[ad_1]

BITCOIN, CRYPTO KEY POINTS:

- Bitcoin Remains Above the 40k Mark Which Remains Key for Further Downside.

- Crypto Industry Resilience on Display with Latest Research Piece Reveals 83% of Crypto Mentions are Positive.

- Over $300 Million in Long Positions Liquidated Following Todays Slump in Prices.

- To Learn More AboutPrice Action,Chart Patterns and Moving Averages,Check out the DailyFX Education Series.

READ MORE: EURO Weekly Forecast: ECB Expected to Hold Rates but How Will Projections Differ from Market Expectations?

Recommended by Zain Vawda

Get Your Free Introduction To Cryptocurrency Trading

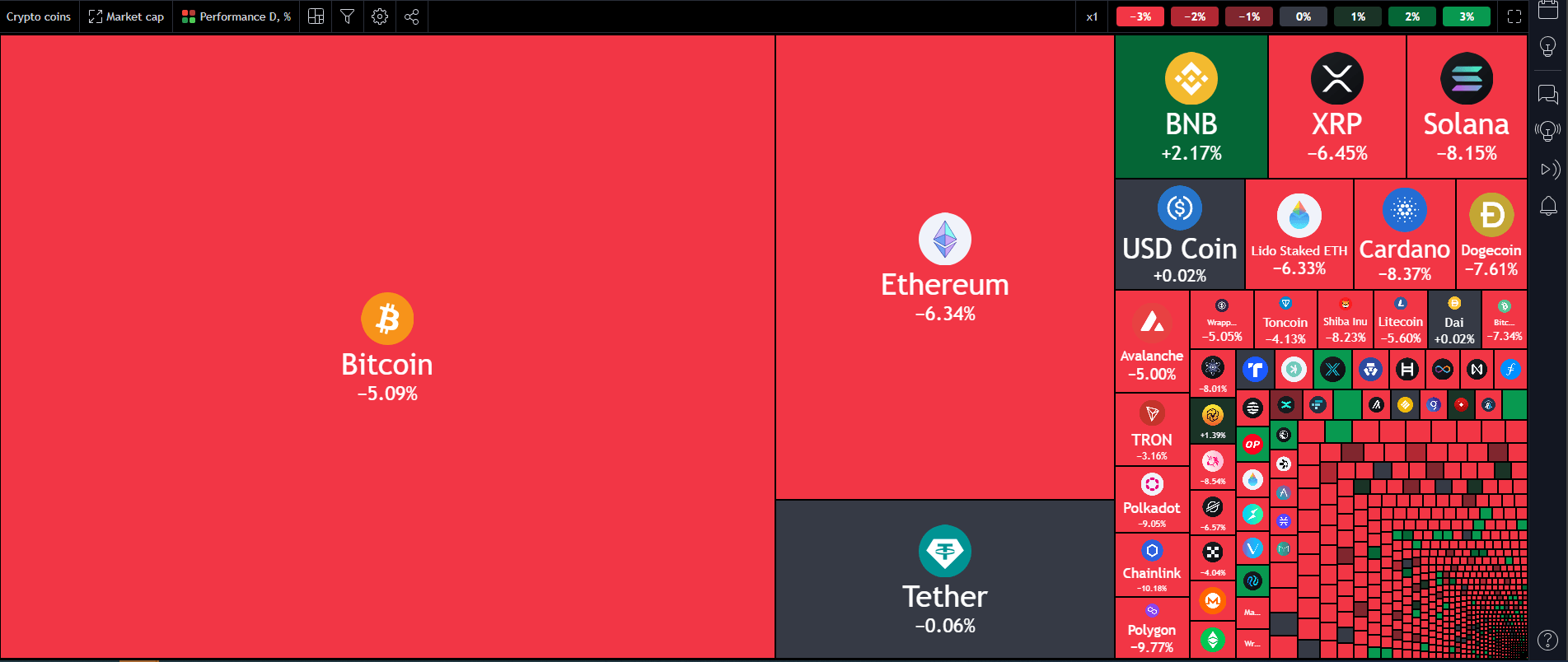

Bitcoin (BTC/USD) Sank as much as 7.5% overnight to a low of around $40520, which is just a whisker away from the psychological $40000 level. I had discussed the possibility of this potential pullback last week in my article (to read click here). There does not appear to be any singular driving force behind the move except perhaps the slightly stronger US Dollar. I however think that this is in part down to profit taking ahead of the Risk Events this week and the end of year holidays.

