[ad_1]

US Dollar, Treasury Yield, Consumer Confidence – Asia Pacific Market Open:

Recommended by Daniel Dubrovsky

Traits of Successful Traders

- US Dollar drops on Tuesday despite upbeat consumer confidence

- Treasury yields push higher, hinting fading dovish Fed estimates

- Wall Street futures are green heading into Wednesday Asia trade

Asia-Pacific Market Briefing – Lack of Love for the US Dollar

The US Dollar underperformed against its major counterparts on Tuesday, with the DXY Dollar Index dropping about -0.4%. Taking a closer look, DXY is down about 2.4% this month so far, setting up for the worst monthly performance since November.

Traders did not give the Greenback much love despite a combination of solid economic data and a rise in the 2-year Treasury yield. At 14 GMT, Conference Board Consumer Confidence data crossed the wires. The 104.2 outcome for March was higher than the 101 estimate as well as February’s 103.4 outcome. This means sentiment improved this month despite the fallout of Silicon Valley Bank’s collapse.

A notable item within the report is that the percentage of participants who noted that jobs were “plentiful” decreased to 49.1%. That was the first drop in 5 months. Still, the reading remains elevated from a historical perspective. Traders also dumped tech-oriented stocks, causing the Nasdaq 100 to slump. The latter is down about 1.1%, looking at the worst week since early March.

Looking at Wednesday’s Asia-Pacific trading session, notable economic event risk is lacking. This is placing traders’ focus on general market sentiment. Wall Street futures are pointing slightly green heading into the Tokyo Stock Exchange opening bell. As such, an improvement in risk appetite could further depress the haven-linked US Dollar.

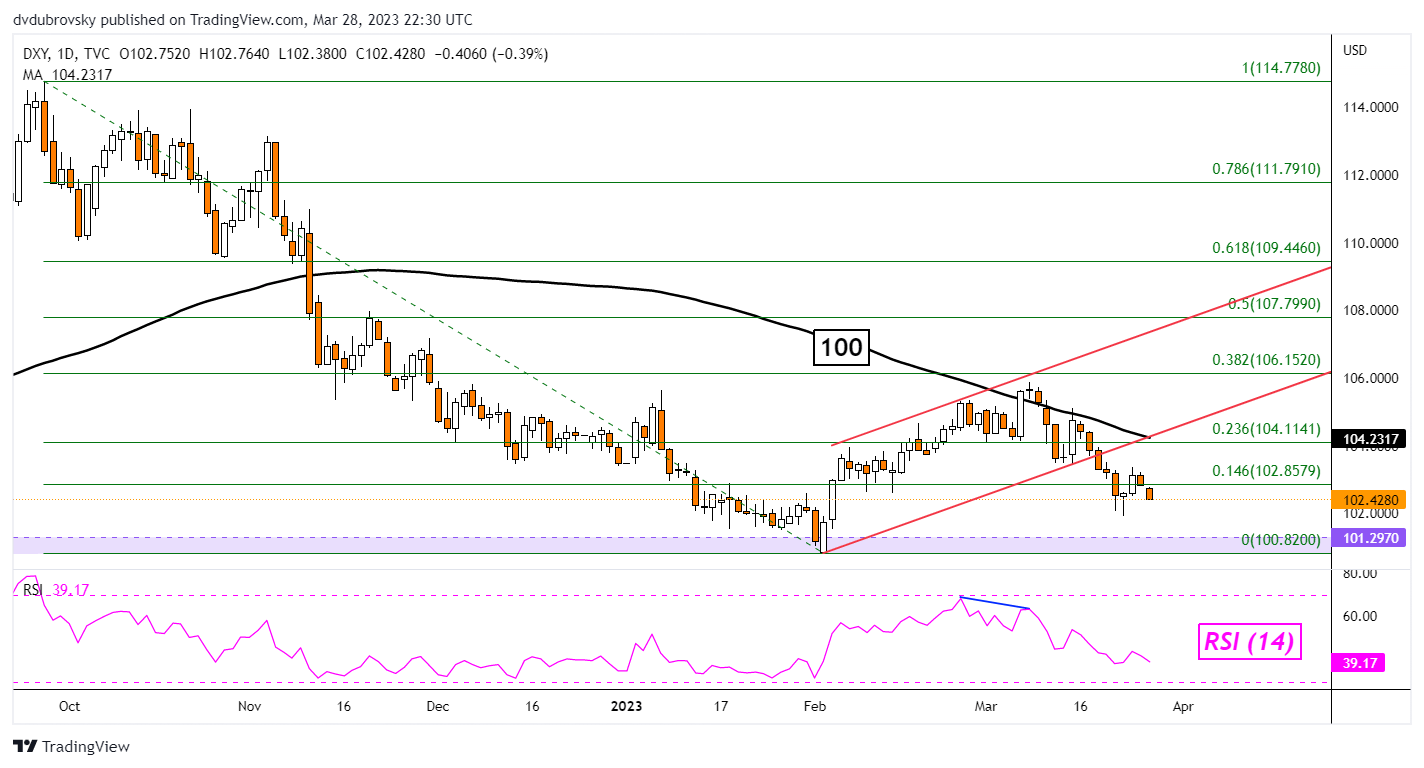

US Dollar Technical Analysis

On the daily chart, the DXY index continues to make downside progress after breaking under a rising channel. The currency is testing lows set last week, which will be interesting to watch. Arguably, the more important support zone to watch will be February lows (100.82 – 101.29). As such, there is room in the near term to continue the bearish trajectory without offering an increasing downside technical bias. Key resistance seems to be the 100-day Simple Moving Average (SMA).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]