[ad_1]

Indices Talking Points:

- The S&P 500 has built into a symmetrical triangle inside of the rectangle formation that held through the holidays.

- The Nasdaq ended the year with a key support test, but that level hasn’t yet come back into play in the New Year. The big question is whether NFP brings back the trends as heavy focus will be paid to the Friday release with the Fed keenly watching employment figures.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Recommended by James Stanley

Get Your Free Equities Forecast

US equity markets are range-bound as has been the case for a couple of weeks now.

A forceful move showed on the back of the CPI release last month and continued after the FOMC rate decision that followed a day later. That pushed prices in all of the S&P 500, Nasdaq and Dow to key spots of support, which held. And those support holds led to mean-reversion through the holidays and New Year which remains in-place today.

Looking on the horizon, Friday brings some headline risk with the release of Non-farm Payrolls and a Services PMI release at 10 AM ET. With the Fed’s focus firmly on employment data, markets will be watching the unemployment rate for any possible clues of rationale for a softer FOMC. This is one of those areas where bad could be ‘good’ for risk assets, as a worsening unemployment rate highlights the possibility of greater motivation for the Fed to soften their approach towards rates.

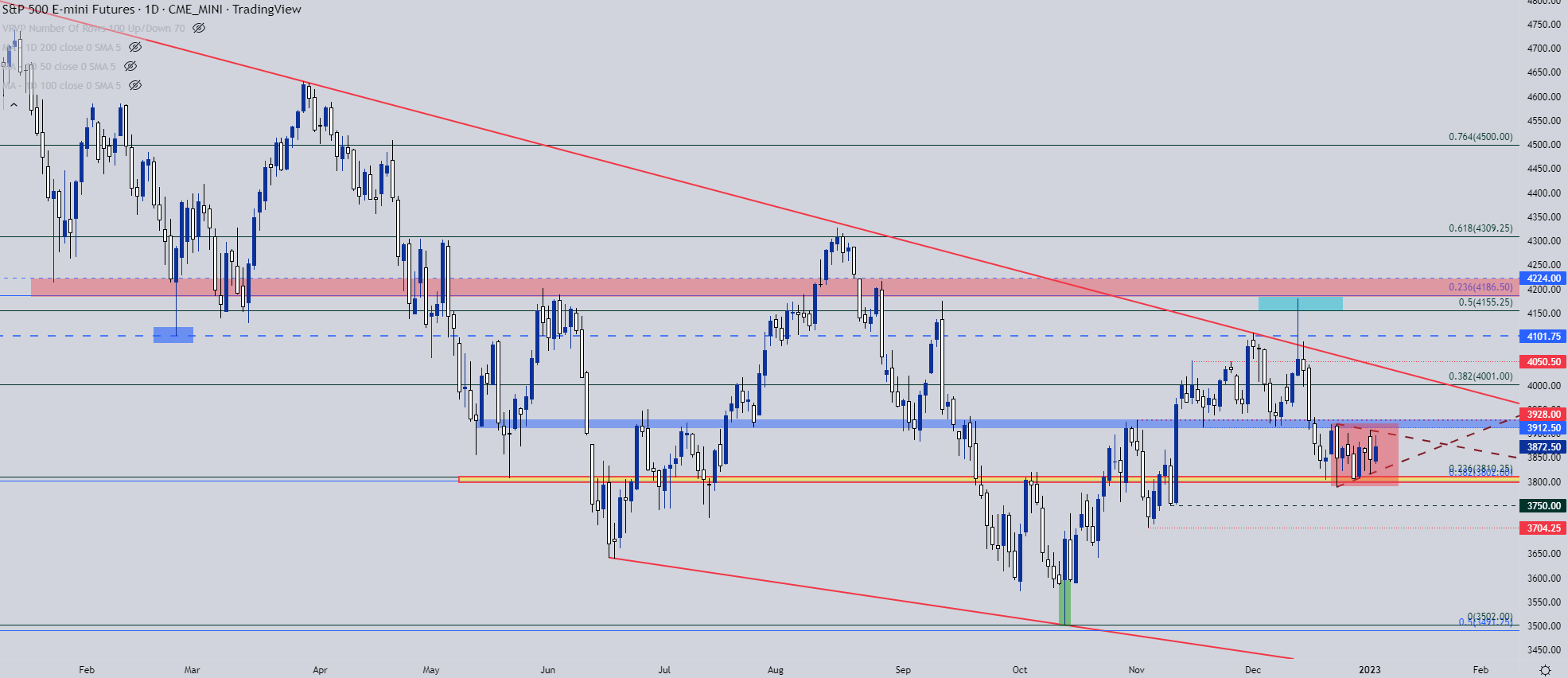

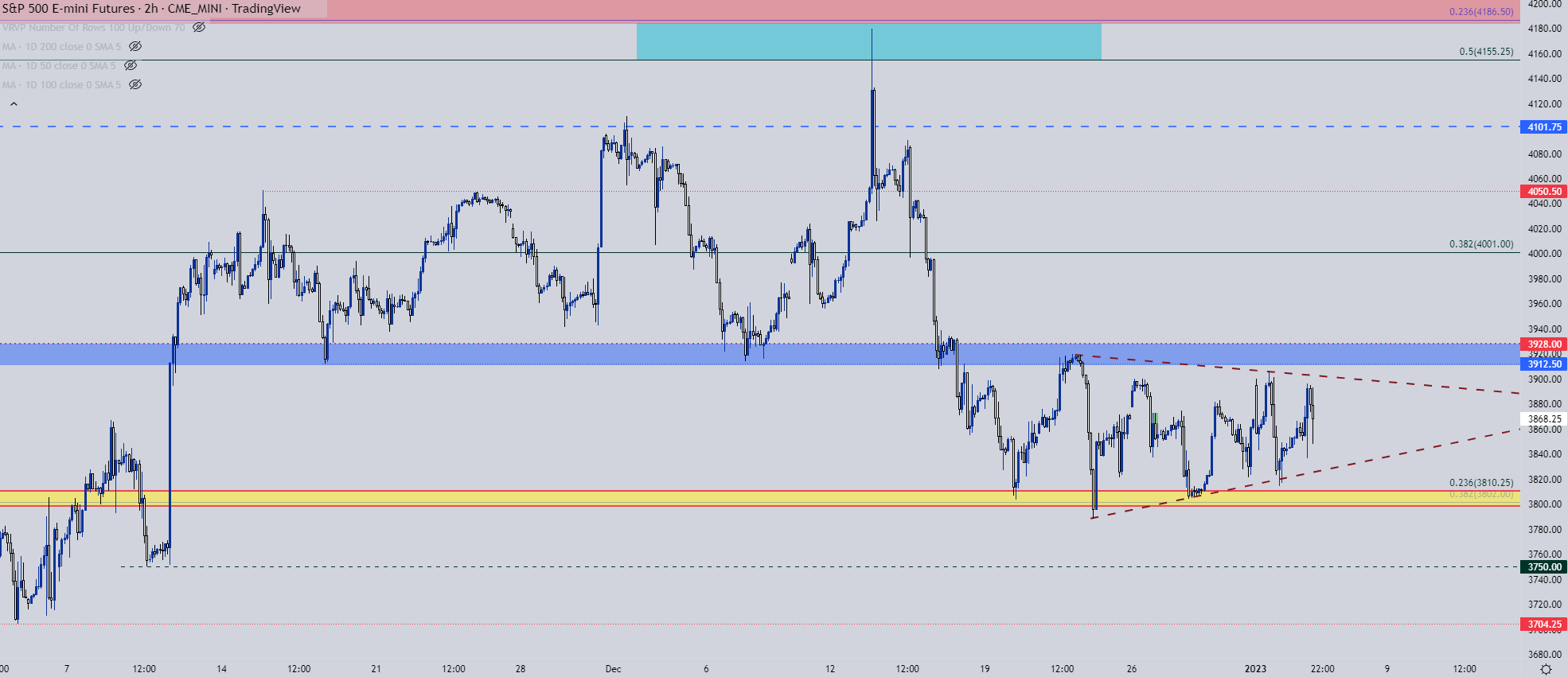

At this point, the consolidation in equities has gone into deeper consolidation. Through the holidays, the S&P 500 had built into a box or rectangle formation, with rigid support and resistance on either side. On the support side, 3802-3810 remained the spot, as each of those prices are Fibonacci retracement levels of note. And then on the resistance side, 3912-3928 remains in-play. This was previously support in mid-November and early-December after showing as resistance in October. And now it’s back in to help demarcate the topside of the rectangle that’s been in-play since the Friday after the Fed.

More recently, that consolidation has narrowed into another consolidation formation as a symmetrical wedge, marked by both higher-lows and lower-highs. The rectangle is in a red box below, with the symmetrical wedge marked by dashed lines on either side of the formation.

