USD/JPY Analysis

- USD/JPY likely to see muted trading until tomorrow’s FOMC meeting + projections

- IG client sentiment clouded by the recent uptick in longs. Overwhelming short positioning remains

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

USD/JPY Likely to See Muted Trading Until Tomorrow

The week was always shaping up to be a quiet one at first before ramping up drastically from Wednesday right up until the weekend. Tomorrow the FOMC rate decision is likely to spur volatility in the pair even though the committee is likely to keep interest rates on hold.

This is because the September FOMC meeting brings with it the quarterly forecasts known as the summary of economic projections, which ought to provide insight into the thinking of the committee ahead of the fourth quarter. Markets will have a keen eye on inflation forecasts for 2025 and further out, in the event labour market tightness prevents inflation from reaching 2%.

Recommended by Richard Snow

How to Trade USD/JPY

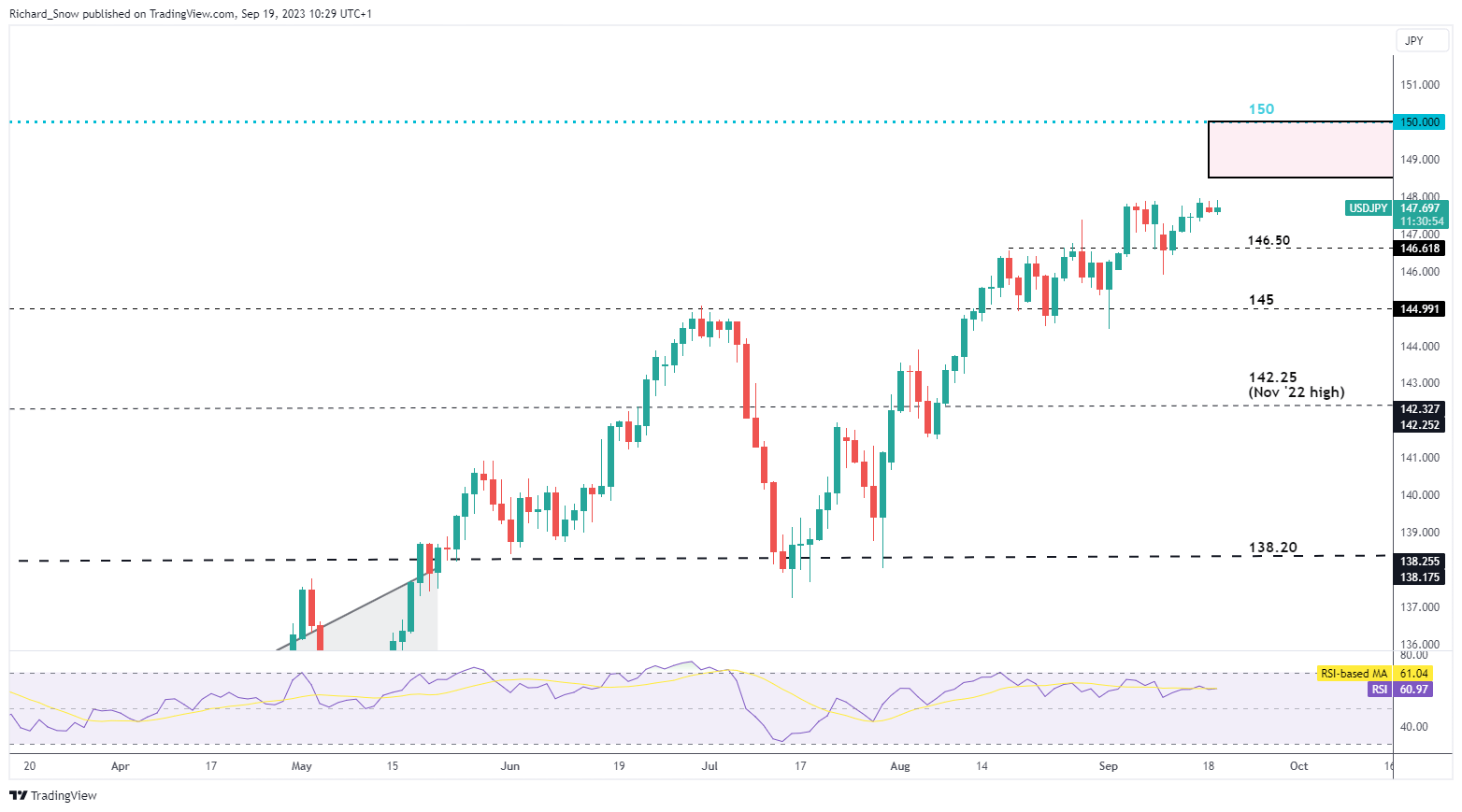

The pair has shown a lot of respect for the 148 level which coincides with the recent highs, suggesting that a major catalyst is needed in order to propel the pair towards 150. In the absence of a major catalyst dollar yen may continue to trade in a sideways manner Until a new direction can be found. Support currently appears at 146. 50.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

