AUD/USD ANALYSIS & TALKING POINTS

- Minimal US economic data this week gives Australian data greater scope.

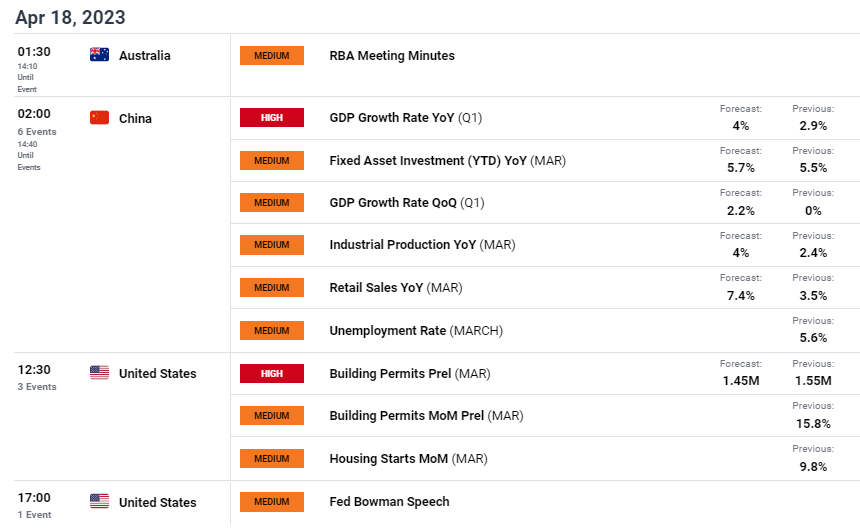

- RBA meeting minutes and Chinese GDP to drive AUD volatility tomorrow.

- AUD/USD death cross could lead to yet another 0.67 break.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar is yet to recover from its fall last week Friday against the U.S. dollar after some hawkish commentary from the Fed’s Waller and better than expected data via the Michigan consumer sentiment report. Some optimism came from China (key Australian trading partner) this morning whereby the PBoC held the 1-Year MLF rate constant art 2.75% that may be an indication to markets that they believe economic growth is on track. Chinese GDP is scheduled for tomorrow (see economic calendar below) and if actual data fall somewhere near the 4% forecast, commodity markets could rally (higher demand-side projections) opening up some upside for the AUD.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

ECONOMIC CALENDAR

Source: DailyFX economic calendar

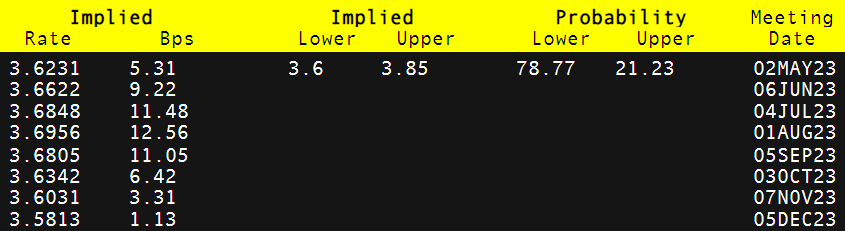

With little in the way of economic releases today, focus shifts to tomorrow with the RBA meeting minutes under the spotlight. A quick recap of events from the prior rate decision saw the RBA decide against a rate hike keeping rates at the 3.6% mark to digest global economic trends alongside local data with particular attention on inflation and labor data. Money markets are currently pricing in another pause from the RBA in the May meeting with a 78.77% probability (see table below). Considering the Fed is likely to hike by another 25bps in their May meet, carry trade dynamics may weigh negatively on the Aussie dollar.

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

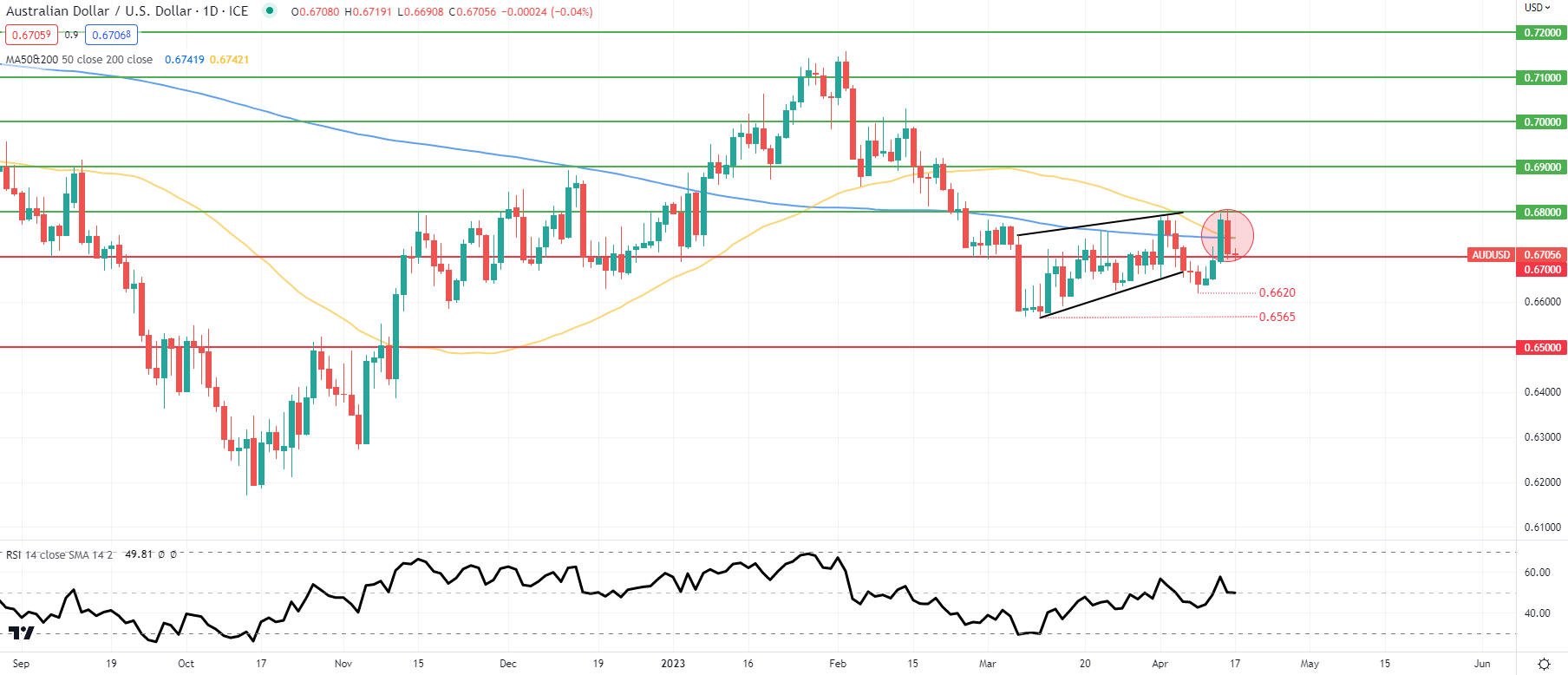

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action manages to hold its head above the 0.6700 psychological support handle although ominous signs stem from the death cross (red) formation unfolding via the 50-day and 200-day SMA respectively. This could point to a continuation of the medium-term downtrend after the upside consolidation phase looks to be fading.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on AUD/USD, with 70% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas