[ad_1]

US 500, Nasdaq 100 Talking Points

- FOMC Minutes pose a risk for risk assets, will the Fed deliver an upside surprise?

- S and P 500 finds psychological support after brutal decline.

- Nasdaq 100 strives to determine a new directional bias after retesting 12,122.

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

US equity futures have suffered from a higher probability of aggressive rate hikes, buoyed by robust economic data. With S&P 500 and Nasdaq futures experiencing four consecutive days of losses, both fundamental data and technical levels have been driving the recent move.

In terms of fundamentals, the January batch of US economic data has been supportive of higher rates which are necessary to curb the higher costs of living. Although employment has remained resilient, the war in Ukraine has exacerbated the effects of rising inflation.

As investors await the FOMC minutes expected to be released later today, the Federal Reserve continues to focus on its dual mandate (achieving price stability and maintaining an unemployment rate below 4%).

Because the economy has continued to withstand the current geopolitical headwinds, the central bank has the opportunity of pushing rates higher.

With non-yielding assets sensitive to an increase in yields and the USD, the collective concerns have been keeping US stock futures bid.

S&P 500 Technical Analysis

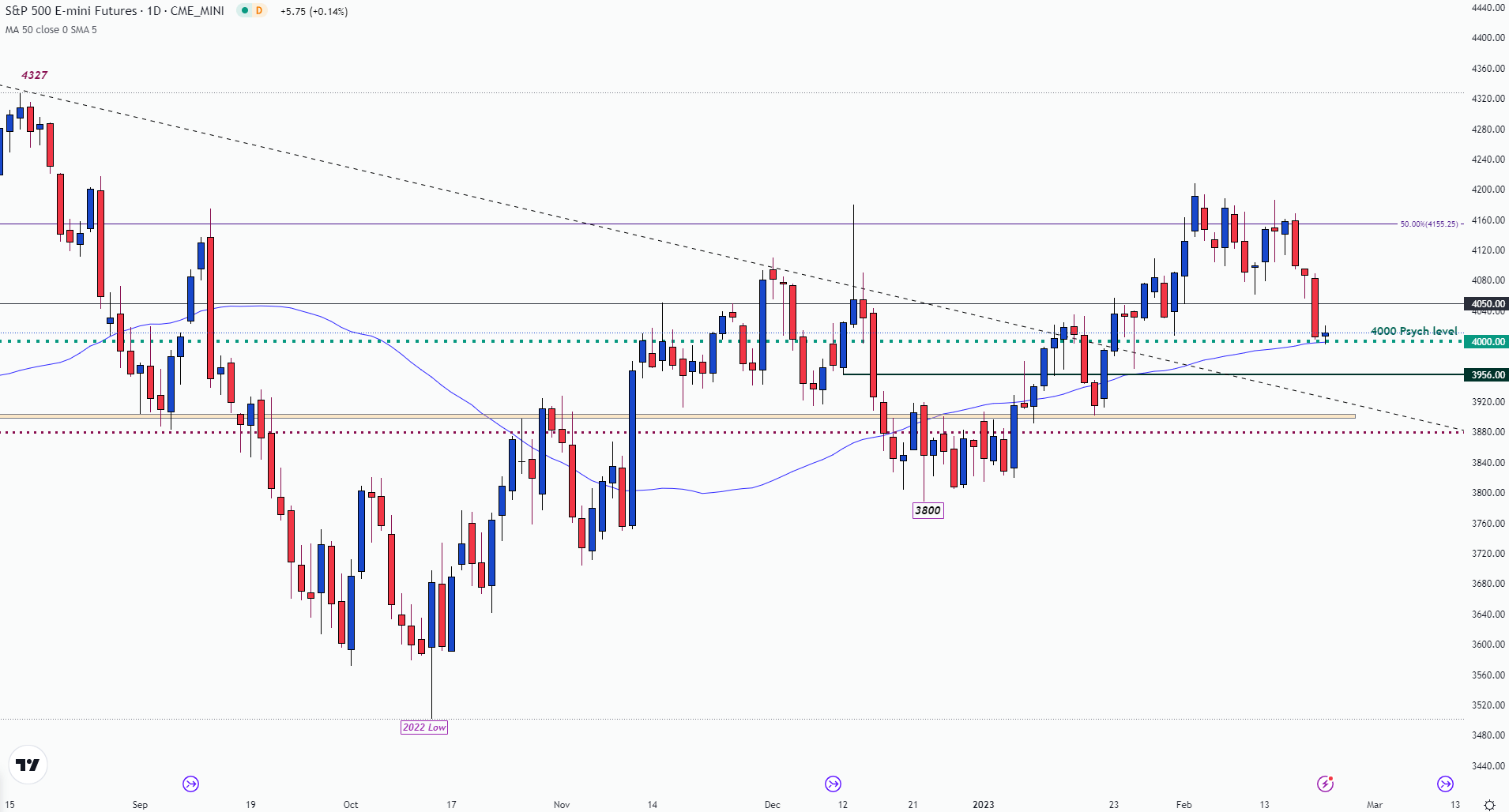

After three consecutive days of losses, SPX (S&P 500) future made their way back to psychological support at 4,000. As prices edge below support at prior resistance, an approximate 0.17% move in today’s session has supported the rise beyond 4,000. With the 50-day MA (moving average) currently holding around the 3,998 mark, a hold above this level may continue to support the upside toward the mid-point of the 2022 move at 4,155.

S&P (US 500) Futures Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Nasdaq 100 Technical Analysis

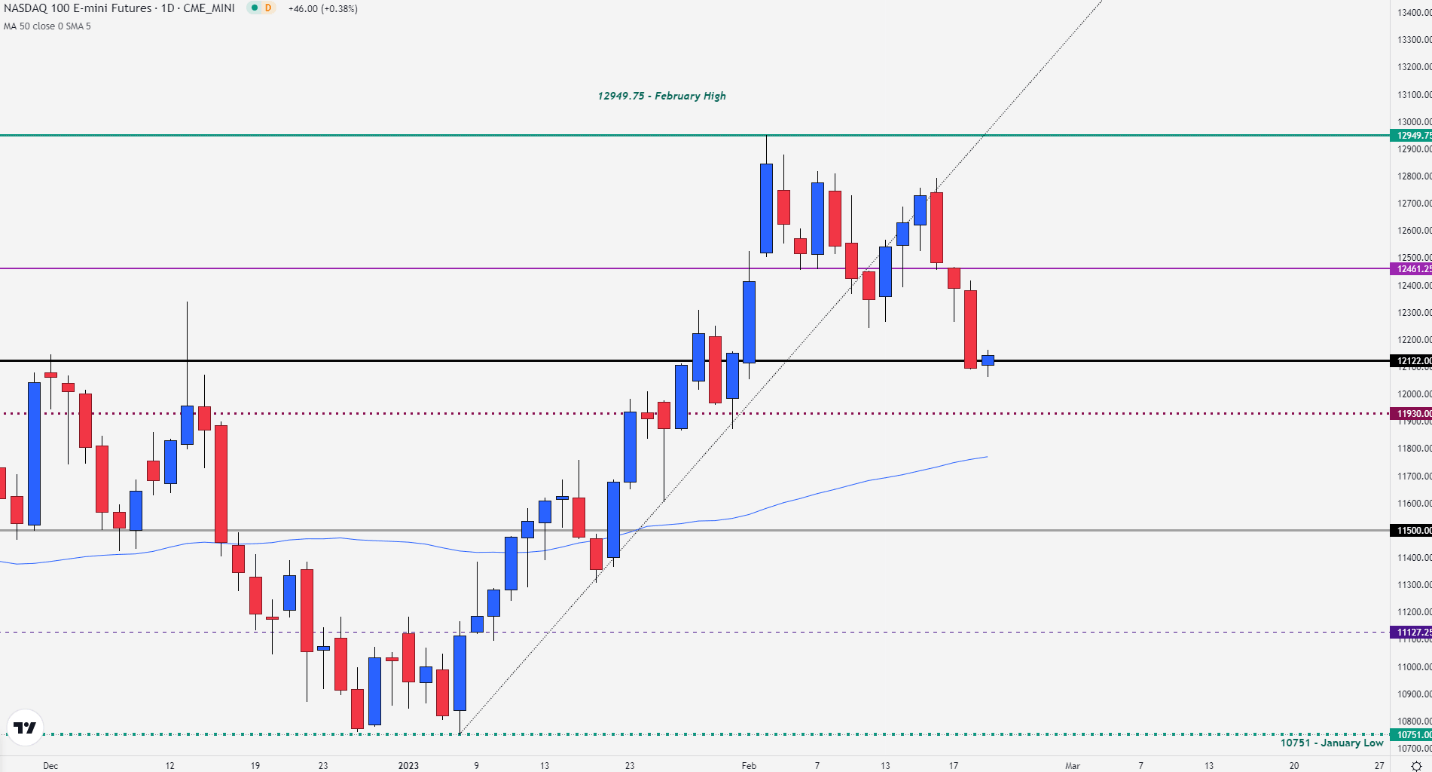

Although Nasdaq futures have followed S&P lower, prices have found support at prior resistance at 12,122. While tech stocks remain under scrutiny, a break higher could give way for prices to retest 12,400.

Nasdaq 100 (US Tech) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]