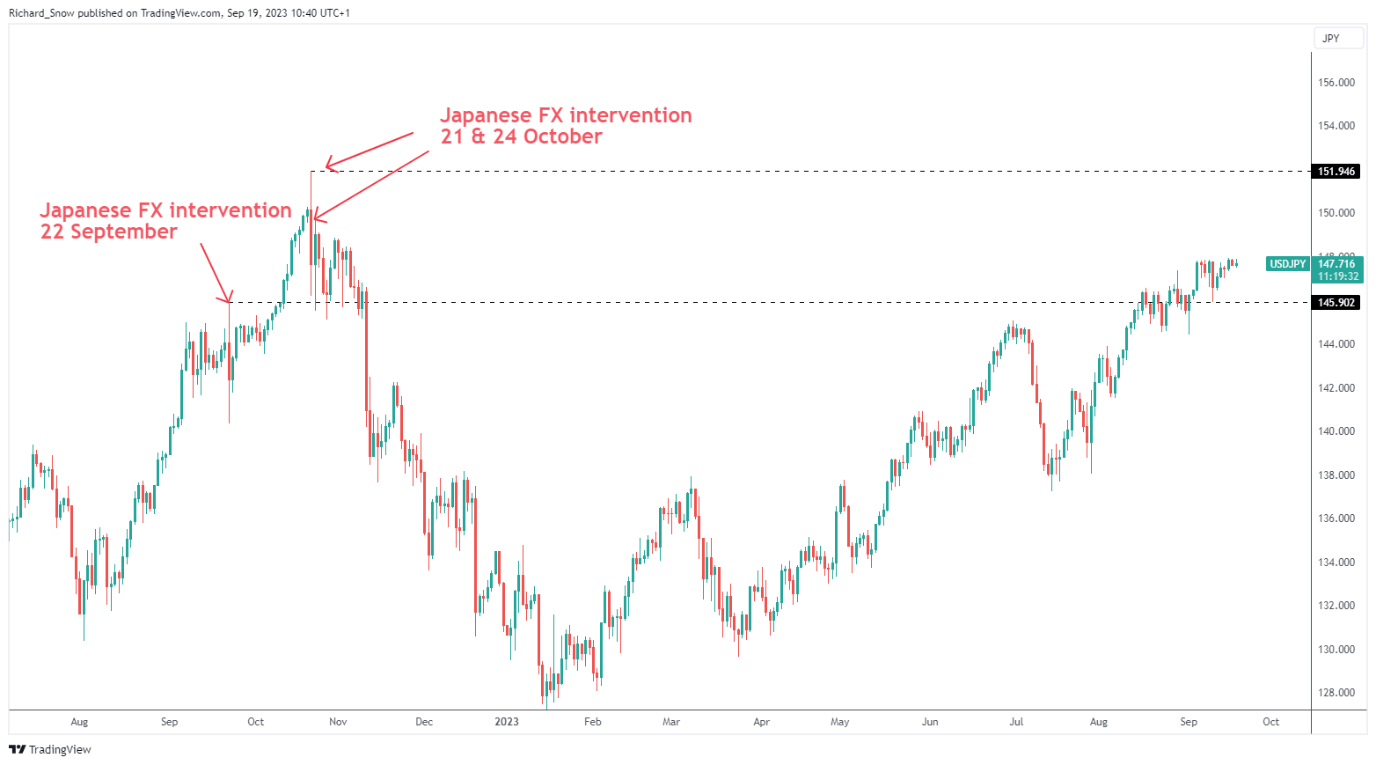

USD JPY upside may be limited as the pair nears the 150 mark. Price action has already advanced above the intervention level we witnessed on the 22nd of September 2022 but the 150 mark has been identified by many as a potential line in the sand for Tokyo. Recent price action has shown a reluctance to push further from the recent high meaning it’s up to the Fed to determine whether prices move higher from here.

USD/JPY Chart Depicting FX Intervention Efforts by Japan in 2022

Source: TradingView, prepared by Richard Snow

High impact economic data or news, like the FOMC event, can lead to increased volatility. Find out how to prepare for such events by studying our guide to trading the news below:

Recommended by Richard Snow

Introduction to Forex News Trading

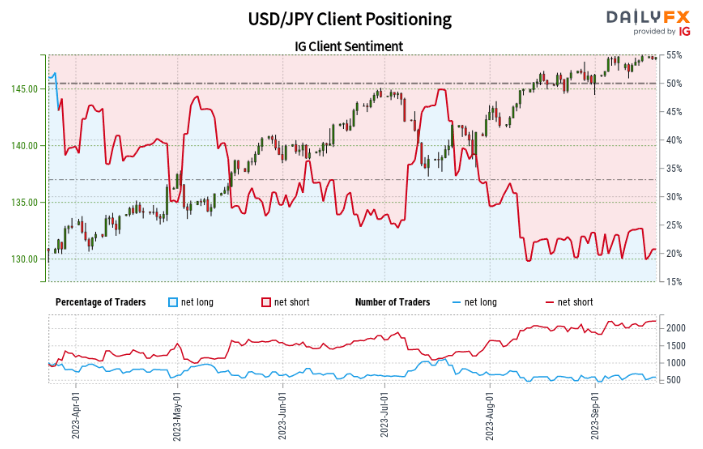

IG Client Sentiment Outlook Clouded By Recent Uptick in Longs

USD/JPY:Retail trader data shows 20.42% of traders are net-long with the ratio of traders short to long at 3.90 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. However, changes in daily and weekly positioning has clouded the USD/JPY outlook.

Read out guide below to find out how to incorporate IG client sentiment into your trading process:

| Change in | Longs | Shorts | OI |

| Daily | 5% | -1% | 0% |

| Weekly | -11% | 7% | 3% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX