[ad_1]

Japanese Yen, USD/JPY, US Dollar, BoJ, Ueda, Sakkibara, Nikkei 225 – Talking Points

- The Japanese Yen has steadied today after falling to start the week

- A new BoJ Governor might see a change of tack for monetary policy

- The appointment has the approval of a Yen stalwart that sees tightening ahead

Recommended by Daniel McCarthy

How to Trade USD/JPY

The Japanese Yen dipped on Monday and Tuesday with USD/JPY trading at its highest level since early January at 133.32.

The appointment of Kazuo Ueda to be the new Governor of the Bank of Japan (BoJ) on Tuesday was somewhat of a surprise.

His tenure will begin on April 8th when current Governor Haruhiko Kuroda steps down after serving two 5-year terms.

Little is known about Ueda’s approach to monetary policy and whether or not the current ultra-loose stance will be maintained.

The 71-year served several years on the bank’s board and is currently Professor at Kyoritsu University. Some commentators have been sceptical of an academic being assigned to the role, but former Finance Minister Eisuke Sakakibara espoused a positive view on Bloomberg television.

Known as Mr Yen for his respected stewardship during his term in office, Sakakibara said that Ueda knows the structure of the bank and he is likely to initially keep monetary policy steady.

He speculated that Ueda might raise rates in the fourth quarter, but it will depend on the state of the Japanese economy and if inflation remains around 2%, as he expects it to be.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

On the question of Yield Curve Control (YCC), Mr Yen said that there isn’t much worry about holding financial assets and that the sale of such assets was unlikely at this stage.

There has been some speculation that an eventual tightening by the BoJ may see a significant repatriation of funds by Japanese investors.

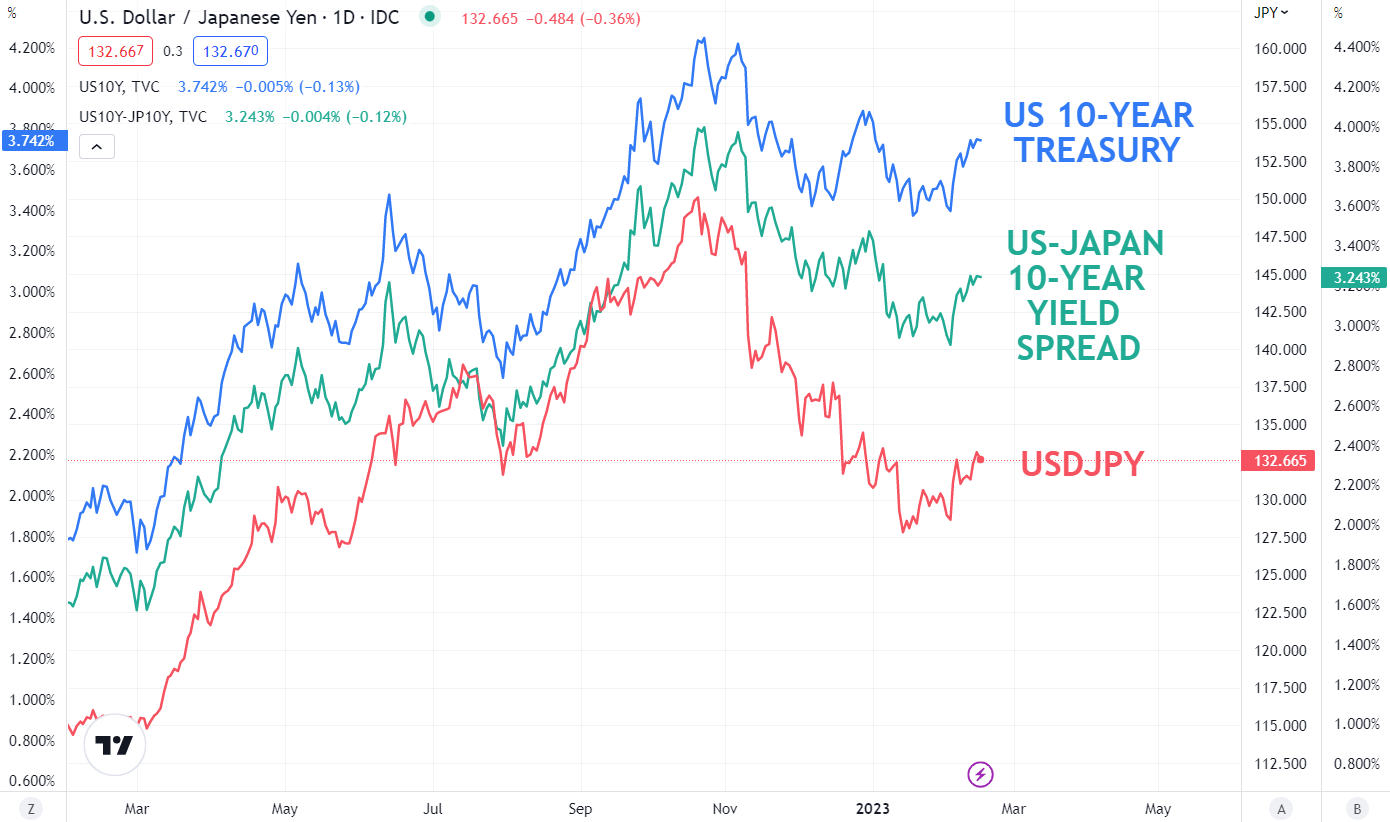

While this might be plausible, interest rates in other developed markets are hundreds of basis points higher. Given the relatively anaemic economic growth rate in Japan, the BoJ would need to be hyper-aggressive to get those levels quickly.

This would seem to risk snuffling out hopes of a recovery from the so-called ‘lost decades’ that have seen Japan’s Nikkei 225 equity index never the peak seen in 1990 due to a struggling economy.

So, while a tightening by the BoJ later this year is now on the radar, an aggressive change of policy might be a while off.

Nonetheless, USD/JPY could be in for a bumpy ride until the market has a firmer grasp of the new Governor’s intentions. If Japanese yields start heading north, it could have a considerable impact on the exchange rate.

USD/JPY TECHNICAL ANALYSIS

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]