Recommended by James Stanley

Traits of Successful Traders

S&P 500 Daily Chart

Chart prepared by James Stanley; S&P 500 on Tradingview

S&P 500 Consolidation Within Range

The dangerous part about such setups is the possibility of false breakouts. If price clears the upper trendline, there’s rectangle resistance standing by at 3912-3928; if it breaches support, there’s the same 3802-3810 area that’s caught at least three bounces over the past few weeks. This can complicate strategy around the symmetrical wedge but also illustrates the importance of looking for the rectangle to be addressed before looking to work with any new trends.

S&P 500 Two-Hour Chart

Chart prepared by James Stanley; S&P 500 on Tradingview

Nasdaq

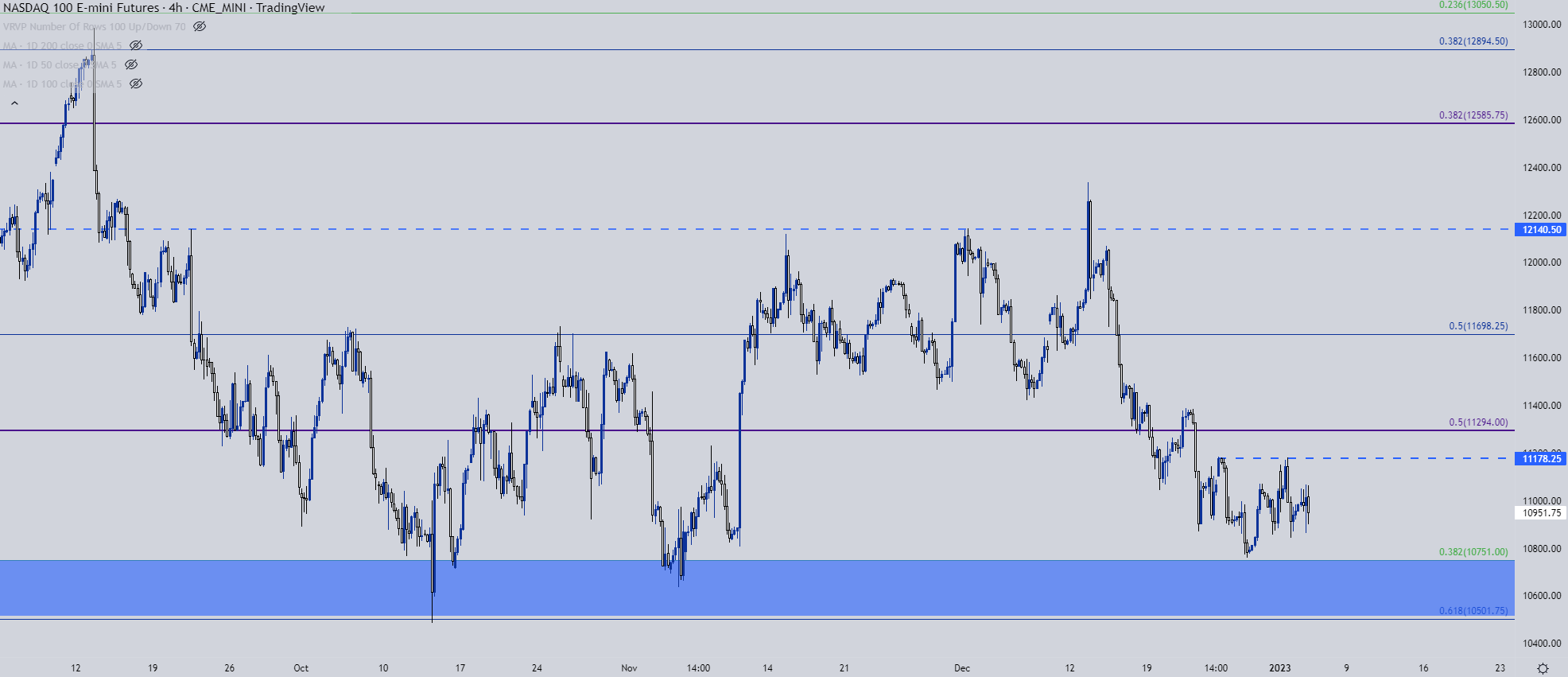

The Nasdaq range is a bit messier, in my opinion. There’s been two solid holds of resistance at 11,178. But the support side has been a bit less consistent and just underneath the recent low is a major zone of long-term support that I’ll look at in a moment.

Nasdaq Four-Hour Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

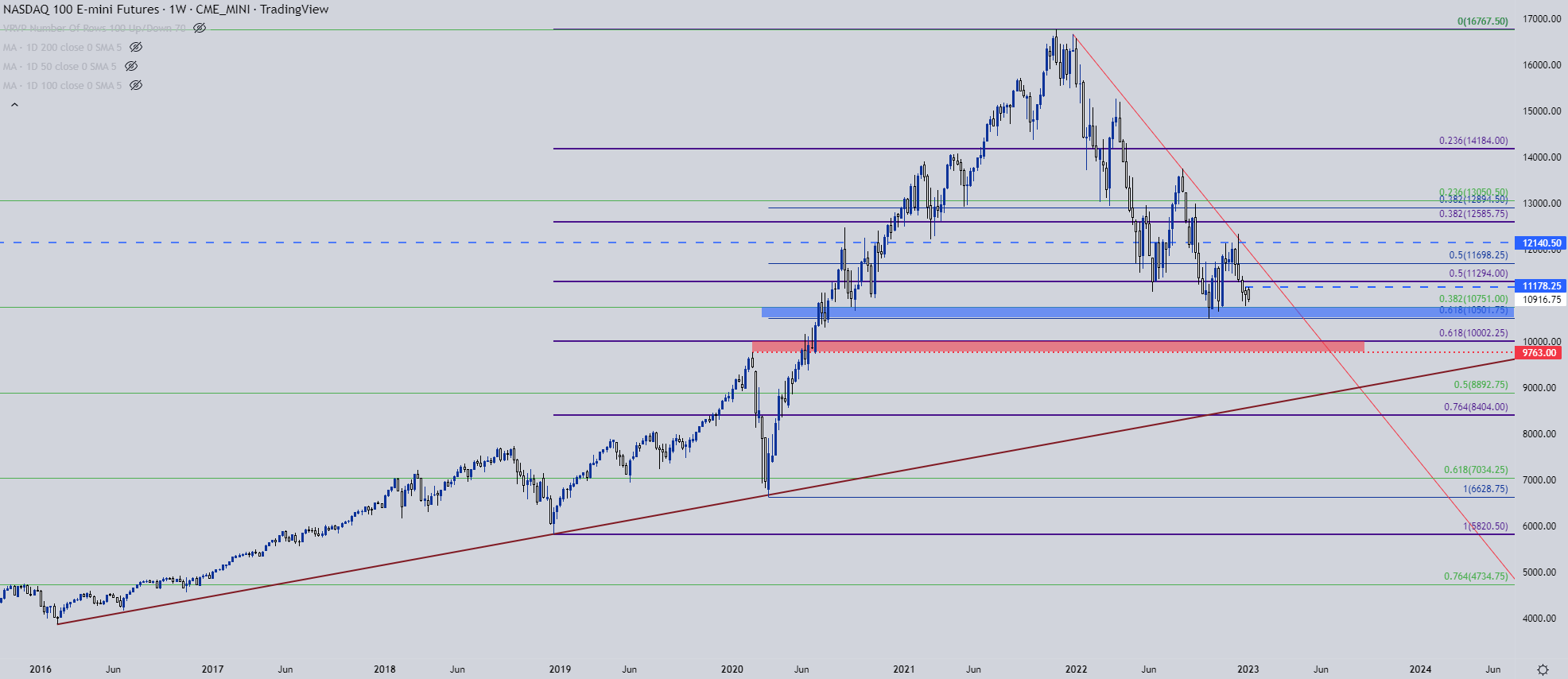

In the Nasdaq, a major area of support came into play in Q4 and helped to hold the lows. This zone runs between Fibonacci levels at 10,501 and 10,751. The bottom side of the zone held the lows in October and the topside in November. Price made a fast move towards that zone in late-2022 trade but has since held above.

This makes for a difficult prospect on short-term bearish themes as any drive into this zone could bring a support response into the mix. However, when this zone finally does give way, the next major zone of support runs from around 9,763-10,002.

I do expect current support to give way at some point but, my bigger question right now is the timing as bears have had ample opportunity to make their move over the past couple of weeks but, as yet, haven’t been able to drive to fresh lows.

Nasdaq Weekly Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

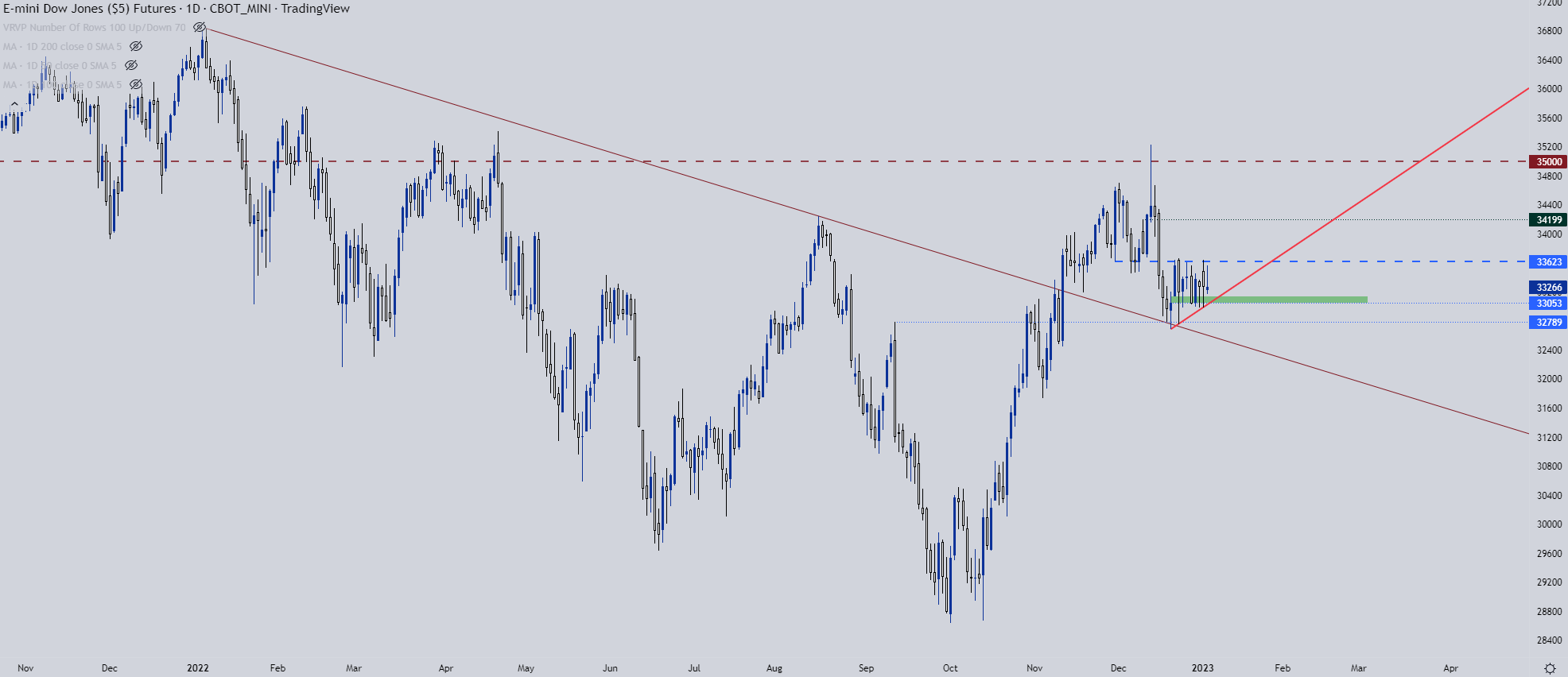

Dow Jones

The support that came into play last month in the Dow is significant: It’s taken from a trendline projection that connected January and August swing-highs in the Dow. That projection caught the lows on December 20th and since then, prices have continued to show support at higher lows.

There’s also horizontal resistance sitting overhead, as taken from prior support. This makes for a short-term ascending triangle formation, which can offer a bullish bias. Key for this playing out will be a hold of short-term support around the 33k level, which would keep the bullish trendline and ascending triangle formation alive. But, if sellers are able to force a breach below 32,789, that bullish equity theme probably won’t look very attractive. And in that case, the S&P 500 or Nasdaq may present a bit more of an attractive setup at that point.

Recommended by James Stanley

Improve your trading with IG Client Sentiment Data

Dow Jones Daily Price Chart

Chart prepared by James Stanley; Dow Jones on Tradingview

— Written by James Stanley

Contact and follow James on Twitter: @JStanleyFX

[ad_2]