dollar Basket Ahead of the FOMC: Consolidation Sets in

The US dollar, via the US dollar basket heads lower but still within the consolidation band that has naturally formed in the long lead up to what is a massive week on the economic calendar. According to the latest CoT data, large hedge funds and institutional money managers remain net short the dollar, suggesting that there is still a view that the dollar is susceptible to further selling.

Nearest resistance comes in at the March 2020 high of 103 while 101.30 is an area to watch for bearish continuation.

US Dollar Basket Daily Chart Showing Consolidation Ahead of the FOMC Decision

Source: TradingView, prepared by Richard Snow

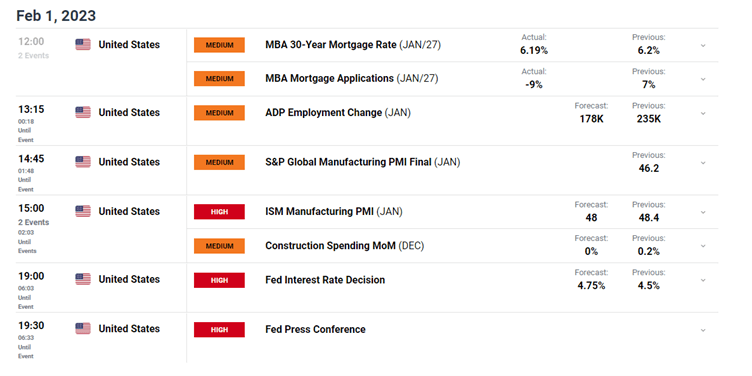

US Jobs and Manufacturing data Ahead of the Main Event: FOMC

As if there wasn’t enough high impact data to go around this week, traders still need to keep an eye out for manufacturing PMI data after the ADP private payroll data disappointed to the downside. Could we see a similar result with Friday’s NFP data in the wake of recent tech job cuts?

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]