[ad_1]

US Dollar, Federal Reserve, CPI, AUD/USD, USD/JPY, Ueda – Talking Points

- The US Dollar resumed strengthening today in the CPI aftermath

- USD/JPY is nudging recent peaks after a new BoJ Governor was anointed

- The Fed reminded markets of their intention and yields responded

Recommended by Daniel McCarthy

How to Trade USD/JPY

The US Dollar is firmer today heading into the European session after yesterday’s US CPI data overshot the mark. The headline number came in at 6.4% y/y rather than 6.2% due to an upward revision in the December read.

The January increase in prices of 0.5% m/m hit forecasts but the December number was upped from -0.1% m/m to 0.1%.

Three Federal Reserve speakers took to the podium with two of them sticking to the script of rates need to go higher and stay there for a while but one

Richmond Fed President Thomas Barkin and New York President John Williams kept their hawkish credentials intact while Philadelphia Fed President Patrick Harker appeared slightly dovish. He said that once the target rate is above 5% it will depend on the data for further hikes.

At the end of the day, the market added to the odds of a third 25 basis point lift in this cycle. While the March and May meetings already have a lift baked in, the June gathering is now live for a potential tightening of policy.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

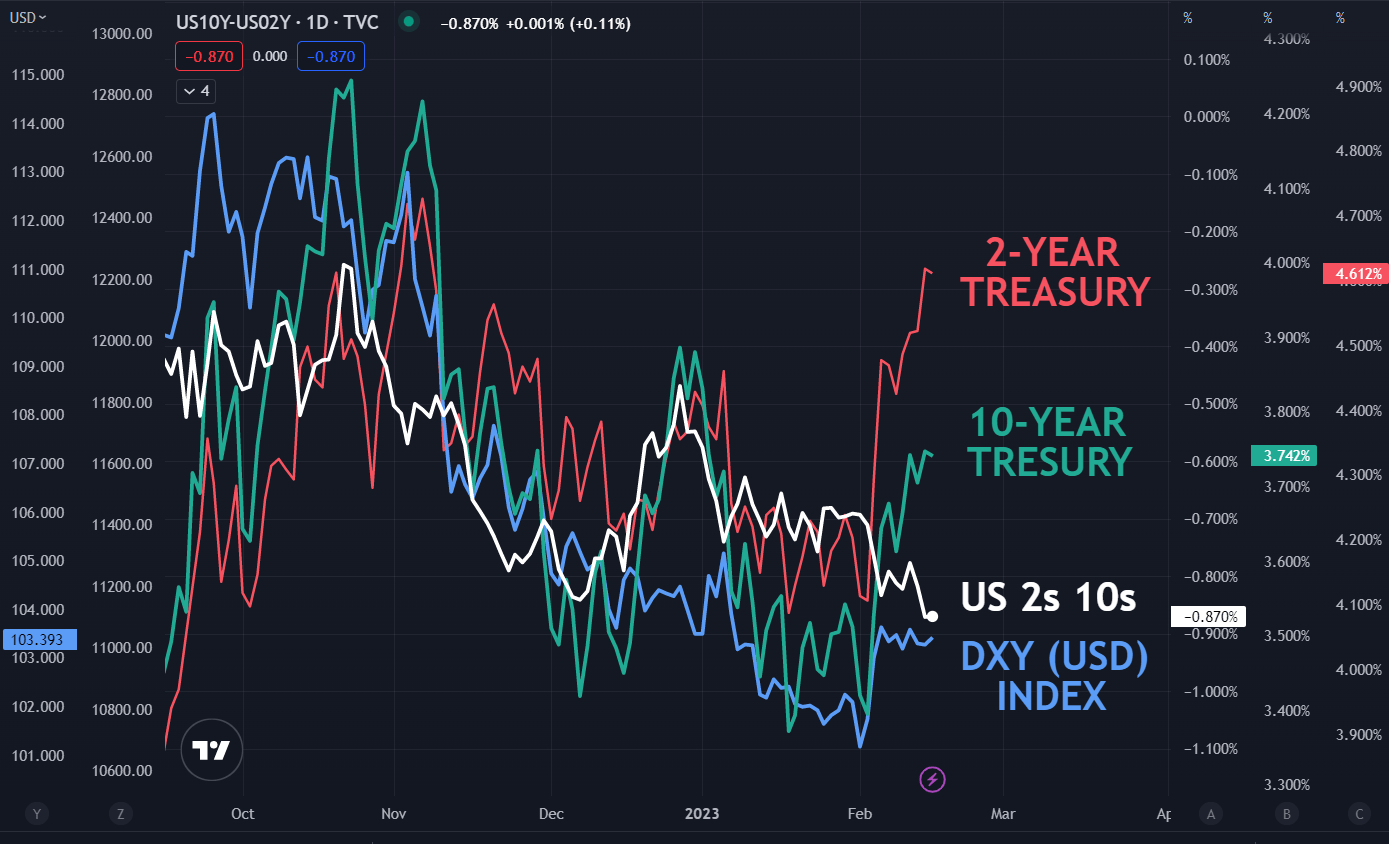

Treasury yields across the curve marched higher with notes in the 1-to-5-year part of the curve notching up the largest gains. The 2s 10s yield curve inversion tracked down to its lowest level since 1980. A concerning harbinger of a potential recession.

The higher interest rates underpinned the US Dollar, and the Australian Dollar has been the largest loser

Reserve Bank of Australia (RBA) Governor Philip Lowe testified in front of the Senate estimates committee today. The questioning was largely as anticipated around the timing of successive rate hikes from pandemic-induced lows, and he wasn’t drawn to any possibly inflammatory remarks.

USD/JPY is trading at its highest level since early January after visiting 133.32 overnight. It remains above 133.00 at the time of going to print as the markets digest yesterday’s announcement that Kazuo Ueda will be the new Governor of the Bank of Japan (BoJ).

APAC equity indices are a sea of red and futures are pointing toward a sift start for Wall Street later today.

Crude oil is a touch weaker with the WTI futures contract under US$ 78.50 bbl while the Brent contract is below US$ 85 bbl.

Looking ahead, after UK inflation data, the US will retail sales data.

The full economic calendar can be viewed here.

DXY, (USD) INDEX, 2-YEAR AND 10-YEAR TRESUTIES AND 2s 10s CURVE

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]