Crude Oil, US Dollar, WTI, SVB, FDIC, Iraq, Kurdistan, Turkey, Volatility – Talking Points

- Crude oil has steadied after an astounding rally seen at the start of last week

- Supply issues remain problematic, but the market might be saying something

- If the dynamics within the futures market persist, will WTI rally further?

Recommended by Daniel McCarthy

Get Your Free Oil Forecast

Crude oil continues to hold the high ground after making a 2-month high last week with supply issues dominating headlines.

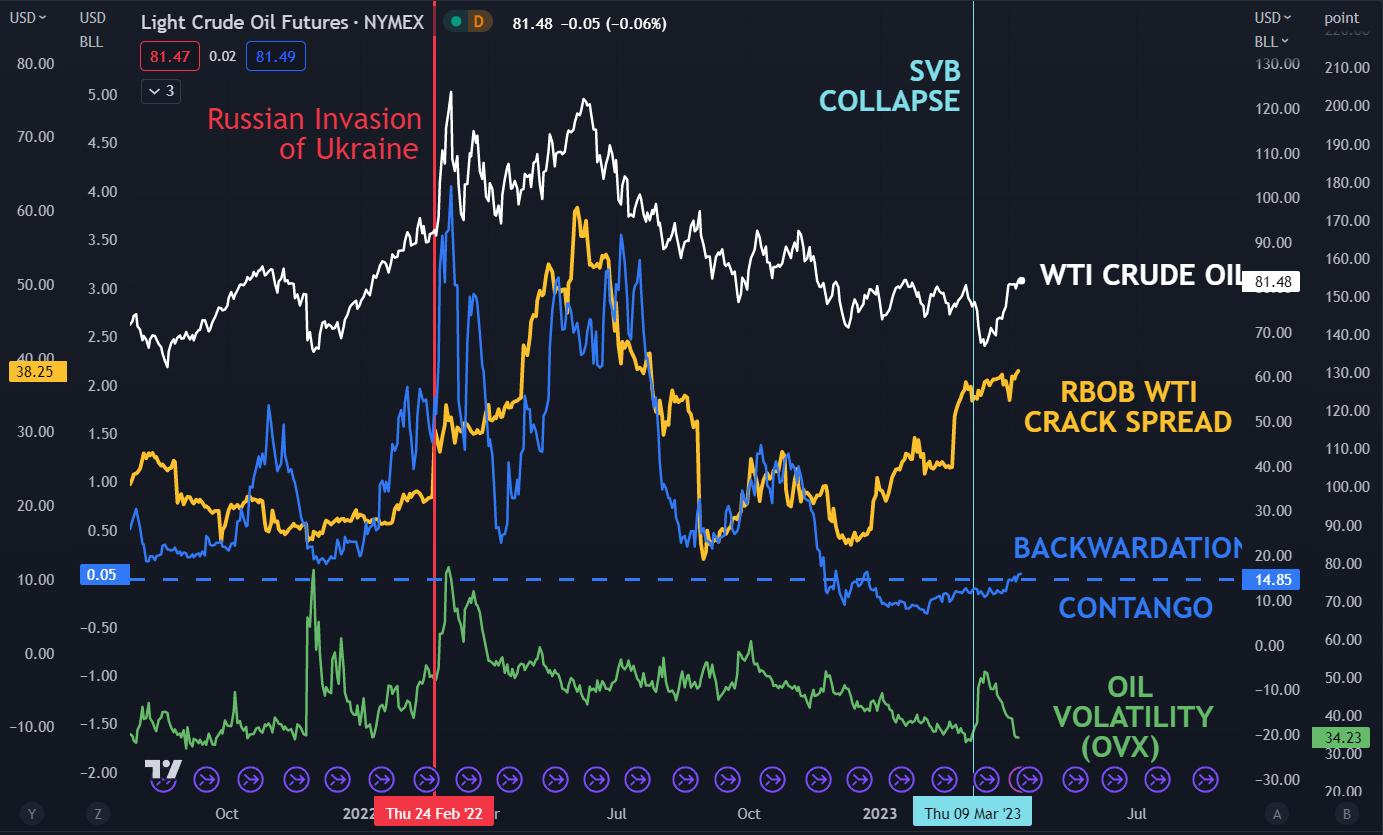

The rally for crude overnight could be attributed to a generally weaker US Dollar with Treasury yield volatility pausing after a few weeks of excessive moves in the aftermath of the collapse of Silicon Valley Bank Financial et al.

The story there might not be over but for now, the market seems to have been appeased by the regulator’s response.

The price action for oil has been caught in a range since OPEC+ announced a cut in its production output target. The next maturing WTI futures contract has been trading between USD 79 and USD 81.81 since gapping higher after the OPEC+ announcement.

The underlying structure of the market might suggest that there could be further upside potential with the OVX index slipping lower while the futures price nudges toward new highs.

The OVX index is calculated in a similar way to the VIX index on the S&P 500 equity index and providers an indication of forward-looking volatility expectations from the options market.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

If volatility is low, the market might be perceived to be comfortable with the current price level. Coincidentally, the difference between the first maturing contract and the next one has moved back into backwardation.

Backwardation occurs when the futures contract closest to settlement is more expensive than the contract that is settling after the first one. It highlights a willingness by the market to pay more to have immediate delivery, rather than having to wait.

The WTI futures contract is a deliverable contract which literally means that if a trader has a position on the last trading day of the contract, then they must either deliver or receive physical crude oil.

Further supporting a potential bullish outlook is the RBOB crack spread, which has been inching higher. This is the gauge of gasoline prices relative to crude oil prices and reflects the profit margin of refiners.

RBOB stands for reformulated blendstock for oxygenate blending. It is a tradable grade of gasoline. If profitability increases for refiners, it may lead to increased demand for crude.

WTI CRUDE OIL, CRACK SPREAD, BACKWARDATION/CONTANGO, VOLATILITY (OVX)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter