Gold, XAU/USD, Consumer Confidence, IGCS – Briefing:

- Gold prices aimed higher on Tuesday as the US Dollar fell

- XAU/USD remains vulnerable to Fed preferred CPI gauge

- IGCS showed increase in long exposure, a bearish signal?

Recommended by Daniel Dubrovsky

How to Trade Gold

Gold prices aimed higher over the past 24 hours, gaining 0.87%. As we approach the end of March, XAU/USD is looking at about a 7.7% gain this month. If sustained, that would be the best performance since November.

The anti-fiat yellow gained despite a strong day for the 2-year Treasury yield. This followed upbeat US Conference Board Consumer Confidence data for March despite the collapse of Silicon Valley Bank and the ensuing uncertainty in the financial sector.

Markets have been slowly fading dovish Federal Reserve policy expectations. Despite this, the US Dollar did not receive much love on Tuesday. This is likely why gold performed well.

XAU/USD will be awaiting key US economic data later this week, such as the Federal Reserve’s preferred inflation gauge, PCE Core, on Friday. Stubbornly high prices would continue making it difficult for the Fed to manage the economy while tackling the aftermath of SVB’s collapse. This is a recipe for uncertainty and volatility. That is something that might benefit the US Dollar at the expense of gold.

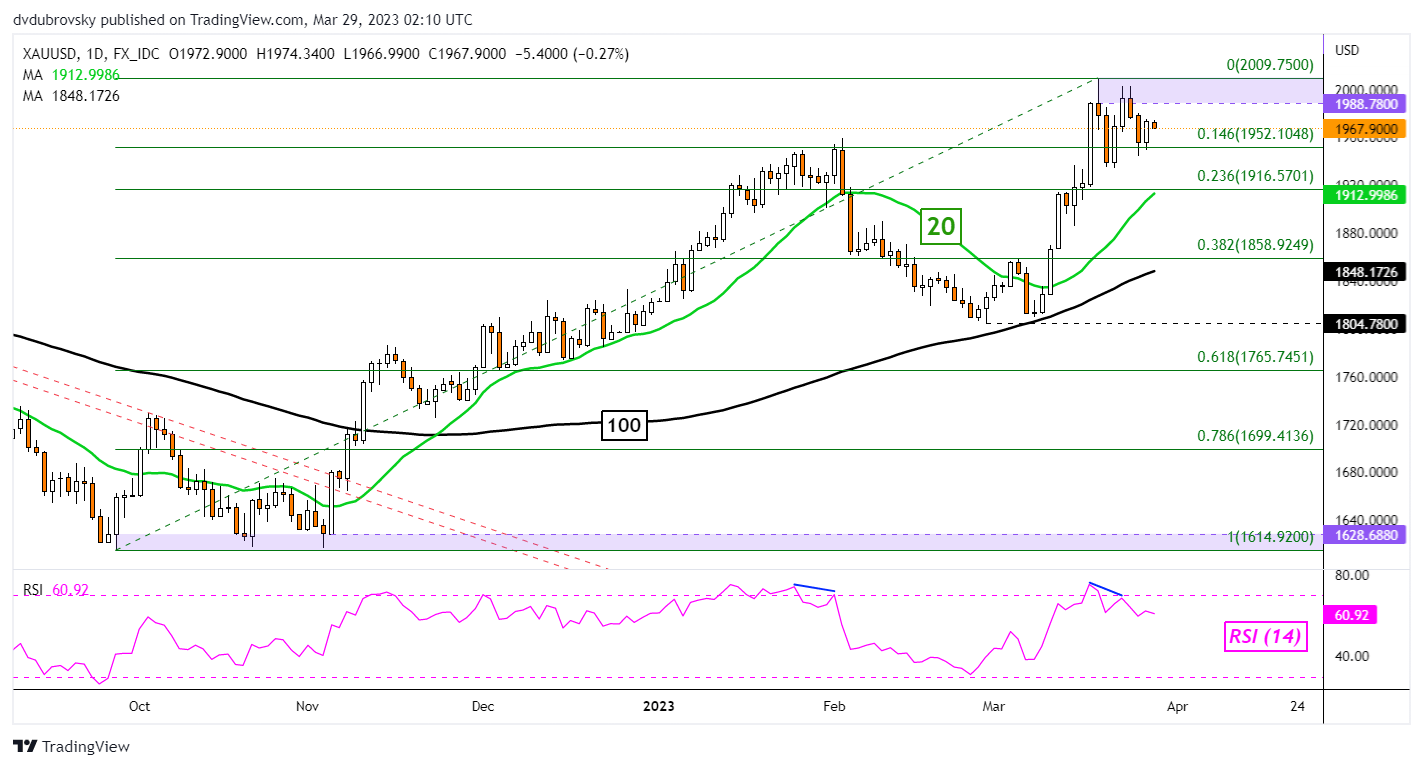

XAU/USD Daily Chart

Overnight, gold reinforced the 14.6% Fibonacci retracement level at 1952, which remains as immediate support. The broader technical bias remains bullish since the yellow metal found a bottom in November. Key resistance is the 1988 – 2009 range. A drop through support exposes the 20-day Simple Moving Average (SMA).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Chart Created Using TradingView

