[ad_1]

FED MINUTES & US DOLLAR:

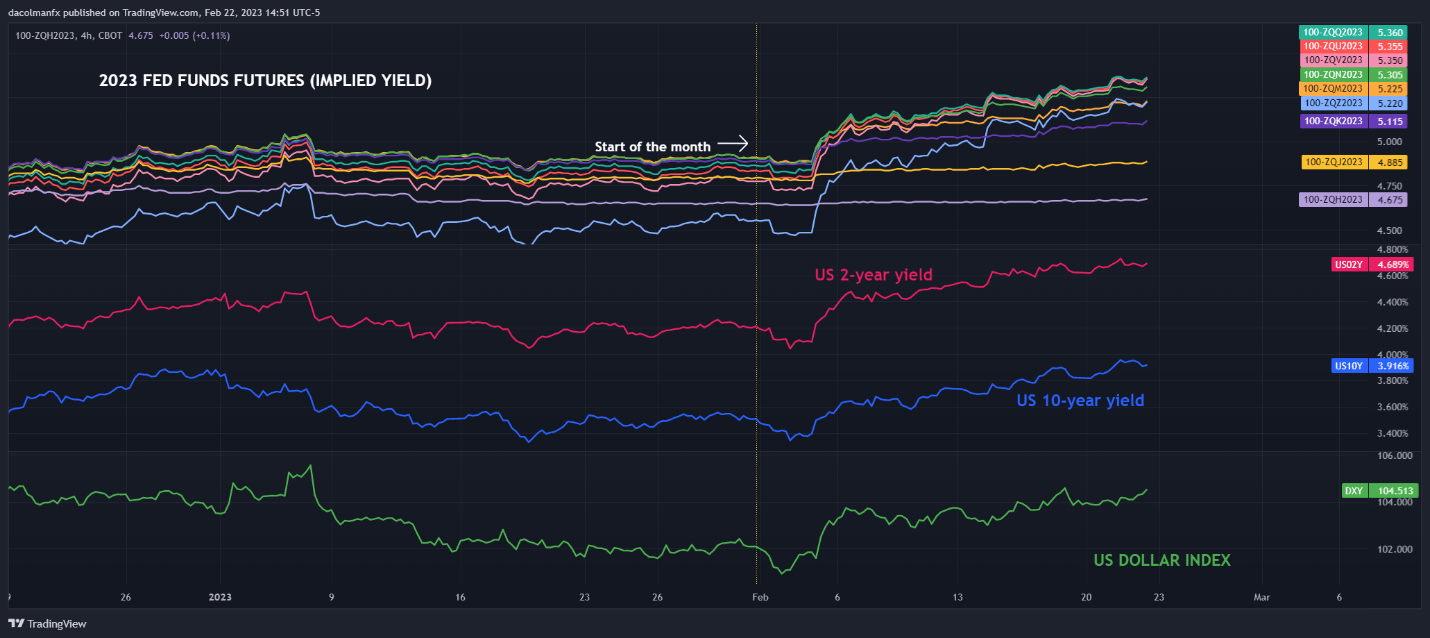

- U.S. dollar extends gains after Fed minutes show commitment to hawkish tightening cycle

- Policymakers admit that there is more work to be done in terms of monetary tightening to cool price pressures amid upside inflation risks

- Yields retrace their decline after the FOMC minutes cross the wire

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Gold Price Outlook – Path of Least Resistance May Be Lower on Real Yields Woes

The Federal Reserve released today the minutes from its January 31/February 1 meeting when the institution raised its benchmark rate by 25 basis points to 4.50-475%. The minutes didn’t offer any new hawkish bombshells, but reinforced recent guidance that there is more work to do in terms of monetary tightening to bring inflation back to the central bank’s 2% target.

According to the summarized record of the proceedings, most FOMC participants supported downshifting the pace of interest rate increases, though some officials favored more front-loaded hikes.

On inflation, policymakers noted that CPI readings have moderated, but also acknowledged that risks are biased to the upside and that the process of restoring price stability will take some time and require more hikes, especially as labor market tightness continues to exert upward pressure on wages.

Focusing on activity, the account of the two-day meeting showed that some participants saw an elevated prospect of recession in 2023 and that the balance of risks to the economic outlook is skewed to the downside. Despite this assessment, the overwhelming consensus among officials appears to be that the central bank’s job is not yet done.

Immediately after the minutes were released, bond yields pared their intraday decline and edged higher, boosting the U.S. dollar, with the DXY index up about 0.34% near two-week highs at the time of writing.

These moves in the FX and fixed-income markets could be reinforced in the coming days as traders come to terms with the fact that the Fed will stay the current course at all costs. For monetary policy, this means that the terminal rate could settle around 5.375% this summer and remain there for some time until there is sufficient evidence that inflationary forces are subsiding on a sustained basis.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

US DOLLAR INDEX (5-MINUTE CHART)

US DOLLAR INDEX, TREASURY YIELDS & FED FUNDS FUTURES CHART

[ad_2]