Source: TradingView

WILL THE $40K LEVEL SUPPORT HOLD?

The $40 k mark could hold the key heading into the festive break. A break below this level could open up the potential of a deeper retracement down toward the $31k-$32k area. As mentioned above I believe that part of the move is likely down to profit taking as we do have a bunch of risk events ahead. The move down may be welcomed by many, particularly institutions who may want to get involved before the Spot ETF decisions early in 2024. The question is how deep a retracement will we get and will the FOMC meeting play a part?

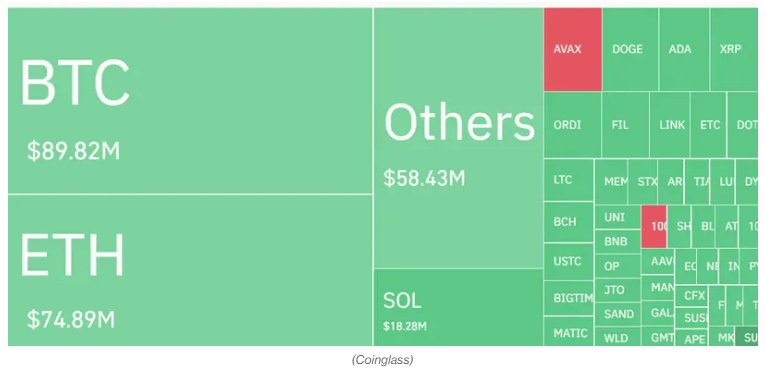

According to CoinGlass data shows that there was an approximate liquidation of around $335 million of long positions over the last 12 hours. The amount of liquidations are represented below with Bitcoin leading the way followed by Ether.

Source: CoinGlass/CoinDesk

CRYPTO RESILIENCE

A pullback should not be viewed in a negative light as the overall cloud which many though would hover over the Crypto sector cleared long ago. This is something I have previously discussed but has actually been pointed out in research of late as well. According to research released recently by Coinwire.com, 83% of Crypto mentions in op publications have been positive in 2023. This would explain the resilience of the industry in a time when it has faced a number of challenges.

Other key takeaways from the CoinWire study revealed that over 65% of global crypt related Tweets have a positive sentiment. The United Kingdom takes the lead in this global cheer, with more than72%of crypto-related tweets from this region being positive. The US as well is a leader here with approximately 2 out of 3 Americans have a positive view of Crypto in 2023. This is one I admit surprised me given the FTX scandal, but I was once again forced to remember the Banking crisis earlier in the year.

I guess the point m trying to make here is a selloff should not be accompanied by doom and gloom and do not get caught up in the FOMO of it all with the festive season ahead. The outlook for 2024 looks promising and I would keep that in mind if we do have a deep and aggressive pullback.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

CATHY WOOD’S ARK INVEST SELLS COINBASE SHARES

ARK has been consistently selling Coinbase (COIN) shares over the past couple of weeks. ARK upped the ante in July selling 480,000 shares at a value of $50.5 million at the time until this past Friday when ARK offloaded a further 335,860 shares which would have been valued at $49.2 million at Coinbase’s closing price. A surprise to me given the positive outlook I have regarding Coinbase in 2024, but that’s a topic for another time.

ARK however did the sale due to the target weighting it applies to its ETFs. The recent rally in the Coinbase share price has seen the weight of the shares exceed the limit of 10% imposed by ARK. The sale however failed to accomplish this, as things stand COIN accounts for some 13% of the Fintech Innovation ETF and +-11% of the Next Generation ETF. A further appreciation in the Coinbase price could see ARK effect further sales in the coming days and weeks and could be worth monitoring.

READ MORE: HOW TO USE TWITTER FOR TRADERS

BITCOIN PRICE OUTLOOK AND FINAL THOUGHTS

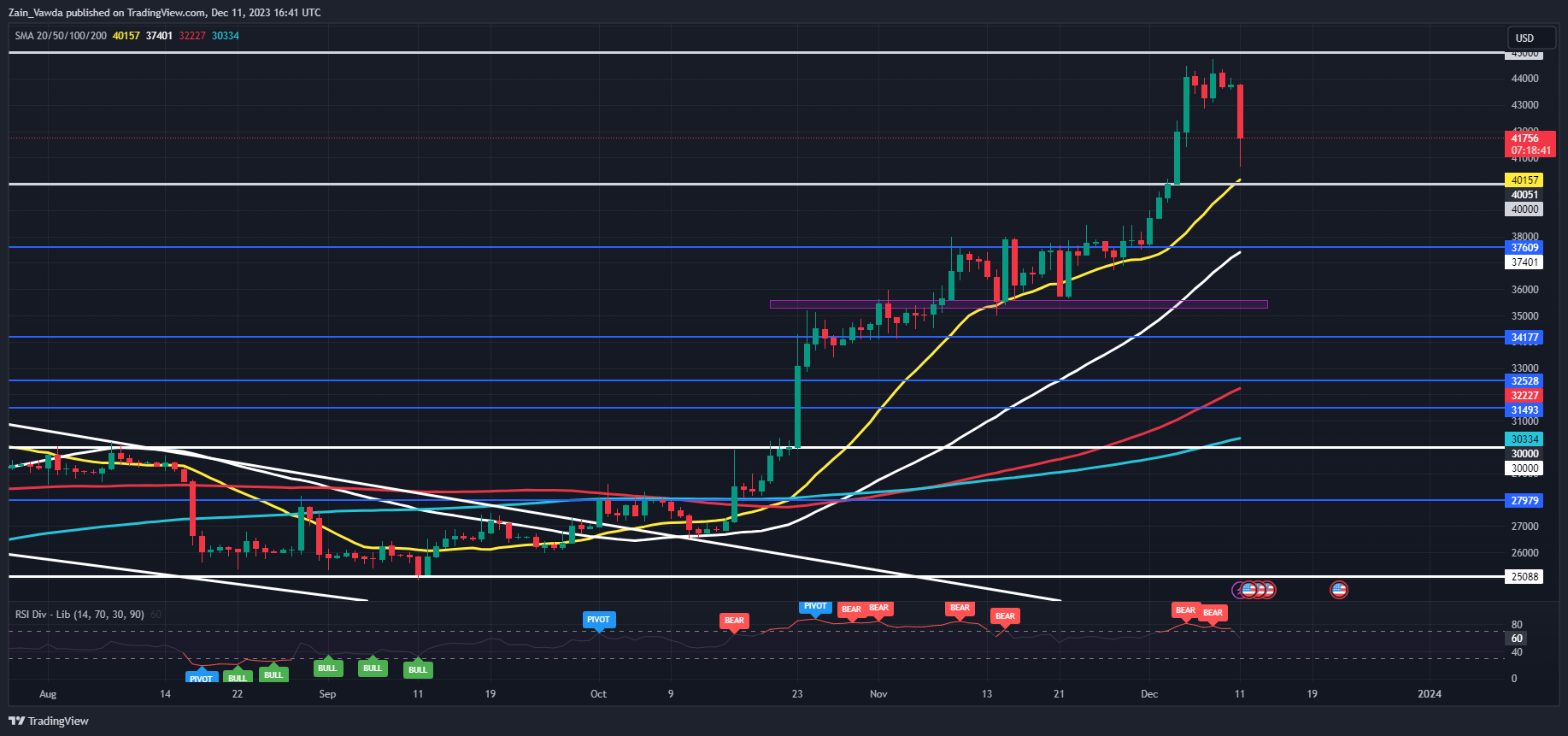

From a technical standpoint BTCUSD failure to find acceptance above $45k was a sign that retest of the $40k level was inevitable. We have just fallen short of this level today but could still go on to tap that level, where the 20-day MA also rests just above the $40k mark.

The support level at the $40k mark with a break lower brings support at the $37600 into focus with the 50-day MA resting at the $37400 mark. Any further drop will bring the support areas at 35600 and 35000 into play.

A move higher from here will face immediate resistance at the $43000 handle before the psychological $45000 mark comes back into focus. The major resistance level at the $50000 mark looks tasty and achievable but there is a growing chance of a deeper retracement before a test of this level comes to fruition.

Source: Kobeissi Letter

Resistance levels:

Support levels:

BTCUSD Daily Chart, December 11, 2023.

Source: TradingView, chart prepared by Zain Vawda

Recommended by Zain Vawda

The Fundamentals of Trend Trading

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]