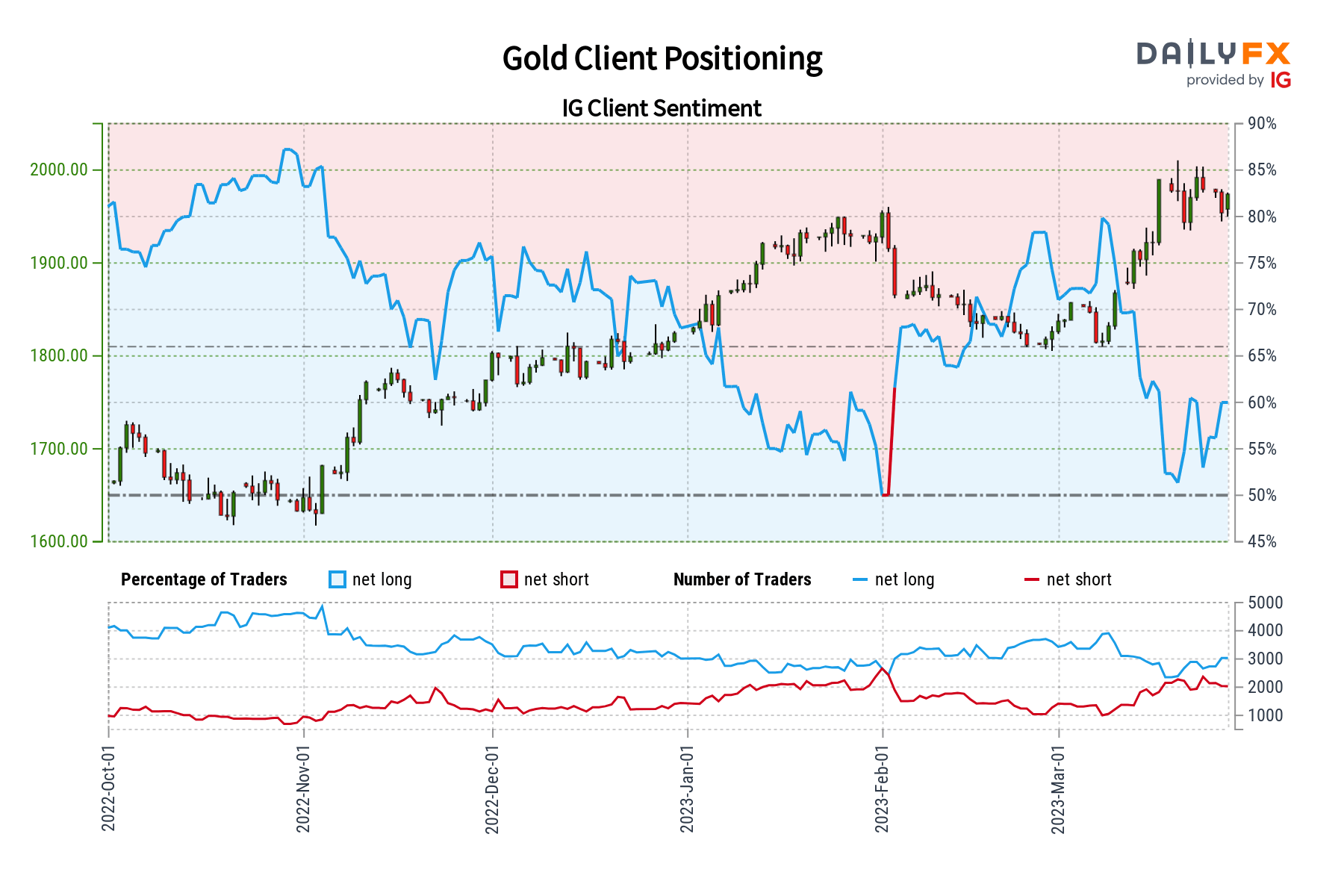

Gold Sentiment Analysis – Bearish

According to IG Client Sentiment (IGCS), about 61% of retail traders are net-long gold. IGCS tends to function as a contrarian indicator, especially in trending markets. Since most traders remain long, this hints prices may fall down the road. This is as upside exposure increased by 7.9% and 21.76% compared to yesterday and last week, respectively.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX