[ad_1]

US NFP REPORT KEY POINTS:

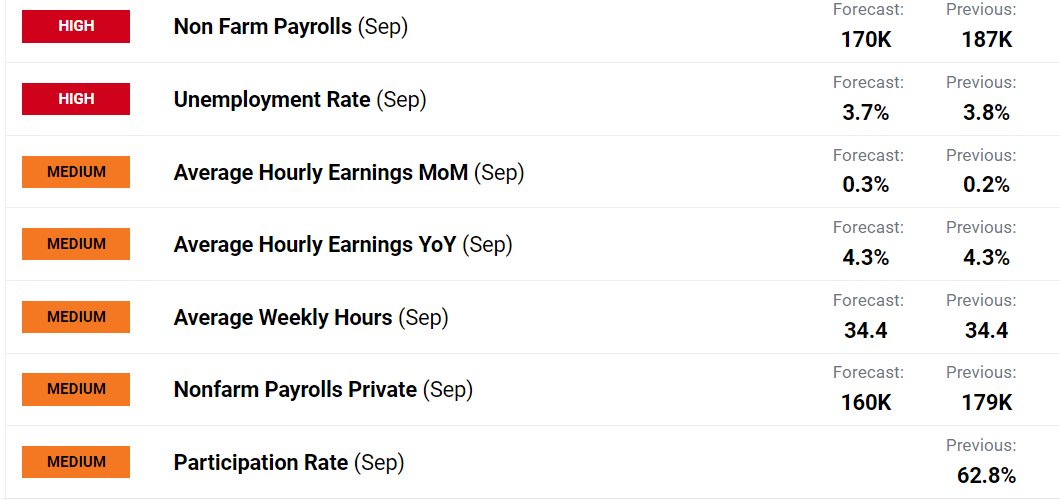

- The U.S. economy is forecast to have created 170,000 jobs in September.

- The unemployment rate is seen ticking down to 3.7% from 3.8% previously, signaling persistent labor market tightness.

- A strong NFP report will be positive for U.S. yields and the U.S. dollar, and bearish for gold and stocks.

Most Read: Gold Price Forecast – Will US Job Data Serve to Deepen XAU/USD’s Bearish Trend?

Wall Street will be on high alert Friday morning when the U.S. Bureau of Labor Statistics releases its most recent employment survey. The report, which will attract a great deal of attention and garner considerable scrutiny due to its implications for the Federal Reserve monetary policy outlook, could set the stage for heightened volatility heading into the weekend.

According to consensus estimates, U.S. employers added 170,000 payrolls in September following a gain of 187,000 jobs in August. Separately, household data is expected to show that the unemployment rate ticked down to 3.7% from 3.8% previously, indicating tightness in labor market conditions and a persistent imbalance between the supply and demand for workers.

Focusing on wages, average hourly earnings are seen rising 0.3% m-o-m, resulting in an unchanged annual reading of 4.3%. Pay growth holds particular significance for the Fed as it serves as a potential barometer of inflationary trends. It is therefore crucial to keep a vigilant eye on this measure, particularly given that current wage pressures may not be consistent with CPI converging to 2.0%.

Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. dollar’s Q4 outlook today for exclusive insights into the pivotal catalysts that should be on every trader’s radar.

Recommended by Diego Colman

Get Your Free USD Forecast

UPCOMING US LABOR MARKET DATA

Source: DailyFX Economic Calendar

If you’re looking for a broader perspective on U.S. equity indices, make sure to download our fourth-quarter equity forecast. It’s your gateway to a wealth of ideas and indispensable insights.

Recommended by Diego Colman

Get Your Free Equities Forecast

POSSIBLE MARKET SCENARIOS

Fed officials have maintained the possibility of additional policy tightening this year, but they have not firmly embraced this scenario. This suggests a strong reliance on data as they move forward.

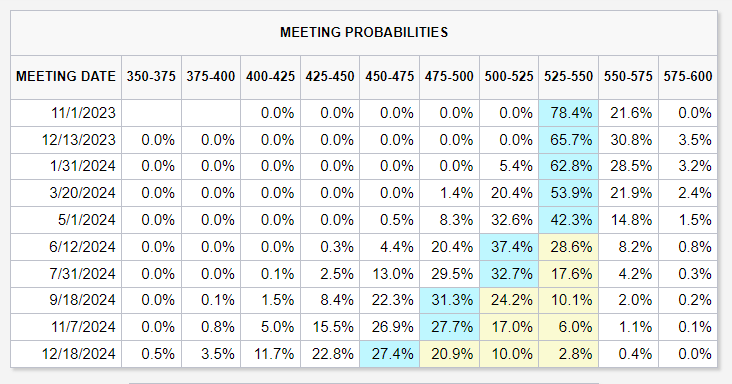

Looking at implied probabilities, the odds of a quarter-point rate rise at the December FOMC meeting stand at approximately 31% at the time of writing. Market pricing has been in a state of flux in recent days, but the likelihood of another hike could rise sharply if the NFP data exceeds estimates by a wide margin. That said, any headline figure above 250,000 could have this effect on expectations.

Should the monetary policy outlook shift in a more hawkish direction, U.S. yields are likely to extend their recent advance, boosting the U.S. dollar across the board. This particular situation is expected to exert downward pressure on gold prices and, especially, on the Nasdaq 100, where tech-related stocks may be vulnerable to significant losses.

Unemployment claims have stayed extremely low by historical standards, with scant evidence of layoffs. In parallel, labor demand appears robust and resilient, as indicated by elevated job openings. These combined factors present a compelling case for a solid September NFP report (the UAW strike, which began on September 15 – the survey week- is unlikely to be fully reflected in last month’s numbers).

Supercharge your trading prowess with an in-depth analysis of gold’s outlook, offering insights from both fundamental and technical viewpoints. Don’t hesitate—claim your free Q4 trading guide now!

Recommended by Diego Colman

Get Your Free Gold Forecast

FOMC MEETING PROBABILITIES

Source: FedWatch Tool

On the flip side, if employment growth meets estimates or surprises to the downside, the U.S. dollar could begin to correct lower, along with U.S. Treasury yields, on the assumption that the Fed is done and will not deliver additional tightening in 2023.

As traders unwind bets of further policy firming, gold prices could stage a bullish turnaround, leading to a moderate recovery in the coming days and weeks. This scenario will also benefit the Nasdaq 100, but any rally in tech stocks could be short-lived if economic conditions begin to deteriorate more rapidly, in line with projections for the fourth quarter.

Discover what sets the best apart and unlock the secrets of trading consistency: download our comprehensive guide on the traits of successful traders and step up your game!

Recommended by Diego Colman

Traits of Successful Traders

[ad_2]