[ad_1]

EUR/USD Price, Chart, and Analysis

- US Treasury yields push higher as traders bet on a 25bp rate hike in May.

- Euro weakness is likely to be limited in the weeks ahead.

Recommended by Nick Cawley

Get Your Free EUR Forecast

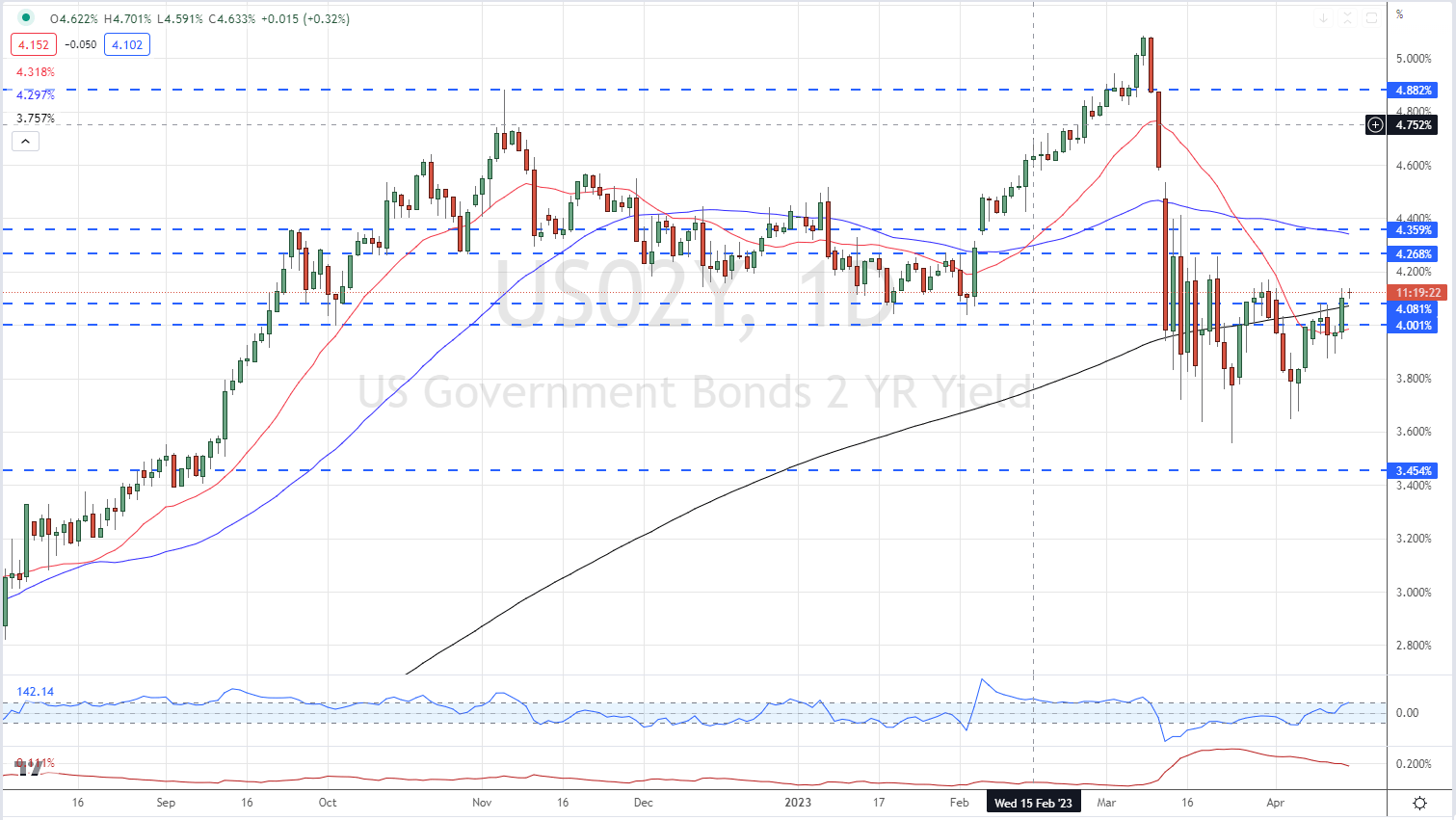

The US dollar continues Friday’s move higher, aided by rising expectations that the Fed will raise interest rates by 25 basis points at its next meeting. The rate-sensitive two-year now yields 4.12%, up nearly 60 basis points form its March 24 low, while the benchmark US 10-year is trading with a yield of 3.52%, up 30 basis points from its recent multi-month low.

US Treasury 2-Year Yield daily Chart – April 17, 2023

The economic calendar is relatively light this week with just a handful of high importance US and Euro Area releases. The most important release may well be tomorrow’s Chinese Q1 GDP reading which will likely dominate price action if the expected rate of 4% is missed or beat by a margin. Th re-opening of the Chinese economy has been one of the major drivers of positive sentiment in 2023. ECB President Christine Lagarde is set to speak later in today’s session and this may give the single currency a shot of short-term volatility.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUR/USD is currently trading in a tight range around 1.0975 with little in the way to move the market appreciably. The pair is one point off Friday’s multi-month high print and remains supported by all three moving averages and a series of higher lows and higher highs. Recent lows above 1.0900 should hold in the short-term.

EUR/USD Daily Price Chart – April 17, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 20% | 0% | 7% |

| Weekly | -4% | 3% | 0% |

Retail Trader Positioning is Mixed

Retail trader data show 38.09% of traders are net-long with the ratio of traders short to long at 1.63 to 1.The number of traders net-long is 13.34% higher than yesterday and 7.63% lower from last week, while the number of traders net-short is 3.08% lower than yesterday and 4.72% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]