Euro Talking Points Analysis

Recommended by Richard Snow

Get Your Free EUR Forecast

European Fundamentals Sour Further

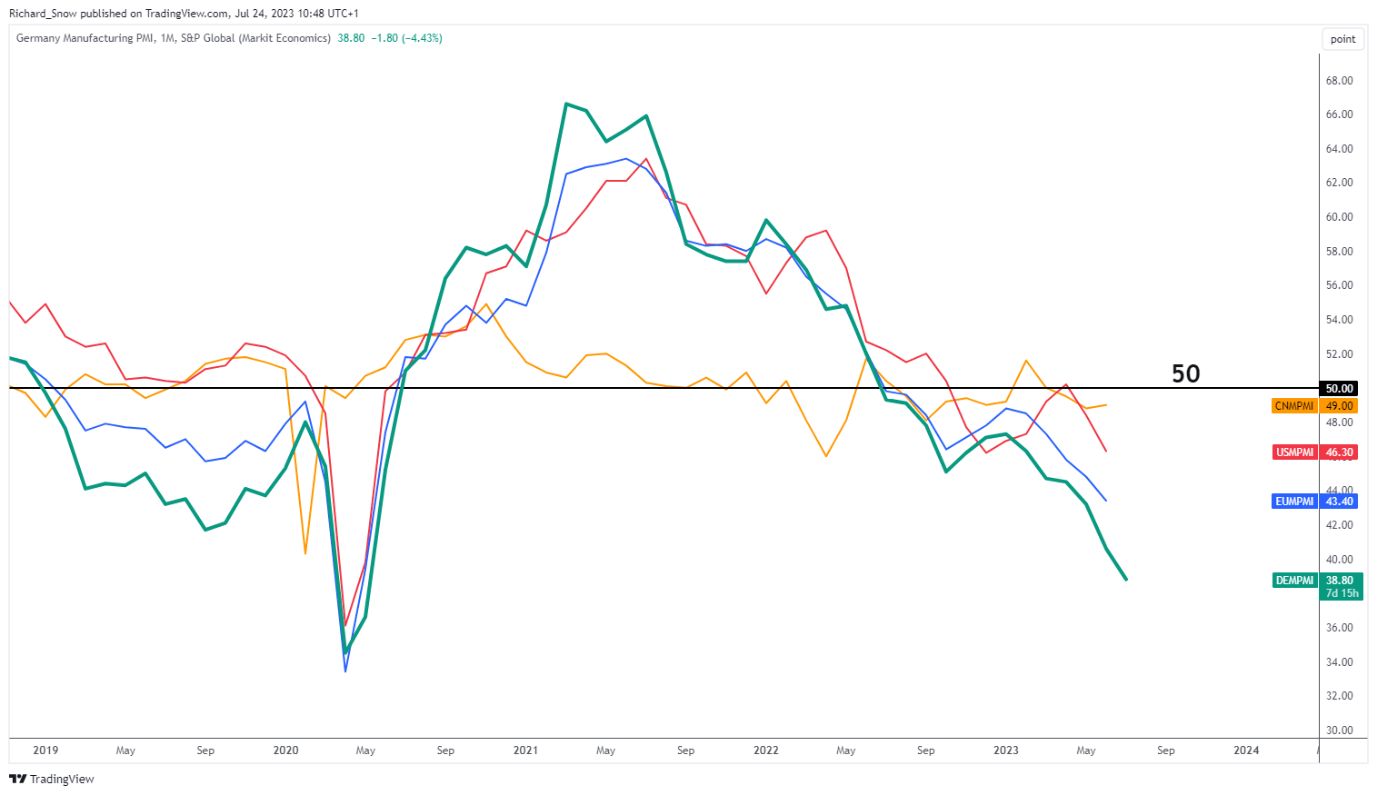

Yesterday’s HCOB manufacturing PMI data revealed a worsening of Germany’s manufacturing sector, declining from 40.6 to 38.8. The industrial hub of Europe now seen an extended contraction in the sector which does not bode well for the rest of Europe.

The chart below shows a comparison of German, EU, US and Chinese manufacturing PMI over time where it is clear that Germany (green line) leads the pack lower. The ECB will be desperate to see progress on future core inflation prints as signs of economic stress have appeared. Tightening interest rates further, complicates Europe’s economic outlook despite the services sector remaining in expansionary territory.

Source: TradingView, prepared by Richard Snow

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUR/USD Pullback Extends After Deteriorating Fundamental Landscape

With a little over 48 hours to go until the ECB interest rate decision, the euro has experienced a broad decline against a number of G7 currencies with the dollar being one of them.

EUR/USD hit the 61.8% Fibonacci retracement of the major 2021 to 2022 move at 1.1274 and headed lower ever since. Falling through 1.1100, the pair continues lower ahead of Thursday’s ECB rate announcement. It’s fairly common to witness price action stall ahead of a major central bank meeting but FX participants are clearly still positioning themselves after yesterday’s disappointing data.

Momentum, according to the bearish cross of the MACD indicator, appears in favour of further downside as 1.1012 – the June 22 swing high – is the next level of support. Resistance, prior support, is at the psychological level of 1.1100.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

EUR/GBP Struggles for Long-Term Direction

EUR/GBP bulls made a valiant attempt to test the 0.8720 zone of resistance (orange rectangle) but fell short. A sequence of extended upper candle wicks tells the story of an unsuccessful attempt to trade higher, resulting in a sizeable decline in the pair which has continued into the London session.

The move is rather telling for the euro given that the pound sterling has sold off ever since encouraging core inflation data last week. Nevertheless, it is EUR/USD that has declined in the aftermath, moving through 0.8635 with relative ease, eying 0.8565 and potentially even 0.8515. Since core inflation remains an issue in Europe, it is unlikely that the Governing Council will the opportunity to ease its hawkish language on interest rates. A hawkish statement and press conference could halt EUR/GBP declines in the wake of the meeting. Resistance comes in at 0.8635 and 0.8650.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

EUR/JPY Entertains a ‘Double Top’ Formation Ahead of ECB, BoJ

EUR/JPY could prove to be a very influential pair this week as both the BoJ and ECB host meetings this week. The ECB is likely to talk tough on inflation while the Bank of Japan is likely to leave policy setting unchanged but the economic landscape is changing in Japan. Governor Ueda spoke at an ECB forum in Portugal last month and mentioned that Japan would need to see wage growth sustainably above 2% and greater conviction of a resurgence in inflation for 2024 to even consider policy normalisation.

Wage growth is picking up and has printed above 3% year on year after wage negotiations had concluded at the start of the year. Also, inflation in Japan has printed over 2% for more than a year now. The time to consider even another tweak to the yield curve is growing week by week so be on the look out for such sentiment this week that could see another spate of yen appreciation – potentially weaker EUR/JPY.

Support appears at channel support before 153.45 – the swing low – can be viewed as a tripwire for a bearish pullback and possible reversal. The possibility of a double top emerging is in play currently. Resistance appears at the yearly high at 158.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX