[ad_1]

RAND TALKING POINTS & ANALYSIS

- Fed narrative changes leaving rand supported.

- SARB Quarterly Bulletin and US retail sales under the spotlight.

- USD/ZAR rising wedge breakout but yet to prove.

Macro-economic fundamentals underpin almost all markets in the global economy via growth, inflation and employment – Get you FREE guide now!

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand attempts to extend yesterday’s gains after the Fed decided to increase its rate cut forecast for 2024 by an additional 25bps. Although the central bank was expected to hold rates, the dovish response by Fed Chair Jerome Powell was hailed by risk assets across financial markets including most Emerging Market (EM) currencies. Key metrics cited by Mr. Powell were slowing GDP, softening inflation and a normalizing labor market. The focus moving forward from this point will be timing and size of upcoming rate cuts and where the Fed will end up settling between their forecasts for 2024 of –75bps and current money market pricing revealing –150bps.

From a South African perspective, inflation data was clearly overshadowed yesterday but the actual data is encouraging for the South African Reserve Bank (SARB). A negative MoM print and a miss on YoY brings inflation back on the downward trend after recent upside surprises.

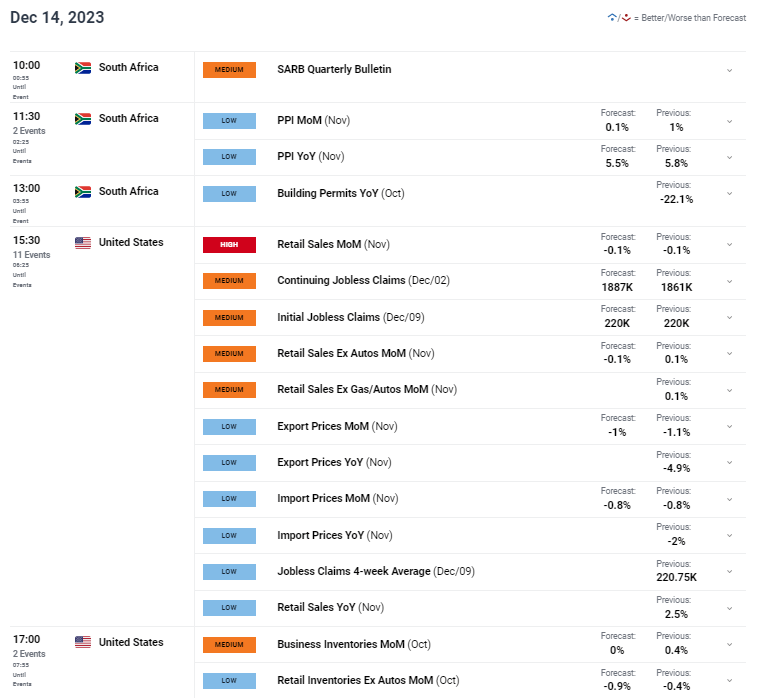

Later today (see economic calendar below), USD/ZAR will be shaped by the SARB’s Quarterly Bulletin, SA PPI and US retail sales data with the latter being the most influential. Jobless claims will be closely monitored particularly the initial jobless claims line item. Other ZAR crosses including GBP/ZAR and EUR/ZAR should provide more volatility as both the Bank of England (BoE) and European Central Bank (ECB) are scheduled to announce their rate decisions. Should they follow on from the Fed, the rand may find additional support across these currency pairs as well.

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, TradingView

The daily USD/ZAR chart has broken below the rising wedge chart pattern (dashed black line) but is not confirmed in my opinion. I would want to see a confirmation close below the 200-day moving average (blue) which may then expose the 18.5000 psychological handle and potentially a retest of the long-term trendline support level (black). The current daily candle reflects a long lower wick and could see the pair pullback higher should it close in this fashion.

Resistance levels:

- 19.0000

- 18.7759

- 50-day MA (yellow)

Support levels:

- 200-day MA (blue)

- 18.5000

- Trendline support

Contact and followWarrenon Twitter:@WVenketas

[ad_2]