[ad_1]

GBP/USD, EUR/GBP Analysis

- Cable struggles to build momentum ahead of UK GDP report

- EUR/GBP threatens to breakout but faces stern level of resistance

- UK GDP anticipated to reveal subdued growth in Q3

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Cable struggles to build momentum ahead of UK GDP Report

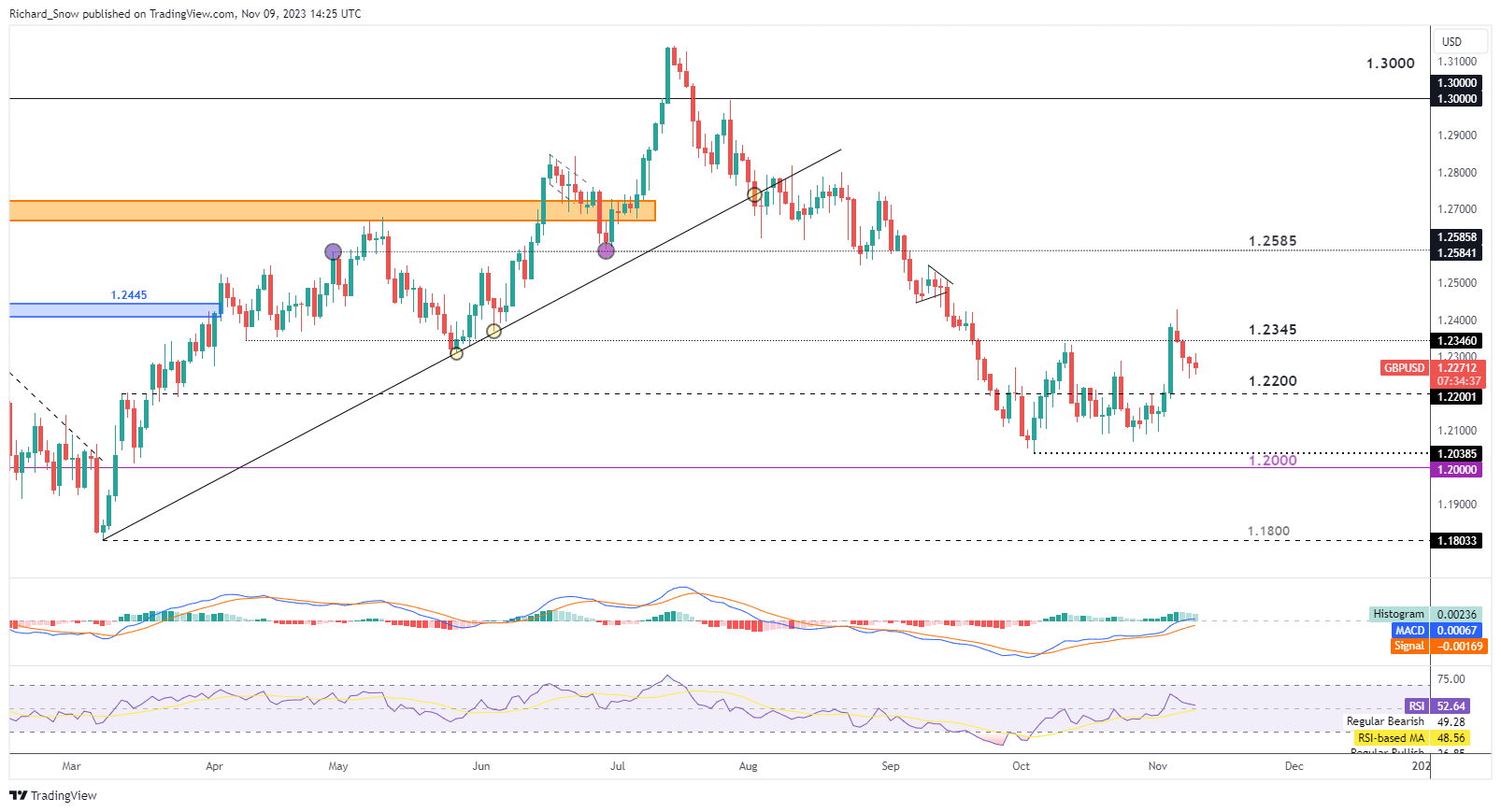

GBP/USD has failed to build on prior bullish momentum and instead has continued to pull back towards 1.2200 after breaching well above 1.2345 – a prior swing low. The FX market in general has struggled for direction recently as major central banks near their respective peaks as far as interest rates are concerned.

The dollar has come under risk recently after a string of softer economic data such as PMI and labour data (NFP, Unemployment rate and average earnings). Now the Fed’s very own GDPNow forecast tool shows a markedly lower figure of 1.2% growth forecast for the final quarter of the year – a sizeable drop from the 4.9% rise in Q3.

Therefore, if the softer data really starts to take hold, the dollar could see further declines which would elevate GBP/USD over time. This however is a longer-term outlook but remains something to consider as the pair attempts to make higher highs and higher lows.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

EUR/GBP Threatens to Breakout but Faces Stern Level of Resistance

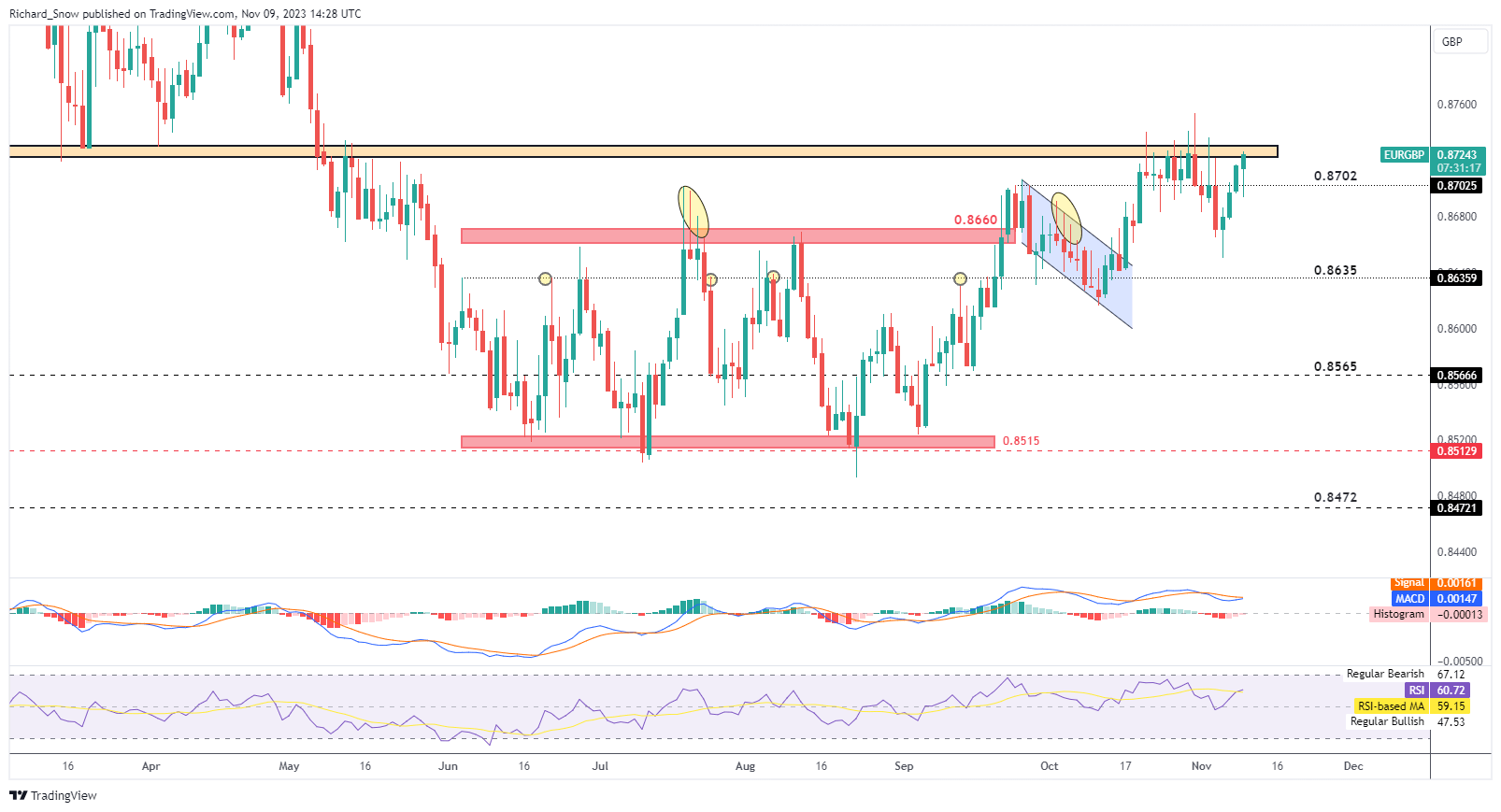

EUR/GBP has shown resilience and has approached the zone of resistance around 0.8725 once again. While the recent bullish lift is impressive, the zone of resistance has proven a really tough obstacle to overcome. Throughout large parts of October price action tested this zone without any subsequent momentum.

Tomorrow’s UK GDP print may provide a catalyst for intra-day volatility but in the grander scheme of things the growth outlook for the UK remains subdued and unlikely to see a massive beat to the upside.

Resistance remains at the zone of resistance with near-term support at 0.8702 and a more appropriate level of support further down at 0.8635.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

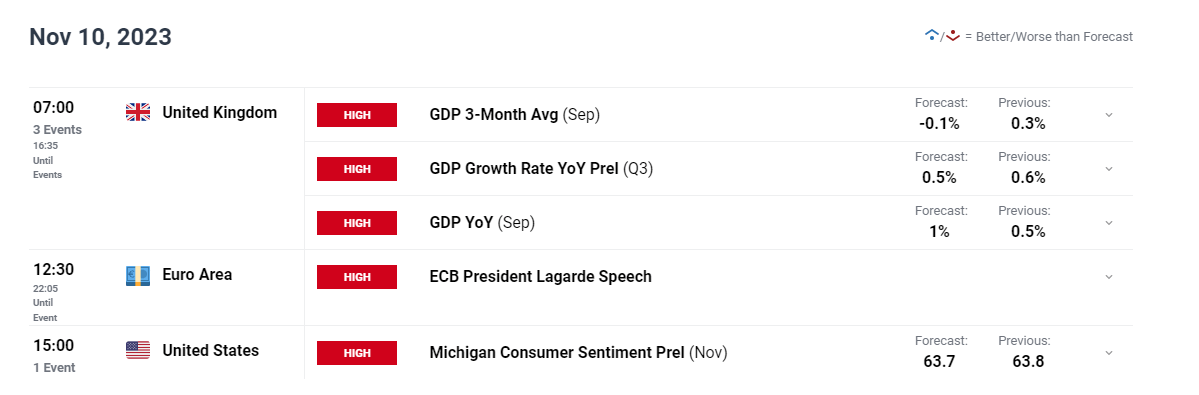

Risk Events for Tomorrow

UK GDP is the major piece of data heading into the weekend and consensus estimates don’t look great for the UK economy. The Bank of England’s recent forecast for 2023 has the UK economy narrowly expanding by 0.5%. Anaemic growth is likely to continue into 2024 where economy is anticipated to achieve zero growth before rising slightly in 2025.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Introduction to Forex News Trading

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]